Healthcare was front and center throughout the recent election cycle and with Trump's victory and his party gaining control of both houses of Congress, Republicans have taken a big step forward to make good on their promise to 'repeal and replace' the Affordable Care Act (ACA) by releasing their draft plan on March 6th called the American Health Care Act (AHCA).

This bill, which was ultimately pulled from a House floor vote on March 24th due to universal opposition by both Democrats and the House Freedom Caucus (who thought the AHCA was a watered down version of the ACA), represents the first salvo in what will undoubtedly be a very contentious fight within the Republican Party, in Congress and across the country over the future of America's health care system and the government's role. With the release (and quick demise) of the Republican plan, which offers a window into the Republican 'plan of attack' on the ACA, policy analysts and industry participants are now diving into the details to determine who would 'win', who might 'lose' and by how much under a proposed Republican healthcare reform framework.

It is highly likely that a final bill (if and when one emerges) could look materially different than the proposed AHCA, so this Q&A with Craig Standen, SEI's director of Healthcare Advice, is designed to address certain provisions of the draft legislation and broader Republican policy goals, and highlight the potential financial impact on hospitals and health systems as they face the prospect of another round health system reform a little over seven years after the ACA came into law in early 2010.

Q There has been a lot of talk on repealing the Affordable Care Act (ACA) since the election. What specific parts are the Republican-controlled Congress looking to repeal, and for healthcare providers, what might be the potential financial impact?

A The stated goal of the Republican Party since the ACA was enacted in 2010 has been to repeal the entire law and replace it with a more 'market-centered' approach that would provide for universal access to coverage vs. the goal of universal coverage under the ACA (a subtle and important distinction). Since 2010, the Republicans have not coalesced around an agreed-upon framework for a replacement to the ACA and the release of the AHCA provides incremental clarity on key provisions of the ACA that would be targeted. That said, much disagreement remains among Republicans in Congress and Republican governors about the right way to proceed forward.

The AHCA1, as envisioned would, among other things:

› Eliminate the individual mandate, which requires people have some form of coverage, and the tax penalty for people who go without; the AHCA envisions a 30 percent premium penalty for not maintaining continuous coverage.

› Eliminate the employer mandate for larger employers to provide health insurance for workers.

› Repeal Medicaid expansion in favor of per-capita capped payments to the states based on total enrollment, with states defining eligibility criteria and coverage levels; ACA funding would remain to 2019 and transition to per-capita system in 2020 with payments based on enrollment as of 12/31/2019.

› Provide states with money from the federal government to set up 'high-risk' pools for people with pre-existing conditions who otherwise wouldn't be able to obtain coverage.

› Eliminate the current premium subsidies based on income, which help make coverage affordable for exchange participants, and replace them with tax credits based on age and a sliding income scale.

› Repeal the Medicare high income (HI) tax increase and other ACA-related taxes and revenue provisions.

› Expand the availability and portability of health savings accounts (HSAs) to help people save and pay for health care expenses; this is widely viewed as a benefit more skewed to higher income individuals.

› Eliminate the cap on tax exemption for employer-sponsored plans and delay effective date of the ACA's 'Cadillac Tax' on high-cost health plans from 2020 to 2025.

› Bar expending federal dollars for Planned Parenthood clinics.

Three popular provisions from the ACA were kept in the AHCA and would likely remain in future Republican bills, including prohibiting coverage exclusion for pre-existing conditions, the ban on lifetime coverage caps, and allowing young adults to remain on a parents plan up to age 26. That said, President Trump may have difficulty reaching his stated goal of 'coverage for everyone' based on the provisions in the AHCA, which would negatively impact uninsured levels.

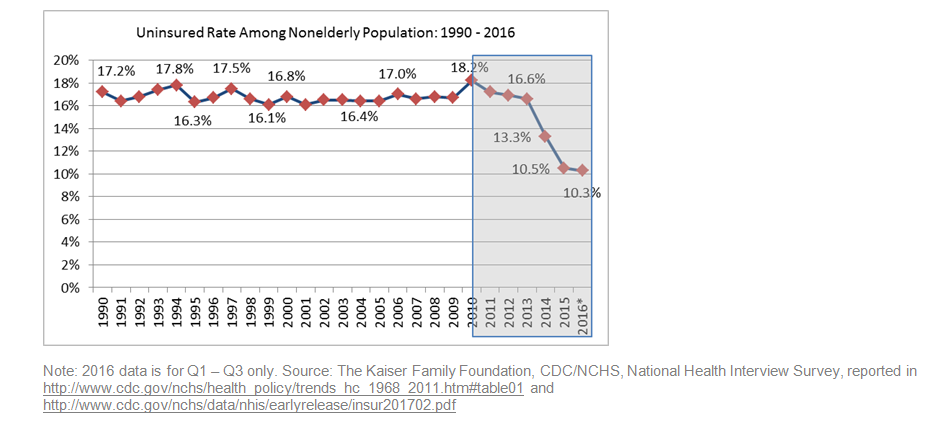

Between 20 and 22 million people gained health coverage under provisions of the ACA, either by gaining access to insurance on the exchanges or through Medicaid expansion in the 32 states (including DC) that have expanded Medicaid to date under the ACA; Medicaid expansion accounted for roughly 11 million of the nearly covered individuals2. And according to data from the Kaiser Family Foundation (www.kff.org), from 2013 – when the ACA was largely implemented – to the end of 2016, the uninsured rate dropped from approximately 18% to just over 10% (or lower based on other sources), an all-time low.

Over that same time period, hospitals saw fairly significant volume and revenue gains3 as these newly insured people sought care and equally material declines in bad debt because of broader insurance coverage. These factors largely contributed to stabilized and improved margins for many hospitals across the country.

Financial gains have been market and organization specific; as the saying goes, 'all healthcare is local'. A hospital with a higher Medicaid population in an expansion state likely realized more significant gains than a similar counterpart in a non-expansion state. And hospitals in non-expansion states and expansion states with low Medicaid populations didn't necessarily see much change. The point is, the broader universe of healthcare providers have experienced financial stabilization or gains since the implementation of the ACA in 2013 from expanded healthcare coverage, higher volumes/revenues, cost efficiencies and lower bad debt expense.

In terms of the potential financial impact if the ACA were repealed, many providers are wary at best and small community hospitals and safety-net hospitals are outright worried about their futures. Analyses by the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) indicate that passage of the AHCA would have potentially resulted in a large number of the 20 to 22 million newly-covered individuals not being able to afford to maintain coverage under a tax credit structure or lose Medicaid eligibility under the proposed legislation4. And the Kaiser Family Foundation estimates that the average health insurance premium tax credit received by consumers in 2020 would be at least 36 percent lower under Republican replacement proposals than under the ACA and the average tax credit also would increase more slowly under the Republican plan5.

It is also probable that an equally large number of people would lose Medicaid coverage from expected tighter state-level eligibility requirements under a proposed per-capita framework and access to care could be impacted by likely reduced Medicaid funding levels under the Republican framework. Ultimately, if uninsured levels were to rise materially under a 'repeal/replace' scenario, hospitals could experience renewed and significant pressure on margins and balance sheets absent increased reimbursement from governmental (i.e., Medicare and Medicaid) and/or commercial payors, each of which are unlikely at levels that would fill anticipated budget gaps.

Q How might the potential repeal of the ACA impact insurance providers and subsequently impact revenues for hospitals and healthcare organizations?

A Health insurers participated in the ACA exchanges with the understanding that everyone would be required to purchase insurance (i.e., the individual mandate), which would result in a broader and more diverse risk pool comprised of young/old and sick/well. The ACA also promised to help insurers by setting up 'risk corridors' and risk adjustment payments to cover expected higher costs for newly insured people who were sicker.

Ultimately, pricing restrictions in the ACA resulted in higher premiums for younger participants and lower premiums for older ones, which dis-incentivized many young and healthy individuals from purchasing insurance through the exchanges when they found the tax penalty lower than the annual premiums. Congress also failed to hold up its end of the bargain by paying insurers only a small portion of the risk adjustment payments for 2016 to cover higher than expected costs6.

With the risk pool skewed to the sicker end of the spectrum and reduced risk payments from Congress, insurers experienced higher than anticipated costs and major losses. In response, exchange premiums for 2017 have risen on average 22% and more dramatically in some markets7. Additionally, a number of large national health insurers, including Aetna and UnitedHealth Group, have indicated they will significantly scale back exchange participation, and Humana stated it will exit the exchanges in 2018 after scaling back over the last several years in response to higher losses. This has led to diminished competition, less choice, higher premiums and rising deductibles in many markets across the country.

The Republican-led Congress has recognized the need to stabilize the insurance markets to stave off possible collapse before their replacement plan is agreed upon (ongoing and contentious), debated and passed into law (a major knife fight) and implemented (timing unknown). In early February, the Trump administration issued regulations intended to bring insurers back to the exchanges by addressing concerns expressed by insurers, including tightening eligibility for coverage during special enrollment periods, continuing risk adjustment and cost-sharing subsidies on a short-term basis, reducing the grace period for non-payment of premiums from the current three months to one month, and giving insurers to June 21st (seven extra weeks) to file rates for individual plans for 20188. To be sure, these are short-term fixes that many Republicans have had to swallow hard to get behind in a delicate dance of wanting to minimize the potential for chaotic market disruptions, while not moving too far down the path of permanently 'repairing' the ACA.

Insurers hate uncertainty and if more take the exit ramp from the exchanges, the likely outcome would be that a large number of newly covered people would find it hard to afford coverage with higher premiums, leading to more uninsured and higher uncompensated care levels for hospitals. Others may shift to lower premium coverage with much higher deductibles and co-pays, which also shifts risk back to hospitals and other providers in the form of potentially higher bad debt and lower volumes/ revenues as people think hard about seeking care and incurring significant out of pocket costs under a high deductible plan.

Ultimately, if the risk pool for insurers continues to skew toward the sicker end of the spectrum and if the individual mandate and other provisions of the ACA are repealed (or materially weakened) without a clearly formed replacement plan, the private insurance market runs the risk of entering the much talked about 'death spiral'. Higher premiums lead young and/or healthy people to forego coverage and the risk pool skews, premiums rise and/or insurers leave the marketplaces, more healthy people leave the risk pool, premiums rise, and so on.

As J.B. Silvers (professor of health finance at the Weatherhead School at Case Western Reserve University, Cleveland OH) said in a New York Times op-ed on January 17, 2017, "Obamacare, or any plan that replaces it that is reliant on private insurers and individual enrollment, will succeed only under the following conditions: a meaningful incentive to purchase insurance (the individual mandate or equivalent); help to make it affordable; risk reduction for insurers to stabilize premiums; and enough funding to pay for it all".

Q Over the past several years, bad debt (or uncompensated care) has materially decreased and the financial profiles of many healthcare providers have stabilized or improved. Do you expect these trends to reverse if the Affordable Care Act (ACA) is repealed?

A In the first couple of years since the implementation of the ACA in 2013, bad debt / uncompensated care declined at many hospitals across the country, especially in states that expanded Medicaid under the ACA. This is important because basically every dollar of bad debt is a direct hit to operating margin. If someone goes to a hospital for care and they don't have any coverage, a hospital is required by federal law to treat them. So hospitals incur the expenses related to that care and, in more cases than not, they receive a fraction of payments owed to cover the costs of care provided.

Most, if not all, hospitals also have charity care policies designed to help low income people or those experiencing hardship. These individuals are required to provide financial information to substantiate their situation and if they meet the policy, the charges/expenses related to 'charity care' are functionally removed from the financial statements and reported separately. That is why broadening insurance coverage and reducing bad debt / uncompensated care have been so impactful financially for hospitals.

As more people gained coverage and the newly insured sought care, hospitals saw higher volumes and increased revenues. Medicaid expansion under the ACA also had a materially positive impact on bad debt with a large number of low income people becoming eligible for Medicaid in the 32 states (including D.C.) that have expanded their programs to date. In non-expansion states, bad debt levels remained largely unchanged. Market demographics and payor mix at the hospital level also factor into the impact on bad debt levels, regardless of a state's expansion status.

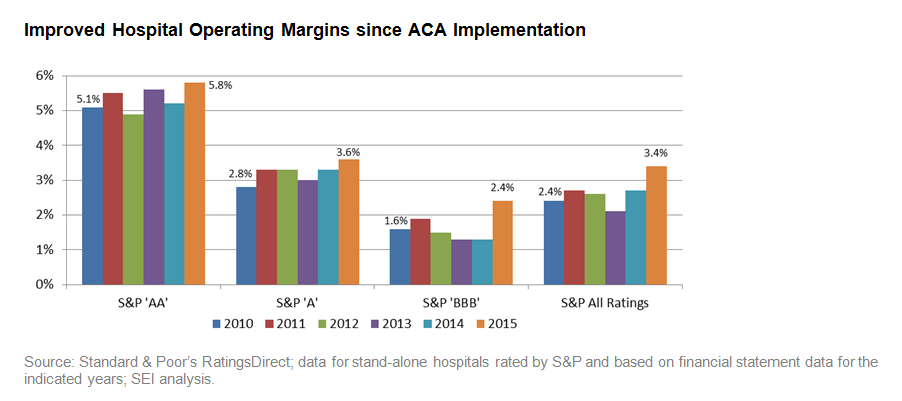

Looking at the broader healthcare sector, declines in bad debt and revenue/volume gains, along with ongoing expense and cost containment initiatives, have helped stabilize and improve hospital margins. The chart below shows operating margin trends since the ACA was enacted in 2010 for stand-alone hospitals rated by Standard & Poor's in various rating categories. And since 2013 – the year when the ACA was implemented – operating margins have measurably improved for most hospitals.

Improved Hospital Operating Margins since ACA Implementation

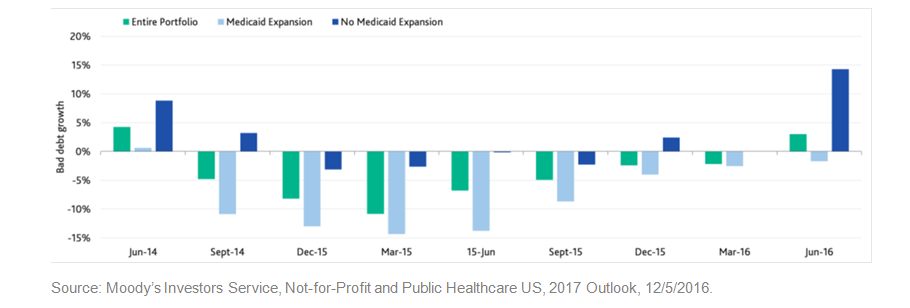

Recently, however, bad debt levels have begun to creep up after material declines in the first two years after the ACA was implemented. This uptick is primarily in response to exchange disruptions, scaled back insurer participation, higher premiums and deductibles, and is especially evident in non-Medicaid expansion states.

Bad Debt on the Rise as Initial Benefits of ACA Abate

This trend of growing bad debt is expected to continue and the resultant financial impact on hospitals and systems will likely grow as the debate lingers in Congress regarding the form, substance and timing of implementation of a Republican alternative to the ACA, if the functioning of the insurance exchanges continues to be challenged, and as out of pocket costs continue to go up for individuals.

Q In the near- to medium term as more becomes known about the form and substance of a potential replacement to the ACA, what should hospitals and healthcare organizations prioritize from an investment management standpoint to prepare for a potential repeal?

A The enactment of the ACA in 2010 represented the most sweeping changes to the US healthcare system since Medicare and Medicaid were passed into law in 1965. And during its life, the ACA has generated passionate and vocal positions for and against it, largely along party lines.

As the country braces for a battle on a possible replacement to the ACA, an interesting turn of events has occurred. Specifically, a recent tracking poll released by the Kaiser Family Foundation in early February 2017 showed that a majority of the country (48% vs. 42%, 10% didn't know or refused response) now has a favorable view of the ACA after many months of negative perception. This may be one reason why many leaders in Congress are returning to increasingly vocal crowds (and in some cases boarder-line hostile) in their home states/districts when the topic of ACA repeal comes up at town hall forums.

Since the ACA came into law, hospital leaders have rolled up their sleeves and adeptly adapted to the new environment by fundamentally changing how they 'do business.' They created new sources of revenue and cost-effective pathways for care; they found ways to cut unnecessary costs and deliver the same or better care; they developed new care delivery models focused on improving the longer term health of served populations; and many providers have begun to embrace risk-based contracting to their benefit.

Hospitals are complex organizations that are very manpower- and capital-intensive. Hospital leaders have to develop and implement strategies that support long-term organizational growth and, at the same time, balance current operations, staffing requirements, revenue cycle, capital access, relations with physicians, building projects, healthcare regulations, and managing/growing investment pools in increasingly complex investment environments. So the growing unease felt by hospitals is understandable when staring at the prospect of significant changes to the healthcare system for the second time in a little over seven years.

The various unrestricted investment pools that reside on most hospitals' balance sheets (i.e., long-term investments, board-designated assets, foundations and endowments) are crucial sources of support for operations and spending on infrastructure and technology. And sustaining and growing these 'stores of value' are key determinants of longer term organizational growth. So for healthcare executives and board members tasked with managing and overseeing multiple organizational investment pools, it is important to remain focused on:

› Strategic asset allocation with broad diversification

› Holistic risk alignment

› Risk tolerance

The key to long-term success of any investment management program is putting in place the appropriate strategic asset allocation and clearly understanding the potential impact that investment performance and volatility across all organizational portfolios may have on the financial condition of a hospital or health system. Many hospitals have more than one investment pool – each with a unique purpose, return objective and risk profile – so to effectively manage the broader investment program, it is critical that: 1) investment decisions take into account all asset pools; 2) the strategic asset allocation aligns with and supports long-term goals and objectives; and 3) the strategic asset allocation conforms to organizational risk tolerance.

Within the strategic asset allocation, maintaining broad asset class diversification is a key factor for achieving desired investment program objectives. Broad diversification helps position the portfolio for long-term growth through exposure to a range of asset classes designed to produce overall returns and growth over a desired timeframe. Diversification enables the portfolio to potentially capitalize on and benefit from macro trends, performance and volatility in various areas of the market that emerge at different points in the market cycle. Diversification also helps manage and mitigate systematic and unsystematic risks, and other more specific types of risk present in any portfolio allocation.

The US equity markets have continued to grind higher since the election achieving record levels and extending the life of the second longest bull market. And growth in non-US developed and emerging markets is picking up. The new Republican-controlled administration has promised major tax reform, infrastructure spending and other policy initiatives that could support continued growth in the US; but there are risks. Equity valuations are elevated and corporate margins may be impacted by higher rates, a stronger dollar, wage pressures, and potential backlash from the administration's protectionist stance on trade.

At the March 2017 meeting, the Federal Reserve raised short-term rates 25 basis points to one percent and increased its projection for future hikes from two to three based on the strengthening labor market and an outlook for firming inflation. While rates remain near historic levels, fixed income is still an attractive source of income, stability and diversification; however, absolute returns will likely modest going forward.

Ultimately, asset class diversification needs to appropriately balance exposure to: equities and fixed income (and sub-asset classes within each category); US and non-US markets (including developed and emerging markets); and public and non-public markets assets classes.

It is also important to have a clear understanding of organizational risk profile and to the extent possible, identify, quantify and prioritize risks in a number of key areas, including: operations and capital budgeting; capital structure (i.e., debt and swaps); investment pools (unrestricted and restricted); and defined benefit pensions (if one or more exists within the organization). Once the key risk factors are identified and quantified, healthcare leaders and board members are in a better position using holistic risk alignment to make decisions regarding the level and types of risk factors they are willing to accept in various asset pools and across the broader strategic allocation to support achieving organizational goals and objectives.

Finally, risk tolerance is a key input to allocation decision making and is unique to each hospital. Detailed analyses can be developed to show the range of potential outcomes for portfolio allocation scenarios under various simulated market environments, which helps quantitatively address the question, "how much risk can I afford to take?" The other more philosophical question – "how much risk do I want to take?" – may begin to take on more weight as healthcare leaders are faced with operating uncertainty and the prospect of health care re-reform just as they were getting used to doing business and delivering care under the ACA.

Summary: With the failure of the AHCA to pass two attempts at a House vote and lingering divisions among Republican lawmakers regarding the 'way forward', larger questions remain on whether a new bill would be introduced and what would be its impact on hospitals and the broader health care sector? And if the ACA remains in place would the Republican-led Congress support the law (including its funding mechanisms and support payments to health insurers and other participants)?

Ultimately, the Republican policy goals envisioned in the AHCA would result in more people having no coverage (either by choosing not to have it, not being able to afford it, or not being eligible for Medicaid) or less coverage with higher deductibles and co-pays. As hospitals face pressured margins from higher bad debt and uncompensated care costs, many may have to grapple with hard decisions regarding services and staffing, and for some, future viability.

As the operational and regulatory uncertainty lingers, many hospitals may also feel compelled to implement allocation strategies for their various asset pools that could sacrifice potential growth over the longer term for more certainty of returns in the near-term. In the end, healthcare organizations must take certain risks to grow, which reinforces the importance of developing and implementing broadly diversified strategic asset allocations that incorporate and align with inherent organizational risks and broader risk tolerance.

The question of reforming the nation's health care system is highly politicized and partisan. And as the debate of the ACA since 2010 and the goals outlined in the AHCA demonstrate, hospitals could face the real prospect of having to drastically change how they do business if and as each election cycle brings a new party into control of Congress. Needless to say, this ongoing uncertainty would make it increasingly difficult for healthcare leaders to look out longer term when developing and implementing organizational growth strategies. And this potentially includes important decisions regarding the strategic allocation of balance sheet and pension assets, the returns on and growth of which are critical sources of support for longer term organizational growth.

About the author

Craig serves as the healthcare director for the Advisory Team, where he is responsible for implementing SEI's healthcare solution to our institutional client base. His team provides advice and analysis that integrates multiple asset pools, including operating, foundation, endowment and pension plan assets, with corporate finances into a cohesive investment strategy.

Craig has extensive experience delivering customized financing and balance sheet management solutions to institutional clients in the nonprofit healthcare sector. He regularly speaks at industry conferences and served as a guest lecturer on healthcare finance at Loyola University in Chicago. Also, publications, such as Crain's Chicago Business, The Bond Buyer and Investor's Business Daily have interviewed Craig.

He earned his B.A. in economics from Cornell University and his MBA from the Weatherhead School of Management at Case Western Reserve University. He also maintains FINRA Series 7 and 66 licenses

Information provided by SEI Investments Management Corporation, a wholly owned subsidiary of SEI Investments Company. This information should not be relied upon by the reader as research or investment advice. This information is for educational purposes only.

1115th Congress, American Health Care Reform Act of 2017, H.R.277 (Washington, DC, 2017), https://www.congress.gov/bill/115th-congress/house-bill/277/text and "Compare Proposals to Replace The Affordable Care Act", The Henry J. Kaiser Family Foundation, http://kff.org/interactive/proposals-to-replace-the-affordable-care-act/, (March 2017)

2Rachel Garfield, Melissa Majerol, Anthony Damico and Julia Foutz, "The Uninsured: A Primer - Key Facts about Health Insurance and the Uninsured in the Wake of National Health Reform", The Henry J. Kaiser Family Foundation, http://kff.org/report-section/the-uninsured-a-primer-key-facts-about-health-insurance-and-the-uninsured-in-the-wake-of-national-health-reform-how-has-health-insurance-coverage-changed-under-the-aca/, (November 1, 2016) and Dan Mangan, "Obamacare pushes nation's health uninsured rate to record low 8.6 percent", CNBC.com, http://www.cnbc.com/2016/09/07/obamacare-pushes-nations-health-uninsured-rate-to-record-low.html, (September 7, 2016)

3Dan Steingart, CFA, Lisa Goldstein, Kendra Smith, "Not-for-Profit and Public Healthcare – US, Outlook Stable as Cash Flow Growth Slows But Remains Positive", Moody's Investors Service, (July 28, 2016)

4U.S. Congressional Budget Office and the Joint Committee on Taxation, "American Health Care Act: Cost Estimate" (Washington, DC, 2017), https://www.cbo.gov/publication/52486%20, Amy Goldstein, Elise Viebeck, Kelsey Snell and Mike DeBonis, "Affordable Care Act revision would reduce insured numbers by 24 million, CBO projects", Washington Post, https://www.washingtonpost.com/powerpost/obamacare-revision-would-reduce-insured-numbers-by-24-million/2017/03/13/ea4c860a-0829-11e7-93dc-00f9bdd74ed1_story.html?utm_term=.0c0eaa12b864, (March 13, 2017) and Emily Rappleye, "CBO scores the AHCA: 5 things to know", Becker's Hospital Review, https://www.beckershospitalreview.com/finance/cbo-scores-the-ahca-5-things-to-know.html, (March 13, 2017)

5"Average Health Insurance Tax Credit for Consumers Would Be at Least a Third Lower Under Currently Discussed Replacement Plans than the ACA, Tax Credits in Proposals Also Would Increase More Slowly Over Time Than Under ACA", The Henry J. Kaiser Family Foundation, http://kff.org/health-reform/press-release/kff-analysis-average-health-insurance-tax-credit-for-consumers-would-be-at-least-a-third-lower-under-currently-discussed-replacement-plans-than-the-aca/, (March 1, 2017)

6"Congress Intended For HHS To Make ACA Risk Corridor Payments Each Year To Insurers", Wolters Kluwer, https://lrus.wolterskluwer.com/news/health-reform-law-daily/congress-intended-for-hhs-to-make-aca-risk-corridor-payments-each-year-to-insurers, (January 19, 2017) and Timothy Jost, "Insurers Seeking Risk Corridor Payments Get First Courtroom Win; IRS Updates Q&As", Health Affairs Blog, http://healthaffairs.org/blog/2017/02/10/insurers-seeking-risk-corridor-payments-get-first-courtroom-win-irs-updates-qas/, (February 10, 2017)

7Cynthia Cox, Michelle Long, Ashley Semanskee, Rebah Kamal, Gary Claxton and Larry Levitt, "2017 Premium Changes and Insurer Participation in the Affordable Care Act's Health Insurance Marketplaces", The Henry J. Kaiser Family Foundation, http://kff.org/health-reform/issue-brief/2017-premium-changes-and-insurer-participation-in-the-affordable-care-acts-health-insurance-marketplaces/, (October 24, 2016)

8"Proposed Rule On The Health Insurance Marketplace Stabilization, What It Means For Government Entities, Issue Brief #4", KPMG, http://www.kpmg-institutes.com/content/dam/kpmg/governmentinstitute/pdf/2017/cms-proposed-rule.pdf, (March 2017), Virgil Dickson, "Trump submits rule to stabilize individual insurance market", Modern Healthcare, http://www.modernhealthcare.com/article/20170202/NEWS/170209973, (February 2, 2017) and Timothy Jost, "Exchange Stabilization Bills Represent New GOP Approach To ACA", Health Affairs Blog, http://healthaffairs.org/blog/2017/01/28/exchange-stabilization-bills-represent-new-gop-approach-to-aca/, (January 28, 2017)

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.