Changes to provider recruitment strategies, compensation, and employed group infrastructure are top concerns for healthcare executives

National healthcare consulting firm, HSG, has released the initial findings of its COVID-19 Strategic Implication Survey. Data collection began on April 14th and concluded on May 14th with input from more than 50 trusted healthcare executives and employed provider group leaders. Respondents from across the country weighed in to share their perspectives on COVID-19's current and expected impact on employed physician networks. Results illuminate concerns around provider recruitment, compensation, management infrastructure, and virtual health.

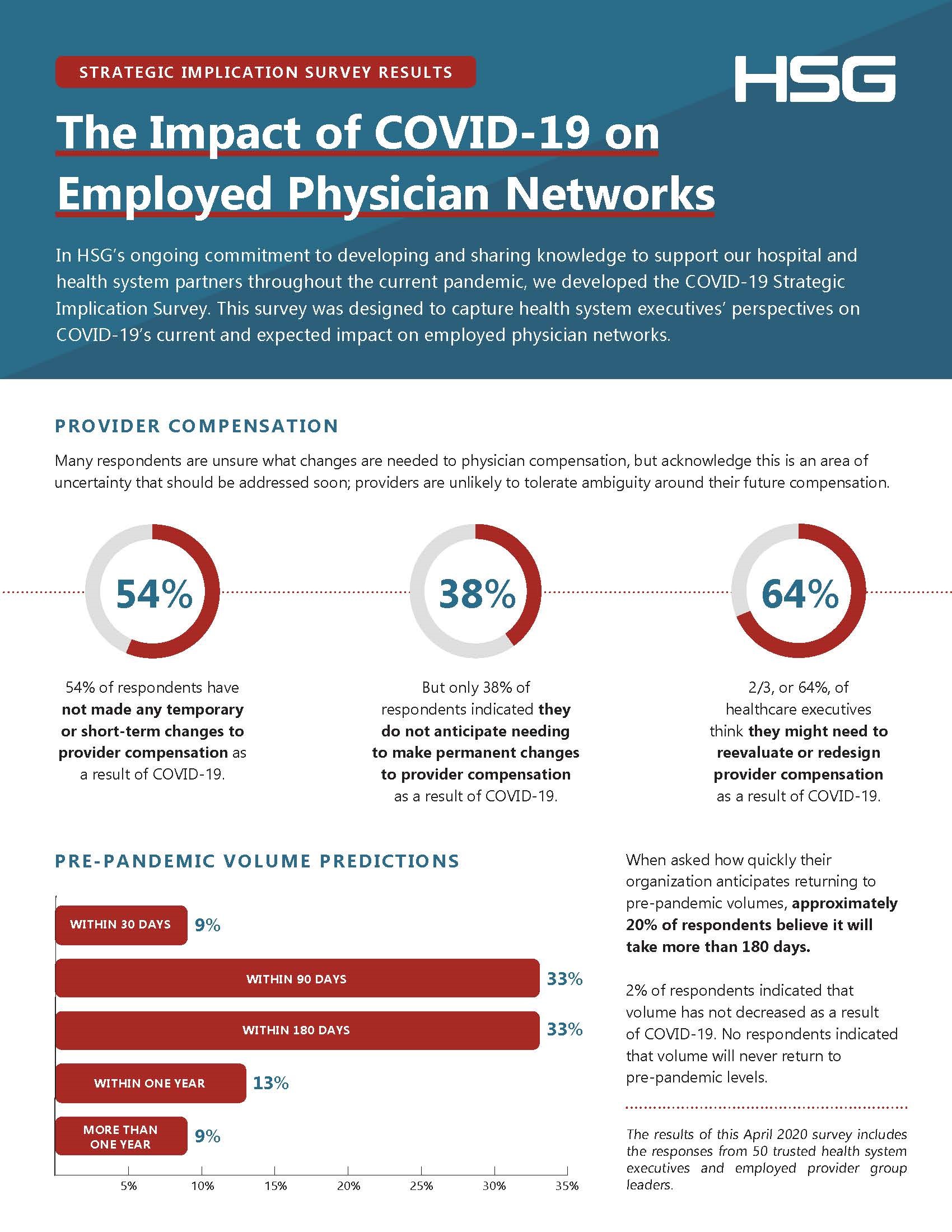

When asked about the need to make permanent changes to provider compensation, 38% of respondents said they do not anticipate needing to adjust incentives or to reduce provider compensation to remain financially sustainable and account for operational changes caused by COVID-19. Many of the participating healthcare organizations noted that they had already asked everyone to take a voluntary pay decrease as a temporary measure, and are requiring providers to utilize accrued paid time off for non-productive time.

"We anticipated that a little more than half of the executives we surveyed would be contemplating long-term changes to provider compensation plans given the current environment and the way that performance is tied to compensation," said Eric Andreoli, HSG Director "The survey numbers were a little lower than we expected. About 1/3 of respondents are still in the 'maybe' or 'we're not sure' zone regarding compensation plan redesign. This could be indicative of the hospital being in a healthy financial position before COVID-19, or it may be that leadership is holding out hope for a successful Virtual Health program. Regardless, we believe leadership should address this uncertainty because providers are unlikely to tolerate long-term ambiguity around their future compensation."

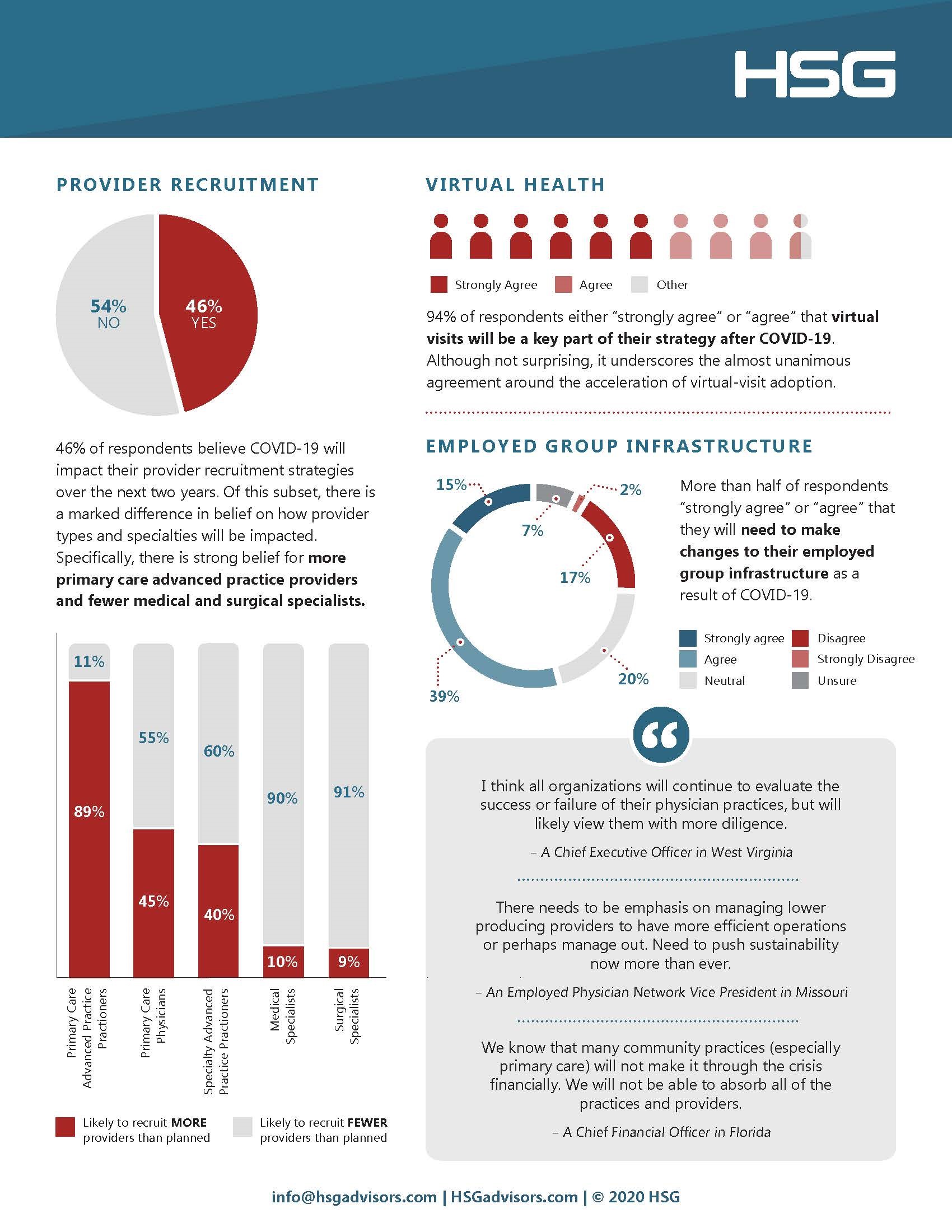

Telemedicine during this healthcare crisis has changed how and where many primary care physicians deliver services. Most of the survey participants agree (34%) or strongly agree (60%) that the delivery of virtual health will be a crucial part of their healthcare strategy even after COVID-19. There was also majority agreement on the likelihood of shifting more services to an ambulatory setting as a result of the Pandemic, with 39% in agreement and 13% strongly agreeing.

When asked how quickly organizations expected to return to pre-pandemic volumes, the good news is that none of the respondents believe that patient volume will never return. 33% percent indicated that they expected to be back where they were within 90 days, and an additional 33% took a more conservative estimate at 180 days before a return to pre-pandemic volumes.

As healthcare leaders and executives examine their system's strategy moving forward, many noted the uncertainty of survival for independent physician practices. While many of these practices may become acquired by larger systems, not every group can be absorbed. In fact, 55% of those that believe their recruitment efforts will be impacted noted they will be recruiting fewer Primary Care Physicians than they had originally planned. The hiring focus will be on Primary Care Advanced Practice Providers in the near future instead, with 89% of participants indicating an expectation to recruit more of these providers than initially planned.

"We know that COVID-19 has had dramatic impacts on our economy, the way we live, and how we take care of ourselves. We knew that its impact on health systems would be equally dramatic, and we predicted that many small practices would not survive. We just weren't sure what their fate would be in light of government aid and regulatory waivers." said David Miller, founding partner at HSG.

Regulatory waivers on Stark provisions are meant to help support engagement with independent practices. According to HSG's survey, about 35% are somewhat or extremely likely to take advantage of the waivers. On the other hand, the survey reveals that the exact same number of respondents are likely to acquire independent practices within their market. This data indicates that 65% are neutral, unsure, unlikely, and extremely unlikely to do anything to engage with struggling small private practices.

Additional details and survey data are available for download on HSG's website. For more information on how healthcare systems and hospitals can address strategic concerns, visit the Thought Leadership section at hsgadvisors.com

About HSG

HSG builds high performing physician networks so health systems can address complex changes with confidence. From boosting market power and financial strength to preparing for value-based care, HSG can help you define your strategy, implement that strategy, and manage your physician network short or long-term. HSG, a Louisville-based, national healthcare consultancy firm, can be reached via their website, LinkedIn, by emailing info@hsgadvisors.com, or by calling (502) 814-1180.