As healthcare executives and physicians look on with chagrin, retailers are moving aggressively to fill unmet needs in the delivery of primary care for millions of Americans. With eye-catching store fronts, convenient locations, and extended hours of operation, drug stores and big box retailers are providing routine medical care ranging from flu shots to pregnancy tests to school and sports physicals.

For the most part, primary care physicians have been content over the past decade to let retailers take on this "lighter" portion of the market. Recently, however, retailers have begun to act deliberately to take on more substantial portions of the primary care market—adding capabilities to diagnose and manage chronic care patients, provide routine blood testing, and even offer insurance counseling to patients trying to navigate the new exchanges. Retailers are sending a warning shot across the traditional healthcare bow—we are serious about providing primary care to the masses, and we intend to grow our footprint in this market. There are numerous implications for traditional healthcare providers.

1. Market conditions are ripe for disruptive innovation.

Numerous market factors are converging to spur demand for convenient, low-cost primary care. Baby Boomers began turning 65 in 2011, and they account for some 10,000 patients per day entering the Medicare ranks. At the same time, millions of newly insured patients are entering the healthcare system, with the result that the number of available primary care physicians falls far short of what is needed to meet this new demand. New care models, such as ACOs and patient-centered medical homes, also require more effort at the primary care level to prevent unnecessary hospital and emergency department usage, monitor chronic conditions in the population, and support a stronger emphasis on preventative care and wellness. Finally, consumer behavior is changing as Americans increasingly seek more convenient and less expensive care. Most physician groups are unable to meet this multitude of needs, leaving a gap that is being readily filled by non-traditional market entrants.

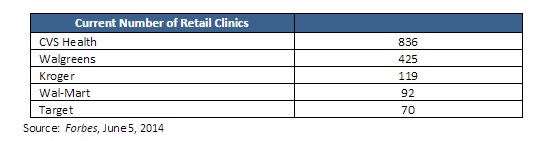

2. The competition is no longer just the primary care practice down the street and the urgent care center around the corner. Today, there are some 1,600 Retail Based Clinics (RBCs) in 39 states that are serving more than 20 million patients, according to Tine Hansen-Turton, Executive Director of the Convenient Care Association. At least five (5) major retailers are investing heavily in the provision of primary care services—the biggest companies to date are CVS, Kroger, Target, Walgreens, and Wal-Mart. These five anticipate strong growth over the next several years--CVS alone is projected to have more than 1,500 RBCs within the next four years.

Current Number of Retail Clinics

3. These retailers have deep pockets and will be formidable competitors in any area of healthcare delivery they choose to pursue. For example, Wal-Mart has 11,053 stores, more than 2 million employees, and $473 billion in annual revenue. While emergency departments in the U.S. handle more than 130 million visitors each YEAR, Wal-Mart sees 150 million shoppers every WEEK. Walgreens has 8,207 drugstores with total annual sales of $76 billion; CVS has 7,600 stores with annual sales of $126 billion. In contrast, HCA, one of the largest players in the healthcare industry, has 165 hospitals and 113 surgery centers in 20 states yielding annual revenue of $34 billion and 20 million patient encounters per year.

4. The new entrants have already taken several steps to raise the bar on customer service and care coordination. The new RBCs are touting at least six areas in which they have an advantage over traditional primary care providers.

Convenience: All of these retailers are open 7 days a week, with extended evening and weekend hours. They offer walk-in appointments, with wait times generally under 15 minutes.

Proximity: Walgreens estimates that they have a drug store within 5 miles of 75% of the U.S. population, according to Katie Lestan, Walgreens Divisional VP of Health and Wellness.

Pharmacists: All five of the major retailers currently have pharmacists on site in each of their clinic locations who can work collaboratively with nurse practitioners to manage patient care.

Information Systems: These retailers can track consumer activity from one store to the next, so that they have a record if someone buys sore throat lozenges in Denver and then goes for a strep test two days later in Baltimore. The RBCs are already working with EPIC and other hospital software providers to allow connectivity between their retail clinics and local hospitals and physicians.

Reward Cards: The RBCs have millions of consumers signed up to benefit from Customer Reward Cards. These cards began as customer loyalty programs to incent return visits but are shifting to instruments of behavior change, rewarding customers who exhibit healthy behavior and buying patterns. According to Dr. Patrick Carroll, the Chief Medical Officer for Healthcare Clinics at Walgreens, they have more than 105 million consumers signed up for their Balance Rewards program, and they are working with psychologists at Stanford to determine how small rewards offered frequently throughout the year can lead to meaningful behavioral change. Through its affiliation with WebMD, Walgreens offers patrons the ability to upload biometric and other health information and receive rewards through the Balance Rewards program as improvement milestones are met.

Price Transparency: RBCs are clearly posting their lists of services offered and associated prices. Visits are being priced in the $25 - $125 range. A primary care visit at Wal-Mart is being advertised as costing $40 for consumers and $4 for employees and their families. A visit at CVS starts at $25. These prices are likely to look very attractive to the high number of consumers who are enrolled in high deductible health plans where insurers are requiring the average family to absorb the first $4,000 - $8,000 of expenses each year.

5. The RBCs are setting their sights on a bigger portion of the primary care pie. Walgreens sent a tremor through the healthcare community earlier this year when it announced it was expanding its scope of services to include the diagnosing and managing of patients with chronic medical conditions such as asthma and diabetes. Others are considering expansions into insurance products, radiology, and lab testing. Over the long term, it is likely that all lucrative aspects of primary care, outpatient care, and insurance coverage will be considered by these large retailers as they re-position themselves to provide healthcare in addition to retail services. Walmart, for instance, has just announced a new foray into the insurance industry through a partnership with DirectHealth.com. During the 2014 open enrollment period for the new insurance exchanges, DirectHealth.com, will have agents in 2,700 Walmart stores to help answer customers' questions about plans and enroll them either online or by phone. It will soon be a new world where consumers can check their blood sugar, get their flu shot, sign up for health insurance, pick up bread and milk, print photographs, replace their propane tanks, try on flip-flops, and buy firewood with one convenient stop.

6. The RBCs are creating a new business model, and the impact on traditional primary care physicians is uncertain. While patient care is the sole business for physician practices, it is only part of a larger strategy for drugstores and big box retailers. For example, Wal-Mart's strategy to offer $4 clinic visits for its employees and $40 visits for its customers has the added benefits of keeping their own healthcare costs in check and enticing people into their stores who will buy other Wal-Mart products as a result of their clinic visit. The result is that Wal-Mart's effective cost for operating its clinics will be substantially lower than the cost incurred by the average freestanding primary care clinic.

On one hand, there is the argument that up to 60% of RBC visitors, according to a recent Rand study, are consumers who do not have a primary care physician (PCP), so the traditional PCP is not being completely stripped of patients by these entities. In fact, primary care physicians may actually see an increase in volume if they can gain referrals from the retail-based clinics as they encounter patients with more advanced needs than can be treated in the clinic environment. On the other hand, traditional primary care physicians are going to face increasing pressure to offer extended hours and a variety of routine services at prices that match those of the retail clinics. The ultimate impact on the traditional primary care physician remains to be seen.

7. Prestigious health systems are participating in integrated networks of hospitals, medical groups, and retail-based clinics in support of their patient-centered medical homes. CVS has taken the lead among RBCs in forming partnerships with some of the nation's leading healthcare providers. Their first affiliation was with The Cleveland Clinic in 2009, and today they have some 28 such relationships, including Sharp Healthcare in San Diego, UCLA Healthcare System in Los Angeles, and Carolinas HealthCare System in Charlotte, N.C. Andrew Sussman, M.D., president of MinuteClinics recently stated in Hospitals and Health Networks that CVS wants to be seen as a support system for the patient-centered medical home. By partnering with major health systems, CVS can provide the convenience and access that patients need. Reciprocally, physicians from partnering health systems can function as medical directors for the region's MinuteClinics.

Undoubtedly, we are witnessing disruptive innovation in the delivery of routine healthcare services. Large new entrants are redefining how and where care is delivered. They are also bringing innovative business concepts to an environment that has been largely unchanged for the past 50 years. With deep information system capabilities, expertise in attracting consumers, marketing tools such as reward programs, and savvy strategic partnerships, they will be formidable competitors for healthcare executives and primary care physicians. Despite protests from industry groups such as the American Academy of Family Physicians and the American Academy of Pediatrics, retail-based clinics will be entrenched players in the healthcare landscape of the future, and the delivery of primary care will look very different five years from now as a result.

Robin Rose is the Vice President of Strategic Initiatives at HealthStream and has more than 25 years of experience in the healthcare research industry. Robin is a recognized expert at providing clients with research-based recommendations to initiate change and improve consumer, patient, physician, and employee perceptions. Prior to joining HealthStream Research, Robin was a partner with CEO Projects, Inc., a Nashville based consulting firm serving CEOs, investors, and board members with research and customer growth strategies. Robin was also a founding partner and Senior Vice President with NCG Research in Nashville, TN.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.