When thinking about the financial performance of the employed physician enterprise for your health system, is your first instinct to focus on the operating loss of the medical group as a standalone business? While this is certainly an important part of the equation, it's by no means the whole story.

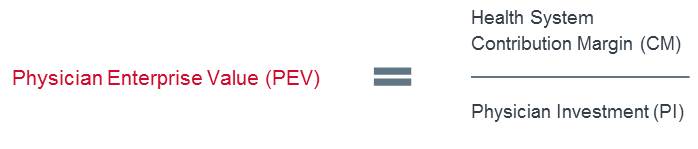

Advisory Board has developed a metric that we call "PEV"—physician enterprise value—and it captures not only medical group revenues and expenses by practice site, but also the hospital contribution margin generated by patients of the medical group.

Health system executives are using this formula to finally capture facility and medical group value within a single number.

Breaking down the PEV equation

The PEV metric is based on a straightforward fraction: the numerator represents the dollar value of hospital contribution margin that is attributed to the employed medical group, referred to as "CM." That is divided by the net investment (or operating loss) of the standalone physician enterprise, referred to as "PI", to generate PEV:

PEV creates a common measure to evaluate practice investment and facility based contribution margin, in which both facility profitability and improvements on the medical group side are properly reflected. To make this metric accessible to health system leaders, Advisory Board embedded the ability to track PEV into its automated medical group performance reporting tool, Crimson Medical Group Advantage.

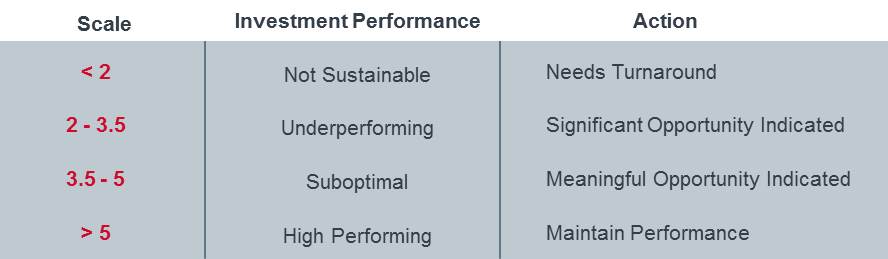

In working with over 100 institutions nationally, our team has found this single measure to be a much stronger indicator of an organization's financial health and sustainability than the physician investment or operating loss. The following table shows how we evaluate the range of scores—a PEV score that is less than two indicates an unsustainable enterprise in need of a turnaround, and a score greater than five signifies a high-performing medical group with strong health system alignment.

It is important to note that organizations connecting medical group data with facility data to calculate PEV should ensure that the resulting analytics are excluded from compensation-related decisions. Your health system can work closely with compliance or legal teams to create internal policies and procedures that create a necessary firewall, wherever possible. That being said, there are numerous valuable insights that can be generated from this data to effectively identify opportunities to advance facility and ambulatory access, invest in workflow optimization, strategically expand staffing, evaluate payer contracting strategies, address geographic limiters, and ultimately improve care for patients and the fiscal outlook for the health system.

Strategic implications of understanding PEV

Advisory Board recently partnered with the leadership team of a six-hospital health system in the Southeast seeking to design a more efficient and aligned network of employed physicians. Within the system, there were two family medicine practices just a few miles apart from one another.

An evaluation of the practices' operating investment (or loss) per physician indicated the sites were contributing equally to the system's financial performance. The practices had similar geographic characteristics, payer mix, number of clinical FTEs, professional fee revenues and expenses, as well as patient severity of illness (i.e. risk scores).

From an investment perspective, it would be reasonable to conclude these practices merit the same attention, good or bad. However, when PEV was calculated for each practice along with the attributed facility contribution from each to the overall health system, there was a three-fold difference: One site was generating a return of $3.6 million while the other was only generating $1.2 million.

With this information in hand, leadership could then target the underperforming practice with different-in-kind strategies to solve for common culprits:

• Are patient referrals being mismanaged?

• Is there significant network leakage?

• Are there problems accessing specialty care?

• Is there a lack of trust or knowledge between the family medicine physicians and the specialists?

• Are quality concerns causing physicians to refer their patients out of network?

While for years the industry has focused on the standalone profit and loss economics of the employed physician enterprise, executives are starting to change the conversation by assessing the value of the medical group in relation to health system performance. Tracking PEV is the first place to start.

John Deane is Chairman of Consulting at Advisory Board, where he leads transformational engagements focused on health-system sponsored medical groups. Adam Bryan is Vice President of Consulting at Advisory Board and leads the firm's technology and data analytics work in service to the employed physician enterprise.

This article is the first in a series about understanding PEV and using the metric to comprehensively impact health system and medical group performance. Stay tuned for upcoming posts on topics that include operational implications of PEV and the importance of this formula in the transition to value-based care.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.