Editor’s Note: This article originally appeared on ECG’s website.

But expense reduction isn’t the only way to maximize operating margins. Rather, making prudent investment decisions supported by solid return-on-investment (ROI) analyses is the best way to increase margins and generate funding for broader near- and long-term strategic goals. For revenue cycle, the key to maximizing ROI lies in finding the cost-to-collect sweet spot—where investments and expenses are in balance.

What Is Cost-to-Collect?

Cost-to-collect is defined as total revenue cycle cost divided by total cash collected.

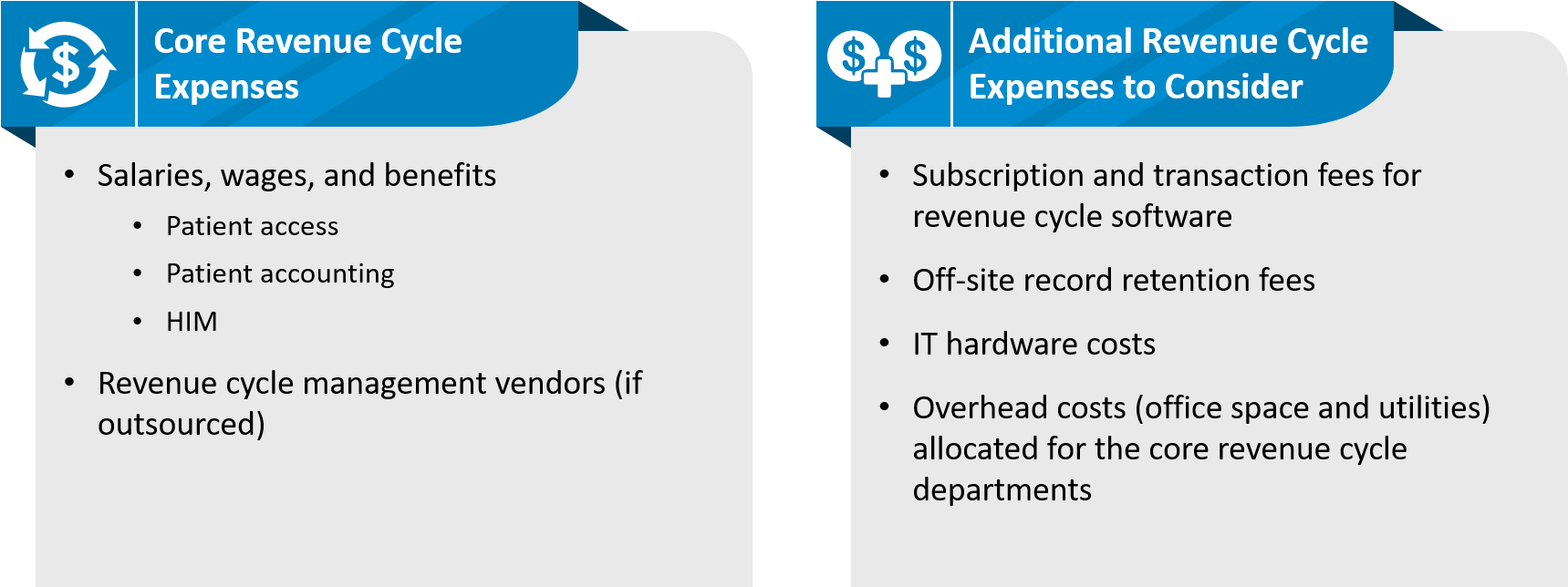

Total cash collected is straightforward enough—insurance and patient payments plus bad debt recoveries. But which expense items should be considered as the revenue cycle cost?

Core expenses that should be included in the cost-to-collect calculations are labor expenses (salaries and wages, including benefits) for the areas of patient access, patient accounting, and health information management (HIM). IT and overhead costs may or may not be included in the calculations.

Note: For physician enterprises, patient access costs are not included; these costs are typically included in clinical operations.

While industry-wide survey information on cost-to-collect varies, currently available literature suggests the median cost-to-collect is 3%. Organizations may break down the cost-to-collect metric further by functional area to be able to pinpoint which expense items contribute most to cost-to-collect.

Reducing Cost-to-Collect

Once you identify your cost-to-collect, organize an effort to decrease it. First, look for opportunities to directly impact the denominator (cash collected) via classic revenue cycle performance improvement activities such as the following:

- Analyze trends in billing errors and denials: Billing errors and denials usually point to upstream process breakdowns happening in patient access, case management, and/or HIM. Start by addressing the trends that impact the larger amount of A/R.

- Prioritize aged, high-dollar A/R: This is one of the most effective ways to decrease A/R and improve cash collections. Often it requires overtime or additional temporary resources to drive meaningful changes in A/R backlogs.

- Improve staff productivity and work quality: Before adding more staff to handle ever-increasing A/R, ensure robust productivity and work quality standards are in place. For revenue cycle functions that are outsourced, this includes holding vendors to the same internal productivity and quality standards. In addition, if your organization has adopted a remote workforce, you may need to establish a baseline work-from-home infrastructure emphasizing robust communication in order to improve overall productivity and work quality. Click here to continue>>

News From Our Partners