Regardless of size, all healthcare organizations’ business offices need to eventually undergo change.

Effective business office transformation, however, requires a multi-faceted claims management strategy. Essential to this process is zeroing in on key performance indicators (KPIs) that will drive operational improvements. By tailoring a cohesive improvement plan focused on these KPIs and earning buy-in from business office staff, hospitals and other healthcare organizations can turn the claims management processes around while better supporting the needs of the revenue cycle team.

Initiating change requires buy-in

Managing business office change begins with a roadmap and understanding of your organization’s willingness to change. To arrive at that willingness, staff must fully understand why change is needed and what it means for their specific responsibilities. Otherwise, the status quo prevents the office from achieving improved viability and competitiveness.

Executive leadership, who need to champion this change initiative, should motivate teams by facilitating discussion, so staff can express concerns openly, find resolution and expand buy in. Most often, staff will not resist minor changes as much as major ones, so that may affect the number of phases and approach steps on the roadmap. Therefore, a larger, complex project affecting more departments may need a more staggered, incremental rollout to ensure a smooth transition.

For any size initiative, however, all hospital departments affected by the change, not just the business office, will require ongoing, reliable support.

KPI selection is critical

Perhaps the most important aspect of a business office transformation is selecting revenue cycle KPIs to help chart the roadmap. When considering KPIs, the gap between current baseline values and the desired level of performance needs to be the focus.

Those baselines can be obtained with a minimum of six months of data for six to eight KPIs selected from multiple different phases of the revenue cycle. Avoid the common pitfall of only focusing on KPIs associated with one revenue cycle phase. This trap creates a lot of work while preventing sustainable long-term progress.

Once baselines have been determined, select three to four critical KPIs as the team’s transformation targets. Formulas for financial revenue cycle KPIs are widely available from nationally recognized groups such as the Healthcare Financial Management Association (HFMA).

The following four KPIs are often top-priority transformation targets for organizations:

1. Net Days in Accounts Receivable (A/R) – This KPI denotes overall A/R management efficiency based on the time to track claims, ensure payment is received and perform necessary follow up on denied claims. The national benchmark is no more than 45 to 50 days.

When calculating the final value for receivables, make sure to subtract credits and amounts designated to collection agencies. If not, falsely elevated values will result. Organizations will also want to consider the speed of pay within each top major carrier. Some professional groups suggest further calculating Net Days in A/R by payer.

2. Did Not Final Bill (DNFB) – As a trending indicator for the claims generation process, DNFB reflects accounts from discharged patients that have not yet generated a claim. A longtime favorite of CFOs, DNFB has the distinction of being the most common bottleneck of the revenue cycle. The national benchmark for DNFB is four to six days, excluding unbilled amounts or those in hold-days status.

Never compromise claim data accuracy just to achieve a better DNFB value. Doing so increases denial rates.

Most organizations find it advantageous to analyze DNFB within two major root causes: charge department and edit/error reason. By further breaking down these causes by age categories, you can highlight easily correctable errors.

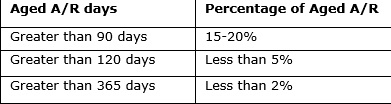

3. Aged A/R – Effectively liquidating A/R within the revenue cycle and collecting timely payments is crucial for any top-performing business office. Keep in mind that payer mix along with the business office’s ability to successfully address denied or aged claims are key factors affecting this metric. If values show sustained elevation or continual rise, it’s time to question revenue cycle management effectiveness.

When calculating receivable age, do not include responsibility changes from primary to secondary insurance or from insurance to patient. Use the discharge date to determine age with mutually exclusive age categories totaling 100 percent.

Aged A/R standard category ranges include:

4. Denial Rate – A low denial rate indicates healthy cash flow, requiring less staff maintenance. The industry average is 5 to 10 percent, though less than 5 percent is highly desirable. Following automated processes utilizing industry and local payer edits will ensure cleaner claims before submitting to payers. This establishes and sustains low denial rates for the long-term. Strong internal audit processes to track, incorporate and deploy new payer edits will decrease denial rates and save time overall.

Support with data and recognition

Some transformation targets will take longer than others, so it is critical to keep the team on a solid path forward with consistent motivation and feedback. Teams, comprised of staff from multiple departments closely associated with your selected KPIs, should meet weekly. Those meetings must include team members responsible for department charge entry, cash posting, claim generation, payer follow-up, registration and financial clearance data collection.

Graphed data visualization depicting 12-month historical trends per KPI can drive discussion and track improvement. Without a clear picture of current KPI values, it will be difficult for the team to stay focused and achieve its final goals.

In addition, use KPI benchmarking data from both similarly sized peer organizations and internal departments during meetings to serve as team motivators. Another inspiring technique is to post trends over time alongside associated business-office changes or actions so teams visualize the cause-and-effect dynamic.

When setting targets, avoid unattainable goals or immediate negative feedback. If a large KPI improvement level is needed, teams should use a phased approach with specific values at each phase and a realistic time period for each stepping stone.

Remember that transformation goes beyond the business office team, so from the top down, reinforce strong communication and persistence to facilitate your change program.

Likewise, celebration, praise, public recognition and internal newsletters are all valuable tools to set the proper tone, foster an environment of success and reward staff for hard work while adopting more operationally sound processes. The result will be increased cash flow and improved enterprise-wide financial performance, but also a more efficient and satisfied business office staff.

About the author:

Joncé Smith is vice president of revenue cycle management at Stoltenberg Consulting.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.