Throughout VMG Health’s client base, we are privileged to work with many major players across the physician practices landscape—from solo practitioners and independent physician groups to large platform practices, private equity (PE)–backed physician practice rollups, and those affiliated with large health systems.

VMG Health has been engaged to assist clients in varying capacities associated with transactions, ranging from providing business valuations to financial due diligence (quality of earnings). This insight has provided important visibility into the buyer’s perspective. Further, our work has delved into the operations of practices, including coding and compliance, physician compensation, and strategy work. As a result, our experience offers us a unique glimpse into physician practices and the underlying transaction environment. From our experience, including anecdotal discussions with clients and operators in this space, we’ve outlined a few major headwinds and tailwinds facing physician practice transactions in 2024.

Tailwinds

Continued Operational Challenges Stimulate Consolidation

Reimbursement Pressure: Physician practices continue to face reimbursement pressure. In November 2023, the Centers for Medicare & Medicaid Services (CMS) issued its final rule announcing policy changes for Medicare payments under the Physician Fee Schedule (PFS) for 20241. Per CMS, overall payment rates under the PFS will be reduced by 1.25% in 2024, following a 2.0% decline in 20232,3. Although the overall impact on reimbursement varies across specialties, the rate cuts will continue to suppress margins and put pressure on physician practices. For more information on operational challenges and opportunities with physician practices, see VMG Health’s most recent Physician Alignment Tips & Trends Report.

Persistent Inflation: Wage inflation (largely driven by a tight labor market, an aging physician base, and recruiting challenges) and the rising costs of drug and medical supplies have been persistent. According to the government’s Medicare Economic Index (MEI), medical practice costs are expected to increase by 4.6% in FY 2024 on top of last year’s 3.8% increase4. Without reimbursement keeping pace with increasing costs, many physician practices’ profit margins have contracted.

Many physician practices seek out a partner to help combat the daily pressures they face. Practices may benefit from operational synergies by consolidating with a larger organization, particularly if the larger organization has favorable reimbursement rates or anticipated cost savings from duplicate services (back-office employees, external accounting, etc.). In fact, many buy-side clients run a managed care or “blackbox” analysis to assess the potential rate lift and the resulting practice economics on a post-transaction basis to better inform themselves and their investment committees during diligence. Contact VMG Health’s Revenue Consulting & Analytics team to analyze the potential rate lift on your next deal.

Investment Capital: PE Dry Powder

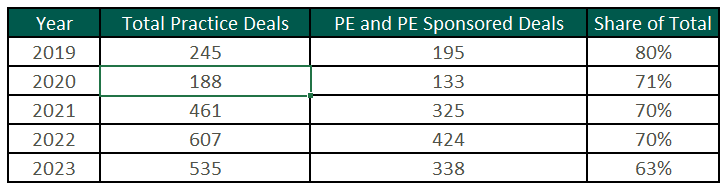

Record High Dry Powder: PE has been an active participant in the physician practice transaction space for many years, as evidenced by recent deal volume presented in the table below5. Capital committed to PE funds but not yet deployed (dry powder) is presently at record highs for healthcare services. The current estimate of dry powder earmarked for healthcare services among U.S. headquartered PE managers is approximately $100 billion, according to Pitchbook’s Q4-2023 Healthcare Report6 . PE funds are regularly searching for a home to deploy this capital and physician practices are a common target.

Source: Irvin Levin, 2024 Health Care Services Acquisition Report

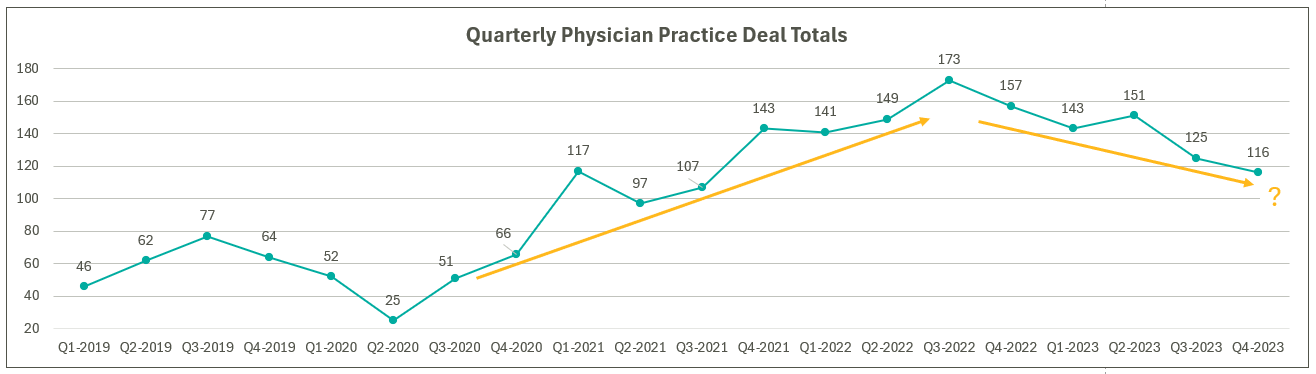

Source: Irvin Levin, Healthcare M&A Quarterly Reports

Headwinds

Interest Rates

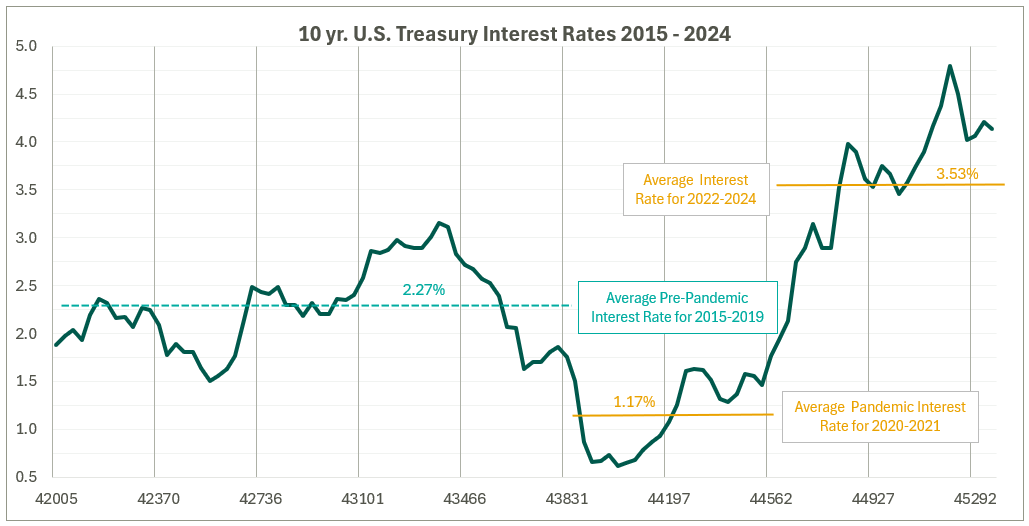

High Interest Rates: As the pandemic hit, fiscal stimulus and loosened monetary policy led to ultra-low interest rates relative to historical norms and spurred transaction activity. Interest rates began to materially rise throughout 2022, challenging overall transaction activity in the latter part of 2022 and during 2023 as access to capital tightened and the cost of capital increased. The below chart presents interest rates over the period as measured by the 10-year U.S. treasury.

Despite higher rates, transaction activity for physician practices has remained robust relative to pre-pandemic levels. However, there are signs that interest rates are having a lagged effect on deal volume considering the recent downward trend from Q3 2022 through Q4 2023 as observed in the above chart. While this does not necessarily mean that we should expect deal volume to revert to pre-pandemic levels, it does highlight that we have entered a new transaction environment. In this environment, the time to close deals lengthens as sellers digest lower valuation multiples and buyers increase scrutiny during due diligence given an uncertain future macroeconomic landscape. Contact VMG Health’s Financial Due Diligence team for details on how the changing tide is impacting the due diligence process.

At the start of 2024, interest rates remain elevated and volatile with an uncertain path to a normalized level, which continues to serve as a headwind for transaction activity. However, interest rates can change quickly, and the U.S. Federal Reserve has signaled that it will likely be appropriate to begin rate cuts at some point during 20247. Market participants have started anticipating rate cuts from this messaging, which could certainly serve as a tailwind throughout the remaining course of this year and into next.

Source: Federal Reserve 10 Year U.S. Treasury Market Data

https://fred.stlouisfed.org/series/DGS10

Regulatory Focus: Transaction Oversight & Non-Compete Agreements

Regulatory Transaction Oversight: Healthcare consumes a considerable amount of U.S. spending and is expected to continue increasing; CMS’ National Health Expenditure Accounts (NHEA) Healthcare projects healthcare spending to increase from approximately 18.3% of U.S. GDP in 2021 to 19.6% in 20318. Furthermore, it is an election year, with a current U.S. Presidential Administration keenly focused on the rising costs of healthcare. As a result, increased regulatory scrutiny has manifested itself over the ongoing consolidation across healthcare services, particularly within the physician practice space.

This heightened scrutiny is most recently evidenced by the Federal Trade Commission (FTC) suing U.S. Anesthesia Partners, Inc. (USAP), a prominent provider of anesthesia services in Texas, over an alleged “…anticompetitive acquisition spree to suppress competition and unfairly drive-up prices for anesthesiology services.”9 The FTC also hosted a workshop on March 5, 2024 to assess the public impact of private capital in healthcare. On that same day, the FTC, U.S. Department of Justice (DOJ) and U.S. Department of Health and Human Services (HHS) requested public comments on the effects of transactions involving PE, health systems, and payors on the healthcare providers and ancillary services space.10

FTC Focus on Non-compete Agreements: It is not uncommon for physicians to a sign non-compete agreement upon joining a physician practice. The intent of a non-compete agreement, as well as the potential impact, are being hotly debated, with the FTC proposing a rule to ban non-compete clauses. A recent VMG article, Non-Compete Agreements: A Prevailing Quagmire provides details highlighting the arguments and broader implications of non-compete agreements and the proposed ban.11

Stay Tuned

Overall interest in acquiring physician practices remains high, and we don’t expect that to change in the foreseeable future. The dynamics outlined above will likely dictate the path and volume of transactions throughout 2024 and beyond. To read more and stay informed as the year unfolds, please visit VMGHealth.com.

1. Centers for Medicare & Medicaid Services. Calendar Year (CY) 2024 Medicare Physician Fee Schedule Final Rule. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2024-medicare-physician-fee-schedule-final-rule

2. Centers for Medicare & Medicaid Services. CMS Finalizes Physician Payment Rule, Advances Health Equity. Centers for Medicare & Medicaid Services website. Published November 2, 2023. https://www.cms.gov/newsroom/press-releases/cms-finalizes-physician-payment-rule-advances-health-equity

3. Landi H. Physician groups decry finalized Medicare payment cuts as 2024 expenses rise. FierceHealthcare. Published November 3, 2023. https://www.fiercehealthcare.com/providers/physician-groups-decry-finalized-medicare-payment-cuts-2024-expenses-rise

4. American Medical Association. Only Cure for Medicare Payment Mess: Wholesale Reform. American Medical Association website. https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year's%203.8%25https://www.ama-assn.org/about/leadership/only-cure-medicare-payment-mess-wholesale-reform#:~:text=To%20put%20this%20into%20perspective,top%20of%20last%20year's%203.8%25.

5. VMG Health. 2023 Healthcare M&A Report. Published [publication date not provided]. https://vmghealth.com/2023-healthcare-ma-report/ https://vmghealth.com/2023-healthcare-ma-report/

6. PitchBook. Q4 2023 Healthcare Services Report. Published [publication date not provided]. https://pitchbook.com/news/reports/q4-2023-healthcare-services-report

7. Reuters. Fed's Powell Set Election-Year Stage with Testimony on Rate Cuts, Inflation. Reuters website. Published March 6, 2024. https://www.reuters.com/markets/us/feds-powell-set-election-year-stage-with-testimony-rate-cuts-inflation-2024-03-06/

8. Centers for Medicare & Medicaid Services. National Health Expenditure Fact Sheet. Centers for Medicare & Medicaid Services website. Published [publication date not provided]. https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet

9. Federal Trade Commission. FTC Challenges Private Equity Firm’s Scheme to Suppress Competition in Anesthesiology Practices Across the United States. Federal Trade Commission website. Published September [publication date not provided], 2023. https://www.ftc.gov/news-events/news/press-releases/2023/09/ftc-challenges-private-equity-firms-scheme-suppress-competition-anesthesiology-practices-across

10. McDermott Will & Emery LLP. Top Takeaways: FTC Hosts Workshop, Solicits Public Comment on Private Equity in Healthcare. McDermott Will & Emery LLP website. Published [publication date not provided]. https://www.mwe.com/pdf/top-takeaways-ftc-hosts-workshop-solicits-public-comment-on-pe-in-healthcare/

11. Aguirre I. Non-Compete Agreements: A Prevailing Quagmire. VMG Health website. Published [publication date not provided]. https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/https://vmghealth.com/thought-leadership/blog/non-compete-agreements-a-prevailing-quagmire/