J.D. Power recently presented "New Approaches to Measuring Patient Satisfaction" in January at Merchant Medicine's annual ConvUrgentCare® Strategy Symposium in Scottsdale, AZ, to health system, retail clinic, and urgent care executives from across the US. These "on demand" health care providers are changing the delivery system and creating competitive pressure in health care.

There are several findings that healthcare strategists at both health plans (payors) and providers should be paying close attention. Executives and strategists in urgent care and retail clinics are very focused on how they interoperate with health plans, and health plans are likewise concerned with how to work with on-demand care.

Starting with Low Expectations

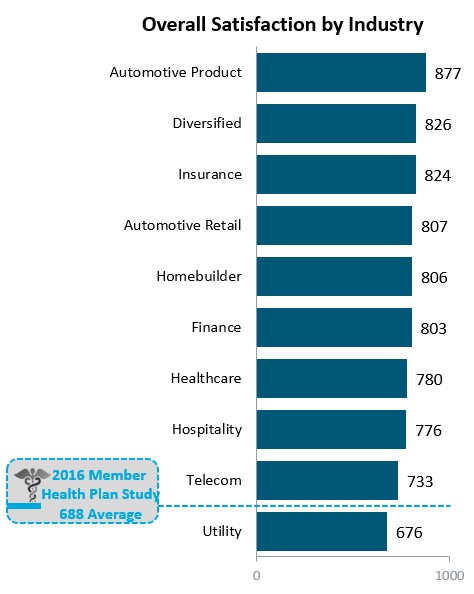

Health plans, generally speaking, are J.D. Power's second worst ranking industry sector for customer satisfaction, slightly behind public utilities 1. Among the traditional customer service and claims processing underperformance, new factors stood out on their 1,000 point index.

Figure 1. Key J.D. Power Industries on 1000 Point Scale

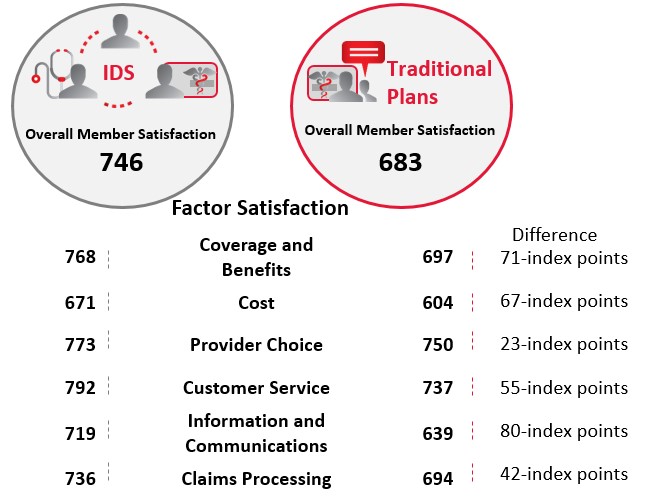

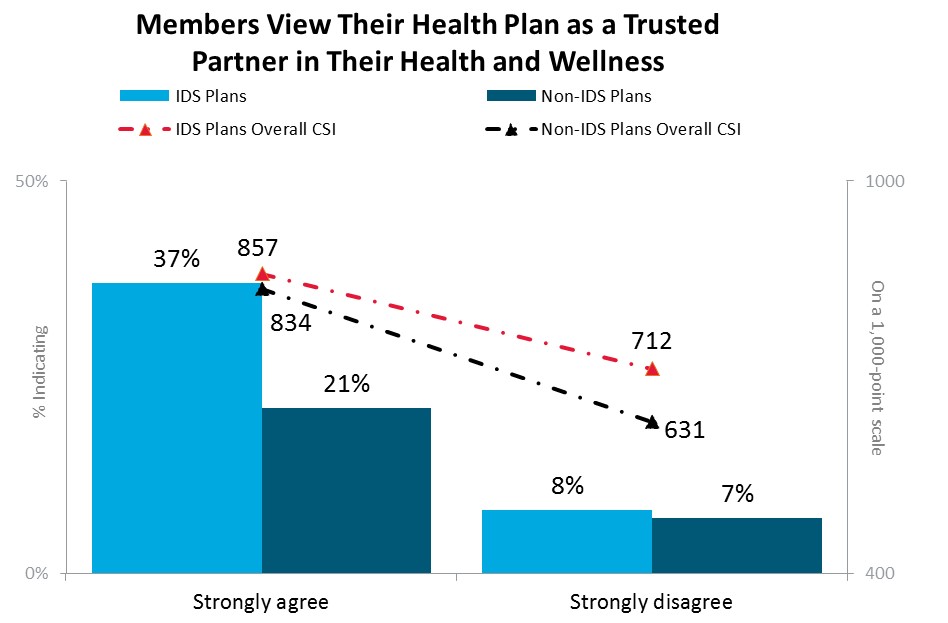

This is reinforced by the fact that health plans which are not Integrated Delivery Systems (e.g. Kaiser Permanente, etc.) need to outperform on other categories of service because they are automatically at a disadvantage from an overall customer satisfaction perspective. Whether it is because the customer (patient) only sees one brand, or the providers more focused representing the organization to the customer (patient), there is a clear scoring gap.

Figure 2. Source: J.D. Power 2016 Member Health Plan StudySM

The Effect of Patient Experiences on Satisfaction

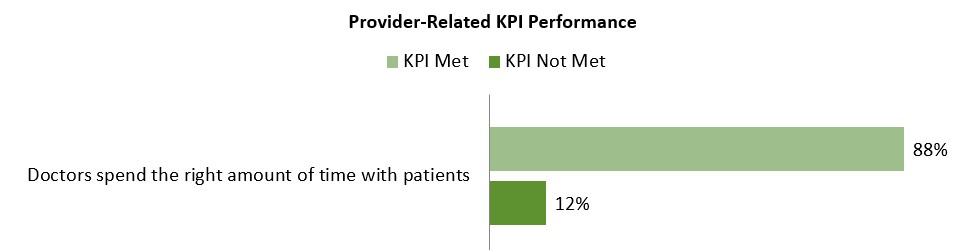

Health plans should be paying careful attention to how the network-contracted provider represents their interests. The effect of a patient/doctor relationship directly correlates back to overall health plan satisfaction. The outlook from the place of care greatly influences the perception of the overall value of the health plan.

Very basic, essential customer/patient delivery factors matter greatly, and these originate at the point of care. For instance, overall satisfaction is a significant 110 points on a 1,000 point scale for Medicare Advantage members who feel their doctor spends the right amount of time with them as opposed to too little time. The typical rushed, over-scheduled and inefficient primary care provider who is in and out of an exam room is impacting health plan rankings, along with clearly creating their own dissatisfied patients.

Figure 3. Source: J.D. Power 2016 Member Health Plan StudySM

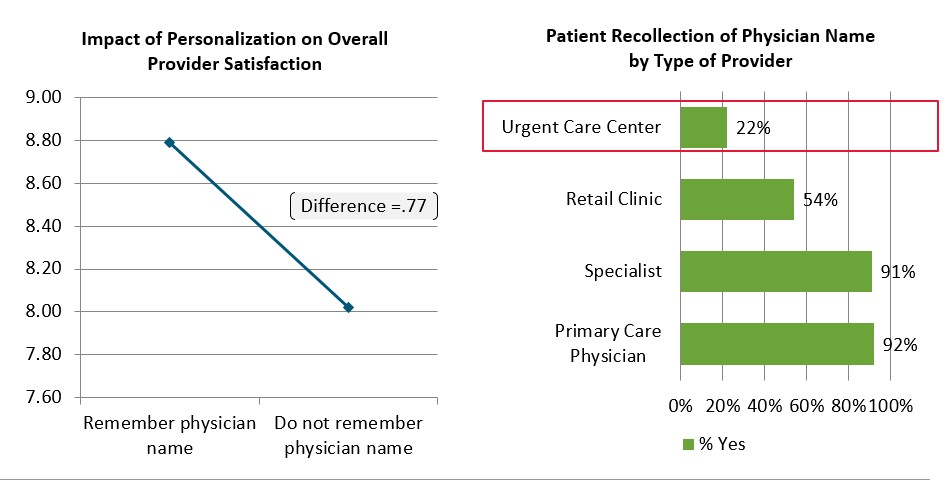

Personal connections matter greatly. On the opposite side, there is also a correlation to customer satisfaction when the patient doesn't remember the provider's name, which is often the case in the on-demand sector. The patient is seen by a care delivery assembly line, and a customer satisfaction improvement opportunity is missed.

Figure 4. J.D. Power Research on Satisfaction when patients don't recall the Provider's Name

This is clearly an opportunity for the on-demand sector and health plans to collaborate on improving personalization and better training so that the patient and provider establish a clearer relationship. Customized personal greeting the patient by name, walking them from the entrance area, walking them to the exit, and subsequent follow-up calls matter greatly in large urgent care chains.

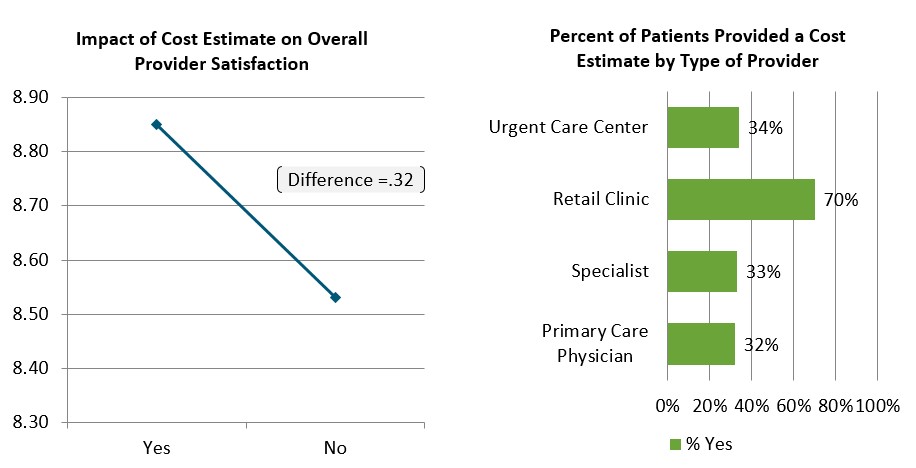

Interestingly, two provider-side satisfaction drivers stood out with respect to consumerism. Providing a cost estimate upfront at time of service is a positive. Retail clinics post their pricing publicly, and their higher satisfaction level isn't surprising. More competitive operators have more satisfied patients, driving higher health plan satisfaction, when the cost of care is not a surprise.

Figure 5. J.D. Power Research on Cost Estimates to Patients

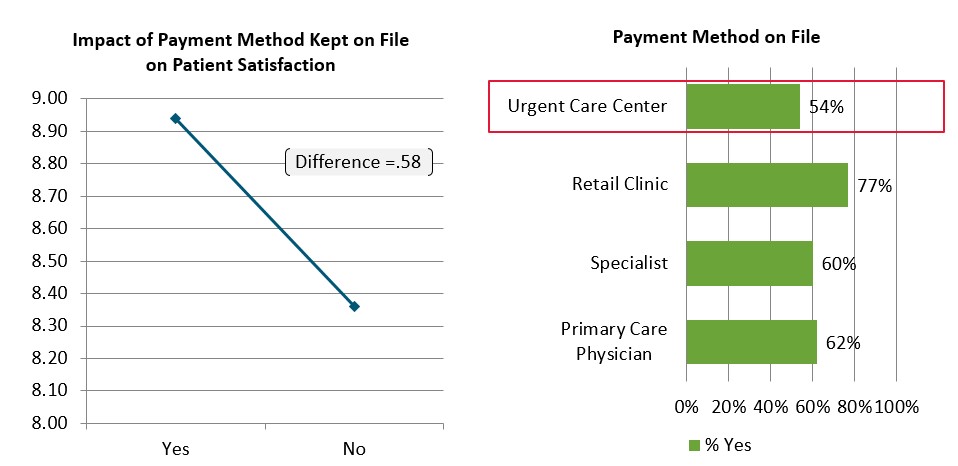

Also of note is the idea of having a payment method on file. Many providers are scared to death of putting patient credit cards on file and running the card once the claim adjudicates. For health plans that have moved patients to high deductible structures this is actually an inverse driver; providers having a card on file actually improves how they are perceived, and in turn the plan is perceived.

Figure 6. J.D. Power Research on Payment-Method-on-File

In few other facets of life are "customers" not required to pay at the time of service. It has arrived for health care and patient receptivity is higher than providers may think.

Digital Tools Are Still Lacking – and This Weakens Customer Satisfaction

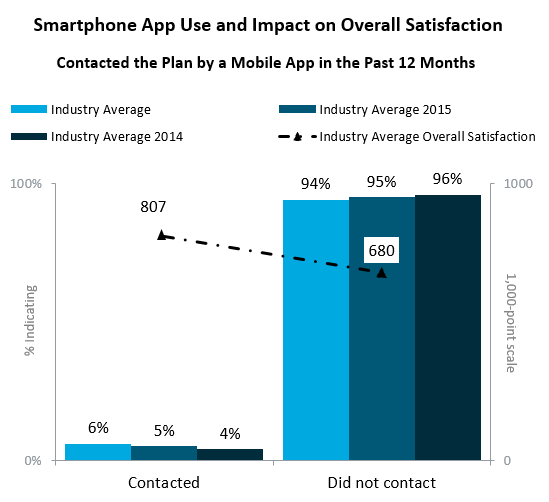

A key take-away for commercial health plans includes large gains on scoring when a plan emphasizes digital member communications and integration. Mobile apps from airlines, stores, fitness tools, retail banking, etc. are setting the stage. Consumers are developing expectations for how health care should be accessed, and the resulting level of satisfaction is clearly linked to digital engagement.

Among health plan members who contacted their plan through a mobile application once in the past twelve months, overall satisfaction is 807 index points, which is 127 index points higher than among those who did not. These would be members that incidentally use their smartphone app to find health care "on demand", so the critical link to the on-demand sector shouldn't be news.

Figure 7 Source: J.D. Power 2016 Member Health Plan StudySM

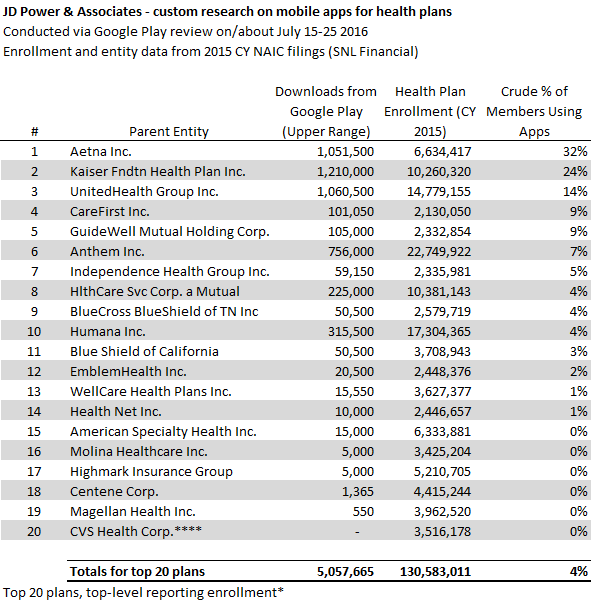

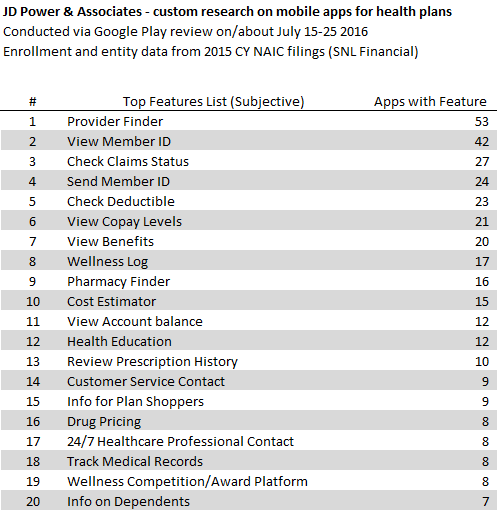

J.D. Power and Merchant Medicine evaluated what health plan apps actually accomplish at the top twenty US plans with an eye toward its effect on the on-demand sector. A dismally low average of six percent of estimated members downloaded their health plan's mobile app last year, up one percentage point from the prior year. Contrast this adoption rate to fifty percent or higher in financial services and travel for member (customer) app utilization. If this changes significantly, look for shifts in network access points.

For directional purposes, we utilized data from Google Play.2 Google's Android dominates the mobile market with more than eighty percent of the market. Utilization by members – despite the health plans' own advertising – as subjectively tracked via downloads show:

Figure 8. J.D. Power Brief: Research on App Usage from Google Play

Many opportunities to drive satisfaction measures abound. BCBS-affiliates show an exact picture of the member's benefits card in text so small that it is difficult to read, and not easy photocopied or scanned in the provider's office. After spending several minutes finding the plan specific app, downloading it, and going through a setup, the member is required to then hand their smartphone to a front desk person at hospital or physician's office upon registration. Now compare this with the potential ease of using a bar code or a text message containing a click-to-authorize link associated with the provider's eligibility system and the member for security, and registering could be done in real-time as with authorizing a credit card payment. Time delays and frustrations can be removed entirely through digital integration.

Of particular value, for example in urgent care, when a member's insurance eligibility is checked at the front desk, the health plan could easily send the same information to the member's phone via text or the app, eliminating the "surprise" factor.

Provider organizations have also taken steps with smartphone technology, which may conflict with health plan objectives, such checking wait times and reserving spots in line at emergency rooms and urgent care centers. Some of these facilities are becoming more sophisticated in real time, with advertising databases knowing what keywords a consumer searches, where the consumer is located, and learning about prior buying patterns.

Merchant Medicine estimates that more than twenty percent of the urgent care market is already on queuing technology allowing patients to reserve a spot in line – smartphone texting – with another twenty to thirty percent due to convert in the next two years. Most clients are moved to these features as a competitive priority. Larger health systems are well ahead with implementing queue management 3. This appears to be missing from the health plan apps.

Figure 9. J.D. Power Research on Mobile Apps from Google Play

Using the health plan app to find providers is obviously a steerage opportunity. Looking at the digital space as capturing market share, some plans are further ahead. Whomever controls the patient's smartphone access gains a strong hook for migrating to telemedicine, wellness programs (e.g. FitBit type monitoring), on-demand care steerage, and care network communications.

Another opportunity is having the cell phone number or email address from the employer's open enrollment, texting or emailing a link to the enrollment app, and then providing a discount to the member to use the app. A tailored plan would be embedded with the member's personal device, would be there to provide recurring updates, provide an on-demand link to care or route to a physical facility when needed, and assist in claim or benefits follow-up.

Last, for traditional health plans lacking in "brick and mortar" facilities must make the extra effort to close the gap with strong digital performance. They need to engage the consumer frequently, control "digital real estate" on the smartphone, and be ready to serve as the need arises to communicate proactively.

Putting Patients First to Improve Satisfaction

In conclusion, 2017 should be about getting "back to basics" for both health plans and providers. Competitive health plans have to work closely with providers and vice versa. Both have room to improve to better serve the interests of all parties. Transparency around cost and subsequent payment efficiencies are overdue. Both need to have a coherent smartphone strategy as it will dominate the on-demand and "funnel" of the market going forward, as well as being something driving up satisfaction.

The following is the spread on IDS versus traditional plans with respect to "Members who agree that their health plan is a trusted partner in their health and wellness are more satisfied".

Figure 10 Source: J.D. Power 2016 Member Health Plan StudySM

Both plan and provider come out ahead when the patient perceives the two as working together. The starting point is to nail down the patient-side experience and smartphone strategy integration.

Contact us to learn more:

Valerie Monet

Director, Practice Lead for Health Insurance at J.D. Power

Valerie.Monet@jdpa.com

Valerie Monet is a Director and Practice Lead for Health Insurance at J.D. Power. She is responsible for North American syndicated, proprietary and consulting services provided for clients within the insurance industry. Ms. Monet has been with J.D. Power for over 10 years and has 20 years of business management and research experience in both the public and private sectors with a strong background across the insurance, healthcare and financial services industries. Ms. Monet earned bachelor degree and a master's degree in public administration from Wayne State University.

www.jdpower.com

Bernie Kuhn

Principal at Merchant Medicine LLC

Bernie@MerchantMedicine.com

Bernie Kuhn is a Principal at management consulting firm Merchant Medicine, LLC. He was previously Senior Vice President for Corporate Development at Doctors Care in South Carolina, and he held a dual role as VP at parent insurer BlueCross BlueShield of South Carolina (BCBSSC). Prior to BCBSSC, Mr. Kuhn was a Senior Manager in KPMG's management consulting group with experience across health care, insurance, pharmaceuticals, and retail clients. He is a member of the Healthcare Financial Management Association (HFMA) and the Urgent Care Association of America (UCAOA). Mr. Kuhn received a BA in Accounting at Michigan State University and an MBA at the University of Florida.

www.merchantmedicine.com

1 jdpower.com/resource/us-member-health-plan-study

2 http://www.businessinsider.com/ios-and-android-dominate-marketshare-2016-2

3 https://www.inova.org/healthcare-services/urgent-care/reserve; Example in practice

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.