Physician Practice Management companies are gaining attention again. In 2012, kidney-care giant DaVita bought HealthCare Partners; the combined company immediately started acquiring and partnering with other large practices. Also in 2012, private equity firm Audax Group acquired Advanced Dermatology & Cosmetic Surgery, and Welsh, Carson, Anderson & Stowe formed U.S. Anesthesia Partners. Even more recently, private equity shop Clayton, Dubilier & Rice completed the IPO of Envision Healthcare (formerly Emergency Medical Services Corp.) in August 2013 — a firm they had taken private in 2011.

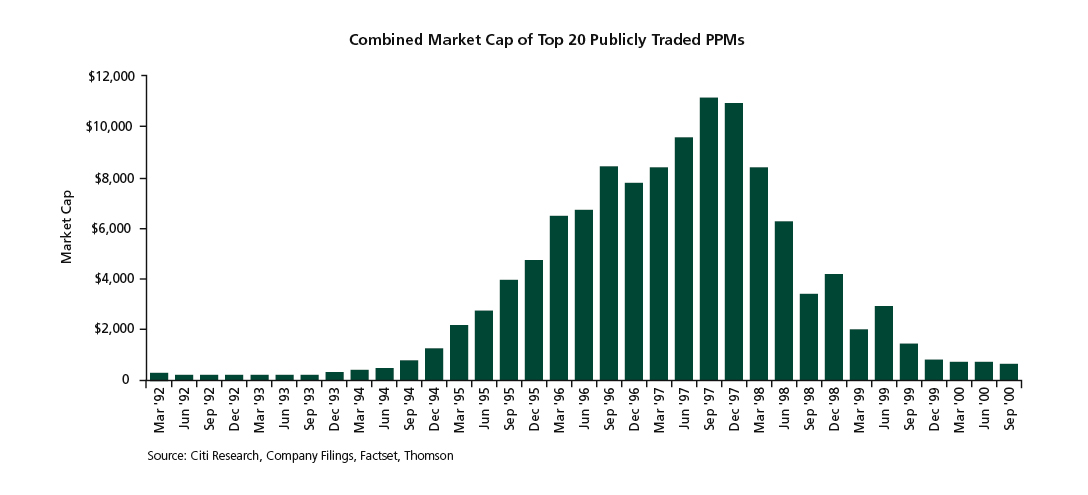

In the 1990s, PPM companies such as Phycor and MedPartners evolved the traditional back-office services model into an industry roll up, building sprawling empires of medium to large multispecialty and single-specialty physician practices. In 1997 alone, public PPMs raised $2 billion to fund the acquisition spree. Any physician group of scale auctioned itself to the highest bidder. By the peak of the phenomenon, in 1998, Sherlock Co. estimated there were 39 public and 125 private PPMs.

Then the bubble burst. Initiated by bankruptcy announcements from MedPartners and FPA Medical Management in July 1998, eight of the 10 largest publicly traded PPMs had declared bankruptcy by 2002. So what happened? Fundamentally, the competition for a relatively limited pool of physician groups large enough to be interesting targets drove prices to unsustainable levels, often 50-100 percent above the underlying cash-flow value. This was accelerated by rapid margin compression, a result of declining premium revenue caused by a downturn in the underwriting cycle combined with the PPMs' inability to bend their cost curves. To compound the problem, acquired groups grew rapidly disenchanted as PPMs' focus on new acquisitions left them low on the priority list. Their frustration only increased when deals founded on equity participation collapsed in value.

Now, we are witnessing a resurgence of PPMs. Physician groups are favored targets of PPMs, and even more hospitals and health systems are on the hunt. Approximately 40 percent of physicians today are either hospital employees or employees of a practice owned by a hospital or health system.

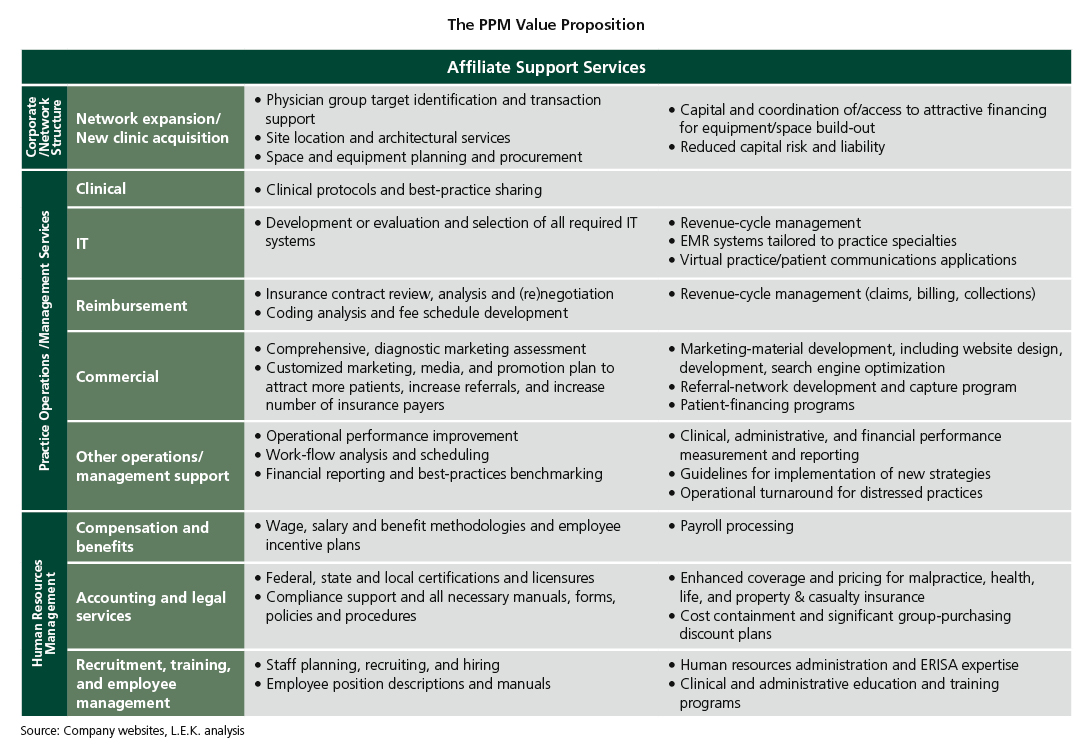

Physician practice management failed because it was premature and poorly executed — not unsound. Twenty years later, PPMs have a clear strategic rationale and value proposition. Indeed, the need is stronger than ever. Physician group requirements have evolved substantially from back-office efficiency to include capabilities such as advanced patient-acquisition methods, population health and risk management and clinical effectiveness.

Why PPMs make sense

There are several fundamental gaps in the capabilities of traditional physician offices that PPMs fill:

- The ability to make capital investments. Today's clinical and back-office environments are increasingly becoming electronic, a transition that demands capital investment, sophisticated software and process-management systems that are anathema to professional services organizations in general and physician organizations in particular. In addition, effective management requires sophisticated data sharing across the value chain — independent physician practices simply do not have the wherewithal to manage data sharing well.

- Population-health and risk management. Traditional fee-for-service arrangements incentivized physicians to maximize utilization. In the wake of healthcare reform, many specialties will see increases in bundled payments and other models that transfer the financial risk to the provider. To succeed, physician groups require the ability to negotiate sophisticated risk-sharing agreements with payers and the actuarial support to identify the patient populations and trends that drive medical-cost inflation. They also need to learn and share the care-model innova¬tions that drive lower healthcare costs and increase quality.

- Patient-acquisition sophistication. Patient decision making is changing due to increased patient financial responsibility for medical care and the increasing transparency of physician quality. At the same time, e-marketing platforms for patient recruitment are rapidly evolving. This confluence of factors requires sophisticated, local patient-acquisition programs that are not in physicians' domain of expertise.

- Administrative efficiency. As a general rule, physicians want to practice medicine, not manage the back office.

The number, complexity and capital intensity of electronic front-office and back-office systems have grown exponentially. The number and complexity of capitated risk contracts have expanded under the next wave of risk delegation. The administrative burden, regulatory requirements, patient billing, etc., has also increased.

Physicians' attitudes about ownership and independence are changing. Whereas going into solo private practice was traditionally the dream pursued by most medical students, now most want jobs as salaried employees. In a recent poll of medical graduates, 75 percent of respondents said they preferred to work either in a group or hospital-affiliated practice. With the supply of larger group practices increasing, PPMs should see increasing demand for their services.

Complications

In the short term, accelerating hospital acquisition of physician groups could provide PPMs with real competition for group affiliation. However, we expect that, as hospital foundation employment contracts come up for renewal, the pendulum will swing in favor of physicians' independence from hospitals.

The second complicating factor is the participation of managed care organizations. United Healthcare recently acquired AppleCare Medical Management (49 percent stake); Memorial Healthcare IPA; WellMed Medical Management (80 percent stake); non-clinical management assets and personnel of Monarch HealthCare medical group; and Aveta Inc. With the implementation of mandatory medical loss ratios, profit potential has shifted to the provider side and payers will continue to be aggressive bidders for multispecialty groups with strong Medicare share. While the acquired groups have compelling capabilities, potential provider partners will need strong economic incentive to overcome their discomfort with payer partners.

Who will win

L.E.K. Consulting has identified a number of best practices and detailed tactics for PPM success; the most important include:

- "What have you done for me?" A strong physician-group value proposition (which is clearly and frequently communicated). To be robust, the value proposition needs to deliver superior income prospects and reduced hassle to physicians. Specific elements may include superior revenue generation, superior local marketing, payer contracting and per-patient revenue optimization, improved clinical efficiency from specialized front-office systems, processes and best practice sharing, as well as more traditional back-office efficiency. The nature of services delivered from the PPM also needs to be refreshed over time to meet the evolving needs of its network and to demonstrate ongoing value creation.

- "Why should I care about business performance?" A model that aligns incentives and motivates engagement. The challenge is to ensure physicians retain a strong link to the local practice while also ensuring their buy-in and participation in the larger entity (e.g., profit share). Several of the more elegant models (e.g., tax-efficient equity participation) can create more friction than alignment (e.g., when equity values inevitably decline). Different models can work but general rules of simplicity and transparency should always be followed.

- "How do we collaborate effectively week in and week out?" Effective governance and operational protocols. Governance and operational protocols are critical to support the first two points above. Sound operating models ensure engagement and rapid issue resolution as well as provide an early warning signal for potential misalignment.

- "How is the toolkit optimized for my local market?" A local before national perspective. Healthcare is a local business. A PPM's capabilities must be tailored to help its companion physician group thrive in its local context, rather than to force the group to apply cookie-cutter national approaches that may be at odds with the local market dynamic.

Even if these value drivers are kept in focus, there will be execution risk. These include managing and implementing systems across a diverse and often still independently minded portfolio of physician groups, the ability to bring actuarial expertise and translate it to clinical action, creating aligned incentives that work, and the challenges of potentially irrational competition for payer contracts. However, we are confident that PPMs will play an important role in the evolving healthcare-delivery landscape.

What the PPM resurgence means for your business

The arrival of the next generation of PPMs provides many opportunities across the healthcare value chain:

- PPMs: The challenge is to provide real value in an aligned framework, which is what ultimately derailed the 1990s generation. PPMs must continue to develop and evolve their business models to optimize their value proposition and beat their competition.

- Physician groups: PPMs can be a real source of leverage, allowing physicians to practice medicine and thrive in today's complex environment, and long-term sustainability must be bal¬anced against more attractive deal terms.

- Health systems: Rapid acquisition of physician practices, while successfully protecting referral volumes, has left many hospitals with severe physician practice management challenges. Hospitals, while better capitalized, are not particularly well-suited to deliver on key practice management gaps addressed by PPMs. Partnering with a PPM could provide unhappy hospitals with a better outcome than spinning groups back out at a loss or continuing with high levels of operational friction.

- Payers: A lack of sophistication in the provider networks' ability to manage risk remains the biggest challenge to managing healthcare cost in the face of declining reimbursement and mandated medical loss ratios.

- Private equity investors: The PPM space represents a strong macro-trend to invest behind. As always, successful investing will require understanding whether the fundamental value proposition is sound, the sub-sector reimbursement risks can be managed and whether the PPM is competitively well-positioned to grow.