The new era of healthcare poses unique and significant challenges to the viability of our nation's academic medical centers and their ability to carry out mission critical activities: delivering complex clinical care, educating medical trainees and performing cutting edge research.

The issues AMCs face are broad and impact all aspects of the organization. They are arising from changes in private markets as well as government policy and regulations. Collectively, these mounting challenges are motivating AMCs across the country to engage in various repositioning activities both externally with other providers in the marketplace, as well as internally with their own clinical faculty and schools of medicine. They are seeking to overcome growing barriers to success and carry out and balance their primary missions long-term.

Key challenges related to AMC market repositioning

Many of the challenges AMCs face in the current environment are well understood and widely recognized even if the solutions are not. Accelerated provider consolidation, both horizontally and vertically, over the past several years is reshaping the competitive landscape. Community-based providers are gaining the size and strength to drive market dynamics and negotiate on equal or better footing with payers. Competitors are also gaining new competencies, keeping and caring for more patients themselves. This has begun to impact AMCs' referral streams and their ability to maintain market share. There are already a growing number of markets across the country where AMCs are experiencing flat-to-declining inpatient volume growth and losing their dominant market position to large, evolving systems.

Government and commercial payers are aggressively advancing value-based payment methodologies and steering patients to lower cost providers. AMCs which tend to have higher costs-to-serve than their community-based counterparts will face difficulty competing for services others also provide at acceptable levels. AMCs looking to thrive in this environment need to find ways to coordinate with other types of providers across the continuum to reorient the site of care to more cost effective settings and control quality, variation and outcomes. AMCs also need partners along the continuum to position themselves as primary contracting entities under population health or risk becoming "commodity" providers in their markets.

AMCs must contend with unprecedented financial pressures as healthcare reform rolls out over the next several years. Payments of all types are expected to decline, including federal reimbursement and commercial rates. As clinical reimbursement declines, the cross-subsidies that have historically helped pay for clinical education and research will be difficult to maintain. Widespread state and federal budget shortfalls are leading to reductions in research funding and educational subsidies and putting those mission-critical activities at risk. There is a fundamental breakdown of the economic structures that have historically supported the academic medical enterprise and AMCs will need to find ways to reconcile their commitments with changing economic realities to assure their three missions are preserved.

Other less recognized challenges impacting AMCs

Aside from the more obvious challenges, there are many others that are perhaps less widely discussed but still critical for AMCs to address as healthcare evolves. This includes market forces driving down inpatient utilization nationwide. This is likely to harm AMCs with substantial investments in acute-care facilities and technology. It puts pressure on AMCs to exercise influence over broader total markets so that they are able to drive enough volume to support existing investments or risk facing economic difficulty. The long tradition of concentrating clinical education at limited hospital and ambulatory care sites is also called into question by this downward trend in inpatient utilization and requires AMCs contemplate more distributed clinical education structures to reach patients as they move to more appropriate, cost effective settings for care.

In an environment where cost-containment and creating value are high priorities, AMCs may also find it increasingly difficult to introduce and integrate emerging science and technology into their care delivery structures without the support of a strong economic value proposition. Greater scrutiny around these decisions may limit their ability to leverage translational research and move scientific discoveries into clinical settings to differentiate themselves as 'cutting-edge' in competitive clinical markets. AMCs which have long been integral to developing innovative treatments and approaches to patient care will face growing tension between what they are capable of doing and what they are actually able to implement.

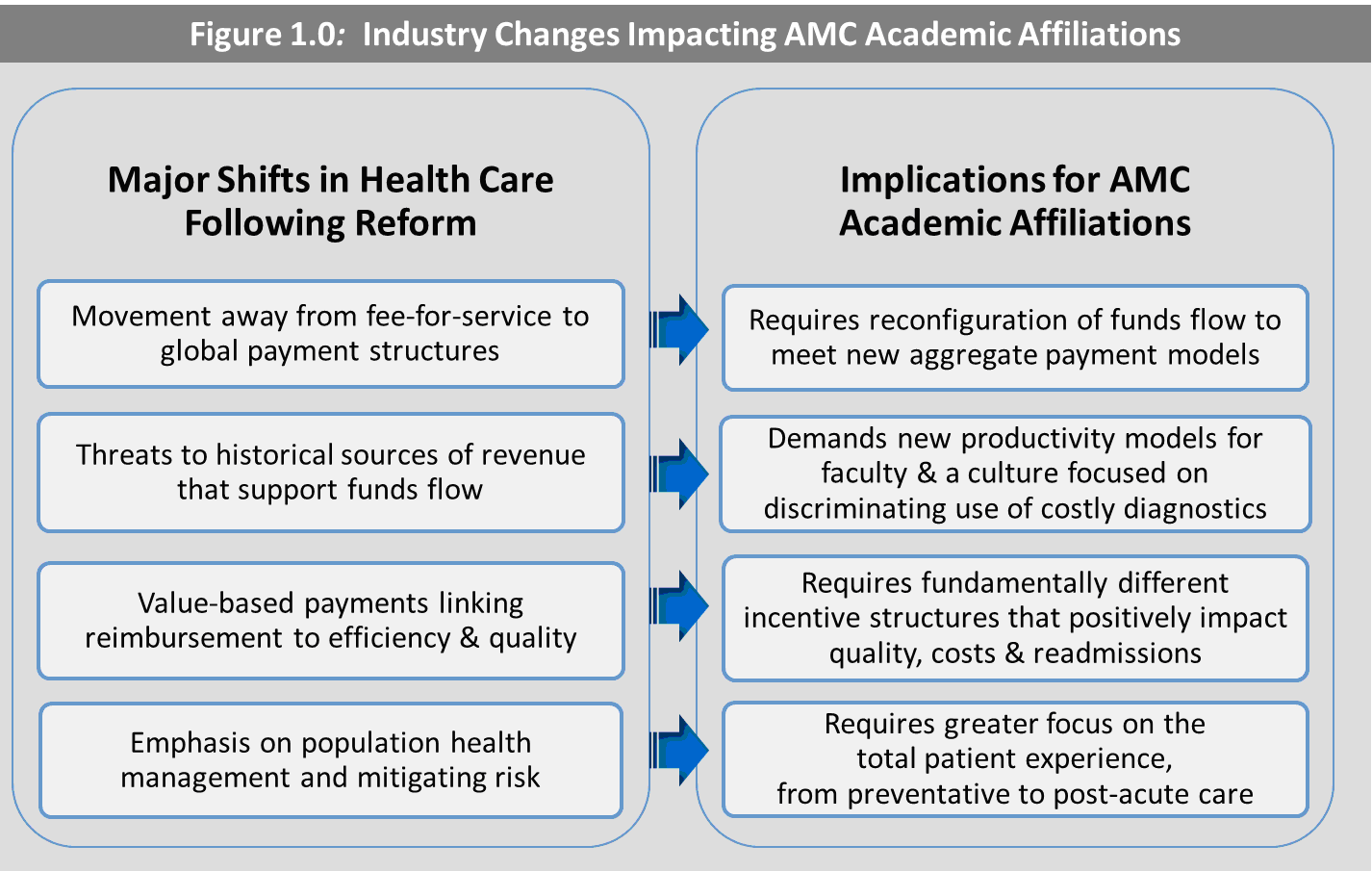

Another less evident, yet widespread issue among AMCs is reliance on outdated academic affiliation agreements that were forged prior to passage of Federal healthcare reform and the widespread industry transformation that has since followed. Existing academic affiliation agreements were predicated on circumstances much different than those in place today. Some major shifts in healthcare that were likely not reflected in the terms and goals of academic affiliation agreements established even just a few years back are outlined in Figure 1.0 below.

As a result, the vast majority of AMCs will need to revisit and restructure their academic affiliation agreements in the context of the emerging market to properly integrate and align the interests of their hospitals, clinical faculty and medical schools, and by doing so their ability to thrive will be strengthened. There is a unique opportunity afforded to those with a linked, multispecialty faculty which is not currently being leveraged by many of today's AMCs.

Observed trends in AMC repositioning activities

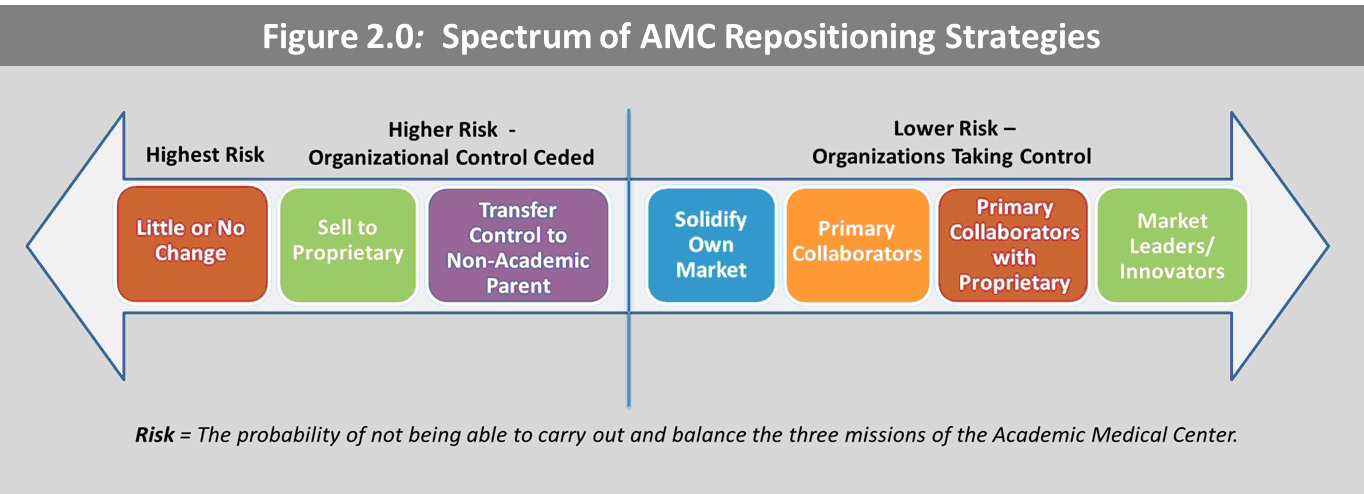

Given the challenging landscape, a growing number of AMCs recognize the need to take bold actions to secure a place in the market long-term. A recent study by TRG Healthcare finds that, while most AMCs are motivated by a very similar set of challenges, they are highly stratified in how they have chosen or been able to respond based on different market conditions and organizational circumstances and their strategic actions carry varying levels of risk as reflected in Figure 2.0 below.

At the one end of the spectrum are AMCs that have engaged in little or no change in response to the challenges at hand. Their inaction or inability to change in very fundamental ways leaves them vulnerable to growing competitive and financial pressures and puts their ability to continue to carry out and balance their tripartite missions at high risk. AMCs that fall into this category typically include three types of organizations: state organizations which are limited with respect to what they might do in considering alignment, teaching hospitals (approximately 50 percent) which are not formally aligned with their clinical faculty and organizations which simply have been indecisive in taking actions to position themselves. There are also AMCs on this end of the spectrum that have responded in a very different fashion with a merger, where the control of the overall enterprise is transferred to a non-academic parent, or the sale of their primary teaching hospital to a proprietary organization. They too are at fairly high risk of compromising at least a portion of their mission-critical activities after ceding full governance and organizational control to a non-academic or proprietary partner.

However, a growing portion of AMCs are pursuing alternative partnership structures and strategies that are inherently less risky as they allow the organizations to solve significant portions of their market and performance issues without a fundamental change in control. They are executing innovative external alignment strategies and finding new and creative ways to partner with other provider institutions across the continuum to solidify their own position in their marketplace and maintain relevance among payers and other purchasers of care. Many are acting as primary collaborators with other high quality hospitals and physician groups in their markets focused on building broad networks that will have the scale, infrastructure, and geographic reach to compete in a risk-based environment and manage population health as the market moves in that direction.

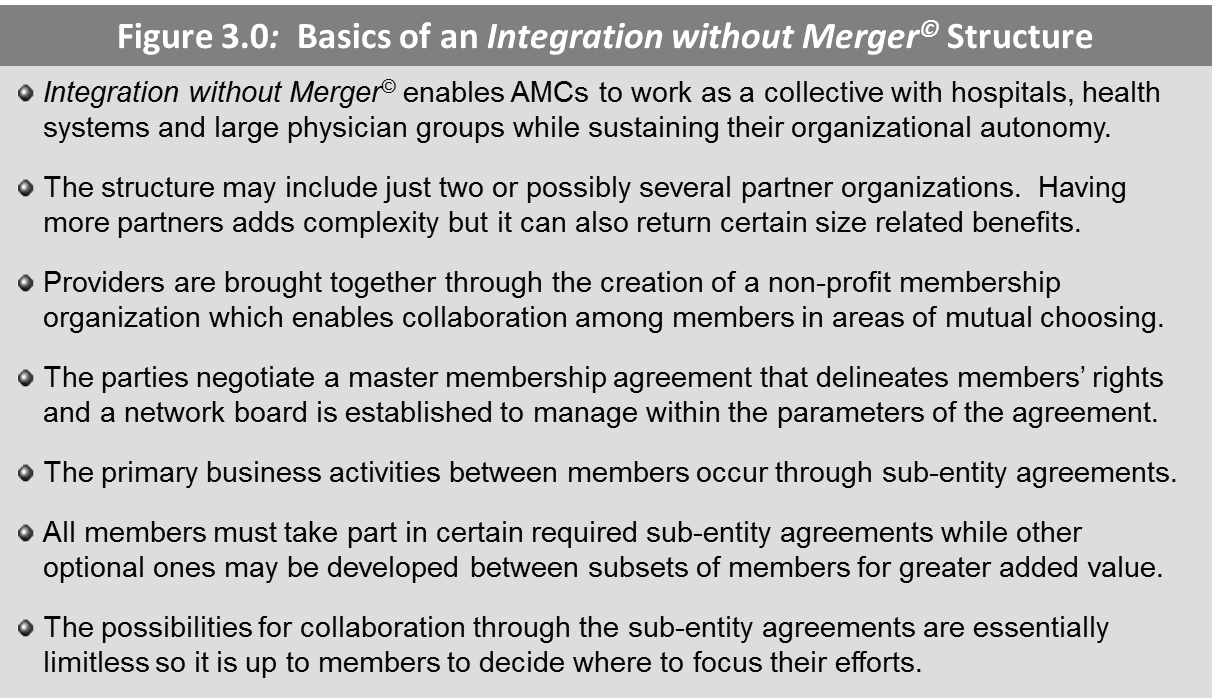

A recent example is the creation of the "University of Iowa Health Alliance" which supports collaboration between four Iowa health systems, their hospitals and clinics. The Alliance was formed in response to the rapidly changing marketplace and a common sense of urgency to work together to overcome mounting challenges and improve market positioning. Through an innovative alignment structure given the trade name "Integration without Merger©" these organizations were able to create a formal structure that achieves many benefits typical of merger while preserving the separate governance and mission of each organization. A brief overview of Integration without Merger© is provided in Figure 3.0.

The University of Iowa Health Alliance now includes more than 50 hospitals and their affiliated medical staffs and more than 160 clinics, and its members work together through various sub-entity agreements to advance the quality of healthcare services, improve the health status of their communities and achieve efficiencies that will help reduce the rising cost of care.

In addition to external alignment with other institutions, AMCs are taking control of their future through various internal repositioning activities. They are reevaluating their relationships with their clinical faculty and medical schools as it becomes increasingly essential to become a single, integrated, accountable clinical enterprise that is efficient and focused on competing successfully in a highly competitive, price-sensitive environment. For some AMCs this involves revisiting their outdated academic affiliation agreements to establish new terms that will achieve greater functional, structural and economic cohesiveness with their faculty in the context of the changing market. Others have been motivated to pursue entirely new structures that replace their old academic affiliation agreements and achieve greater alignment with clinical faculty and community physicians since relationships with both will be required to drive business and function successfully under population health.

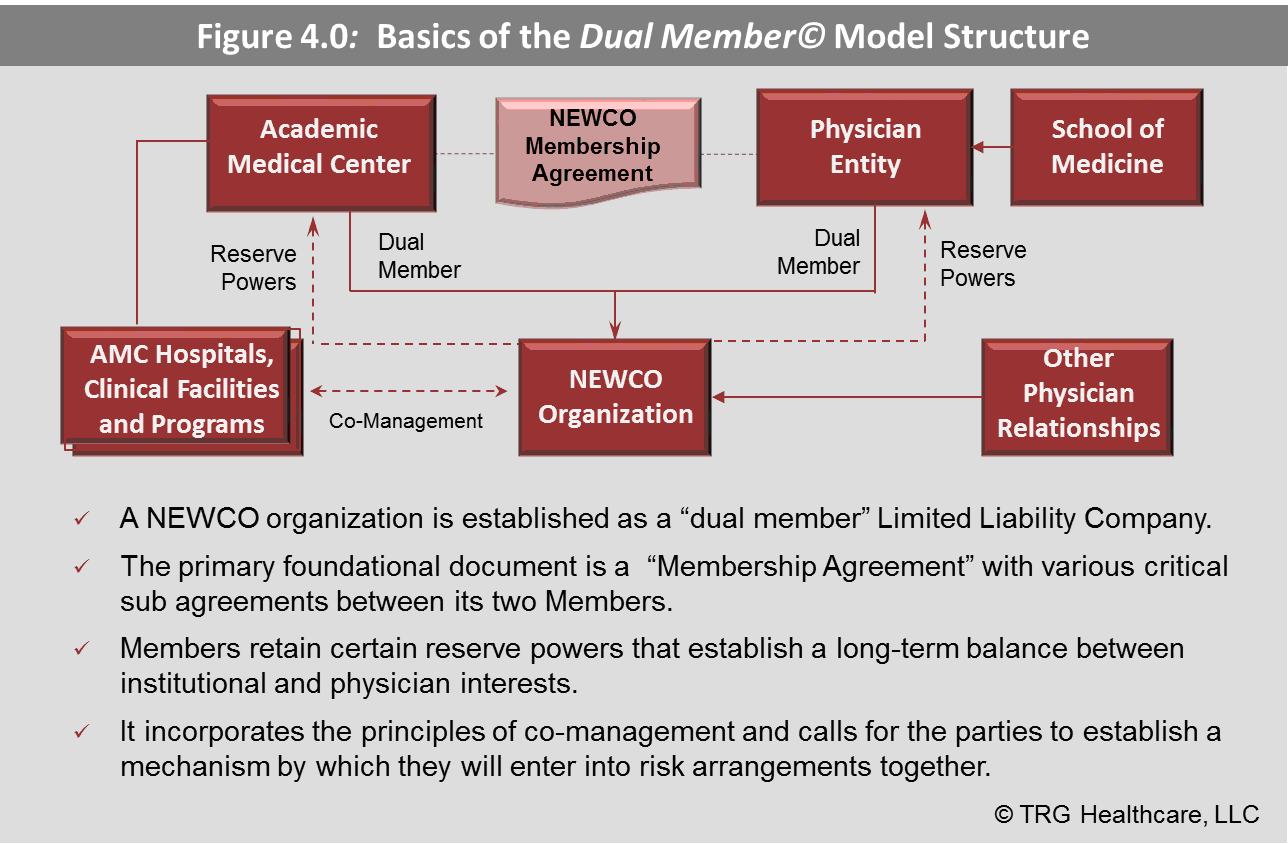

The "Dual Member©" Model is one such structure that has been proven effective in realigning academic institutions and their physician partners to prepare for the changes ahead in healthcare. It creates a single structure where all clinical faculty physicians within a school of medicine and all employed clinical faculty of the related primary teaching hospital can reside and work together as engaged partners with key clinical and economic interdependencies that enable them to share risk and improve patient care. Key attributes of the model are reflected in Figure 4.0.

This model responds to the changing nature of the economic relationship between hospitals and physicians as payment structures evolve. It is meant to be inclusive of community physicians who would like to participate either directly or through contractual arrangements and it creates an attractive structure not previously available to physicians who may want to participate in risk arrangements and population health initiatives with other providers. It also serves as a nimble approach to effectively compete for physician loyalties in an increasingly competitive market.

What are the implications for your AMC?

Deciding how to reposition your AMC in today's challenging healthcare landscape is a complex matter and the possibilities are wide. Most likely there is no singular solution, but some uniquely constructed combination of internal and external repositioning strategies that will help posture your organization for long-term success. While the appropriate response will depend on your individual circumstances, organizations that embrace the need to change in the context of the evolving market and whose strategic actions are guided by innovation and a spirit of collaboration are likely the ones that will fare best as the situation in healthcare unfolds.

Howard J. Peterson is the founder and managing partner of TRG Healthcare. He has more than 30 years of experience developing progressive strategic, financial and operational solutions for a broad range of healthcare clients. His consulting expertise includes: strategic and financial positioning, strategic transactions, as well as operational and financial performance improvement. He has worked extensively with academic medical centers, teaching hospitals, hospital systems, and faculty/physician groups. Prior to forming TRG Healthcare, Mr. Peterson served for more than 20 years as a hospital executive within leading academic institutions, including seven years as CEO of Penn State University Hospital/Hershey Medical Center and eight years in various executive positions including COO at the University of Michigan Medical Center.