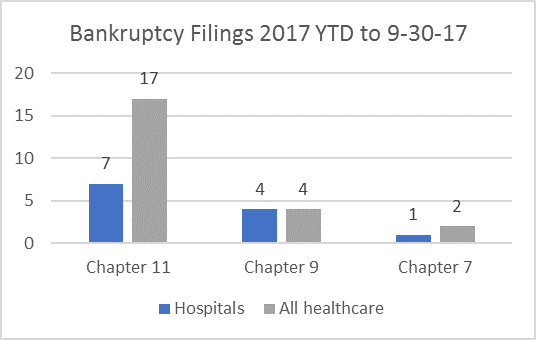

Chapter 9 can fly 'under the radar' in the bankruptcy world, but 4 of the 12 hospital bankruptcies in 2017 have been Chapter 9 filings. That's one third of hospital bankruptcies this year filed by "municipalities" (usually hospital taxing authorities).

With evidence of increasing financial distress among standalone, government-owned hospitals, and continued political uncertainty, we can expect to see more Chapter 9 healthcare bankruptcies.

With evidence of increasing financial distress among standalone, government-owned hospitals, and continued political uncertainty, we can expect to see more Chapter 9 healthcare bankruptcies.

The federal government has limited power to interfere with state sovereignty, so there are certain idiosyncrasies to Chapter 9 that make it more favorable for debtors than Chapter 11.

• The court's powers are much more limited under Chapter 9 than under Chapter 11. In Chapter 9:

o The debtor may borrow money without court authority;

o The court cannot appoint a trustee (except for limited purpose);

o The court cannot convert the case to a liquidation proceeding;

o The debtor may appoint its professionals without court approval and professional fees are only reviewed in the context of a plan confirmation.

• Creditors and the U.S trustee/bankruptcy administrator have a smaller role in Chapter 9:

o The U.S Trustee appoints a creditors committee but there is no meeting of creditors or examination of the debtor;

o The U.S Trustee does not monitor the financial operations of the debtor, or review the fees of case professionals;

o Creditors may not propose competing plans (this would be seen as creditors indirectly controlling the affairs of a municipality)

• The creditor consensus conditions for plan confirmation are much lighter in Chapter 9 cases:

o The plan requires the acceptance of each class of impaired creditor. However, if only one impaired class of creditors consents to the plan, then the court can implement the "cram down" provisions and confirm the plan if it does not discriminate unfairly and is fair and equitable.

o The "best interests of creditors" test in Chapter 9 requires a reasonable effort by the municipal debtor to show the plan is a better alternative for its creditors than dismissal (i.e. leaving creditors to 'fend for themselves'). In Chapter 11, the test is compared to a 'liquidation scenario', which is a higher standard.

Chapter 9 provides a financially distressed municipality the protection of the automatic stay while offering the ability to develop and negotiate a reasonable plan to adjust its debts. The debtor can utilize Chapter 9 bankruptcy to reject unfavorable executory contracts and unexpired leases. Importantly, the debtor may reject collective bargaining agreements and retiree benefit plans without having to follow the Chapter 11 procedures.

As with most healthcare bankruptcies, but particularly with Chapter 9 filings, there is community and political involvement that requires a structured communications program. Keeping stakeholders engaged, particularly clinical providers, is essential to maintaining high quality healthcare operations while the debt reorganization takes place.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.