The places where healthcare is delivered will be greatly transformed over the next five to 10 years. Is your system ready?

As reimbursement pressures have pushed more patient care to less costly settings outside the hospital walls, health systems are discovering new ways to grow revenue away from the core campus. Many are banking on new real estate strategies, setting up shop closer to patients via smaller, niche settings like urgent care centers and ambulatory facilities.

While politicians attempt to determine the future of the Affordable Care Act (ACA), hospitals are making critical long-term decisions now about where they want to be and the type of services they should offer. For hospitals eying their future real estate strategies, three major trends will heavily influence these decisions:

Faster, easier access

Patients are embracing the convenience of seeing a physician virtually from the comfort of their home or office. From the couch, a patient can have a phone conversation or video chat with a physician. Statistics from the American Telemedicine Association prove the appeal: approximately 1 million physician visits in the United States were virtual in 2015, and over half of all U.S. hospitals are using some form of telemedicine.

At a glance, telemedicine might seem like a threat to traditional healthcare providers, who count on patients coming to them. However, the health systems that view telemedicine as a source of referrals to help build their patient base will continue to grow in the face of this disruption.

When a patient sees a physician virtually, some health issues may be resolved by electronically sending a prescription to a nearby pharmacy. But, in many instances, the patient will still need to go to a physical location, whether for a more in-depth exam, lab work or a specialist visit. Forward-looking healthcare providers are seizing that opportunity to leverage their existing real estate assets to see more patients, using telemedicine as an entry point. Some health systems are partnering with a third party such as Teladoc to give their patients more convenient options, while others are building their own operations.

Regardless of the approach, it’s vital to establish goals for telemedicine and define how it will enable patient care. Only then can you evaluate whether you have the right locations in the right places to see virtual patients for follow-up care.

Making healthcare more portable

Physicians who make house calls may seem like a thing of the past—but they’re also the future. Leading healthcare organizations are exploring how to bring semi-urgent care directly to people where they choose to be. Home health providers can help deliver patients with high-acuity issues to the main hospital campus, just as telemedicine does. A nurse visiting a patient with diabetes, for example, can watch for complications such as eye problems and neuropathy that would require acute care.

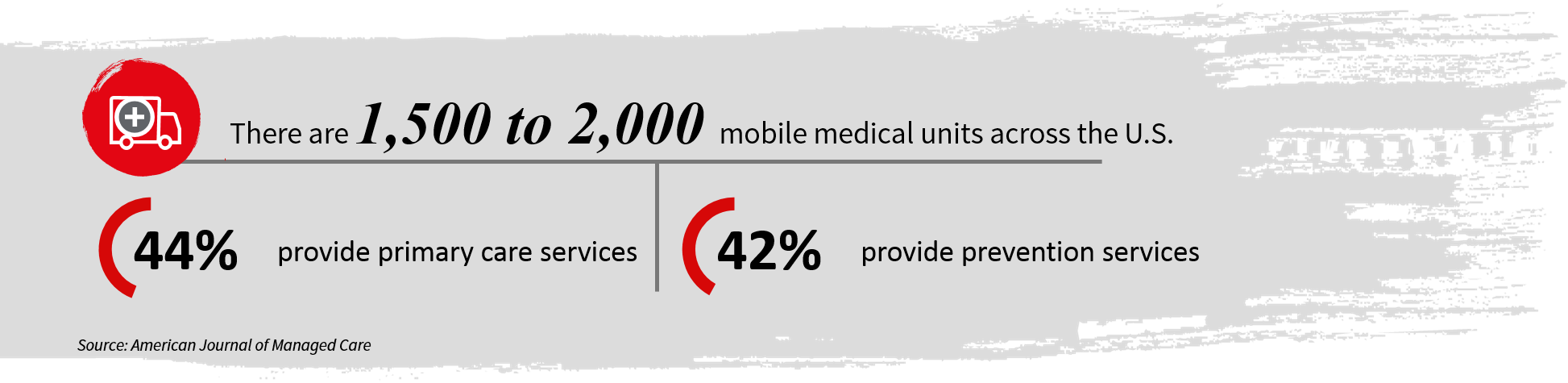

Putting physicians in motion also supports a hospital’s strategy for improving public health. A 2014 study published in the American Journal of Managed Care identified 1,500 to 2,000 mobile medical units across the country, with 44 percent providing primary care services and 42 percent providing preventative care. Many were targeting underserved communities.

Health systems that successfully master the operational complexities of shifting care out of the traditional office setting will need to address new real estate implications. While demand for physician office space may wane, new real estate needs will emerge. For instance, healthcare providers may need for automotive storage and the mechanical aspects of maintaining a fleet of mobile health centers.

Planning for longer life spans

Americans are living longer and in more compromised states of existence. Medical advances are extending lives with vaccines that help prevent disease altogether and treatments that enable patients to live comfortably with diabetes and other long-term illnesses. Patients increasingly need care teams rather than a single physician. Integrated care often starts on the hospital campus, where patients with comorbidities see multiple specialists, such as a cardiologist and pulmonologist who work together. But, integrated care is important for preventative medicine as well.

The United States has seen an uptick in development of new integrated care facilities in recent years. Driven largely by the ACA’s focus on improved access to preventative care, healthcare systems have invested in integrated care facilities that typically include a fitness center, dietician, family medicine, women’s health providers and similar preventative services.

The future of these facilities remains uncertain as legislatures debate what the future of health reform may be. If healthcare systems are no longer incentivized to keep patients healthy, development for integrated care facilities will undoubtedly slow.

Constant vigilance

Hospitals and health systems will need to shift their real estate strategies as emerging forces reshape how, where and when healthcare services are delivered. The best plan of attack for keeping pace with the future is to revisit your real estate strategy regularly and ask:

• Are we maximizing the use of the facilities we currently own? Where can we improve efficiencies?

• How can we make it more convenient for patients to get to us, or access our services?

• What are the dynamics at play within the individual communities we serve? How are demographics, economics and other key drivers of care changing?

• How much flexibility can we build into leases?

• What are we doing to minimize the risks that come with occupying a more diverse network of facilities? Are there ways to centralize processes or standards to ensure quality and safety aren’t compromised?

Regardless of what direction healthcare reform may take, certain facts will not change. Healthcare organizations will need to reduce costs in order to provide more care to more people. Keeping patients out of expensive hospital settings can drive down the cost of care and simultaneously improve population health. The right real estate strategy can help healthcare organizations ensure that they have the right places for the right care —whether that’s at home, in an ambulatory care center or wherever else the patient chooses to be.

# # #

Peter Bulgarelli leads JLL’s Healthcare Solutions group, which serves approximately 540 hospitals across the U.S. With more than 25 years of experience at JLL, Bulgarelli leads the delivery of integrated services across facilities management and real estate solutions. Bulgarelli is the Chicago Board Chair Emeritus for the American Diabetes Association and a member of the Urban Land Institute Healthcare and Life Sciences Council.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.