M&A continues picking up speed in healthcare, generally producing expected results — planned benefits plus feared fragmentation. Among the many functions that may become at least temporarily stressed is finance.

M&A, for all its advantages, is a disruptor. The amount of disruption is based on such factors as existing infrastructures, maturity of business processes, level of change and enterprise readiness to accept the change. Everything about the conjoining organizations — people, schedules, cultures and systems — is pulled together with an expectation that on the backside the newly formed enterprise will work.

For the finance team, this means dealing with data that lacks common structure, terminology, business process and technology. Finance has the unenviable task of capturing data in its varied quality and formats in a myriad of locations within the formerly separate organizations. Order must be created so that the financial data is fit for consolidation, close and reporting for the new enterprise.

It is indeed a stressor.

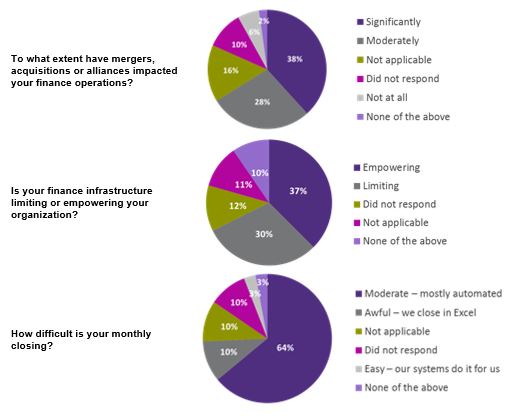

In a spring 2016 poll, healthcare finance professionals described operations as significantly affected by M&A; finance infrastructure is just about as limiting as it is empowering, providing opportunity between the two ends of the spectrum. Let's take a look at how your finance operations can optimize their financial reporting.

Approach the transformation from a holistic perspective

The road to an integrated finance function isn't necessarily long, but it does require a long view. The view has to start where preparations for M&A begin and stretch all the way to the end point of an accurate and timely finance operations structure. Thinking long term promotes decision-making that supports consolidation objectives and allows for more realistic scheduling and budgeting of resources. It reduces priorities so that the team is focused on achieving the goal.

Begin with talks of consolidation

From the start of transaction activity, finance leadership needs to be involved to speak to the work that lies ahead. A key assignment of assessment and due diligence is documenting finance operations in both organizations to uncover gaps and weaknesses. With this knowledge in hand, the change management plan should be wide enough to encompass all participants in the finance realignment and clearly articulate the new financial reporting goals and structure.

Leaders must also ensure that the significance of comprehensive financial reporting is acknowledged. Many times changes to financial reporting result because of a much larger integration program, such as the addition of a physician practice, new service line or systems upgrade. Assessment will reveal any need for capital outlay — though often this is not necessary — or capabilities that can be leveraged within the existing systems.

Value teamwork

People are the most important element in a finance transformation. Get the personnel structure in place, and the work will follow.

The components of a successful personnel structure are simple:

1. Dedicated teams

2. Connected leadership

Developing dedicated teams requires selecting qualified members and lifting from their shoulders as many other responsibilities as you can, relieving them of their "day jobs" to focus on the transformation efforts. It also requires clearly laying out the long-term finance transformation plan along with the tactical steps to achieve it.

Connected leadership is familiar with both the enterprise-wide and finance operational plans, and knows the necessity of partnership with the teams. Connected leaders foster the partnership through frequent communication and regular team meetings to share progress and discuss risks.

The strength of this partnership will determine the ability of leaders and teams to react, gain consensus, make decisions, obtain resources and move decisively.

Establish a process structure for the long haul

With an eye always on the end result, determine how your financial reporting structure will integrate with the larger enterprise platform. Dovetail standard business processes, shared data governance — a common chart of accounts and more — purchasing and supply chain practices, and all the other components touched by finance.

To do this effectively, finance leaders must have even more visibility into business needs and performance than before the M&A. They will need transparency in order to be part of conversations about whether new or redeployed technologies can bring operational efficiencies to accommodate changes in business processes. If new solutions are required, there must be an understanding of how that system will support current operations, as well as scale for future growth. The scalability might be called upon for expansion — integrating later affiliations.

The framework for the finance integration of a new enterprise is complex; it is crucial to know how core applications can come together to form an integrated, cohesive unit.

Recognize the need for comprehensive capabilities

The complexity brought on by M&A must be met with multidiscipline solutions during and after the acquisition. Experience in healthcare business processes, transactions, tax, audit and technology has to be applied in order to effectively interlace systems and processes. Financial reporting is one of the first areas to tackle because finance is typically charged with combined reporting from the start. To be ready for providing accurate and timely reporting in the midst of a certain amount of chaos, issues have to be anticipated and plans set in place for resolving them.

Take the case of Community Health Network, a nonprofit health system based in Indiana.

The history of Community Health Network mirrors that of many healthcare networks today. Community has grown and expanded through a series of mergers, acquisitions and strategic alliances over many years, developing into a major regional healthcare provider.

With each expansion, the newly introduced organization unpacked its set of business processes and supporting financial systems. The result was an amalgamation of tools, applications and approaches to financial operations and data management.

Holly Millard, Community's senior vice president of finance and chief accounting officer, summarized the effect this way: "We were doing consolidation for a $2 billion network in Excel. I was literally keypunching numbers into a spreadsheet. Some hospitals were utilizing costing systems; others didn't have any costing capability. We never had business intelligence. We were spending more time entering and formatting data than analyzing what was driving performance. It could take three months to transform data into insight. By then, it was too late."

Working with Grant Thornton LLP, Community transformed its finance function and gained system-wide harmony. The initial maze of financial management systems was reconfigured and, as one operating unit, now efficiently delivers accurate financial reporting across Community's vast network.

How was it done? By connecting and integrating every key aspect of its finance infrastructure — general ledger, data governance, reporting, planning, costing and profitability, business insight and analytics, and supply chain — Community gained control and is driving consistency throughout the enterprise, improving performance, achieving goals and preparing for future growth.

This outcome can be yours, too. As you start your finance transformation program, keep in mind the principle of a holistic long view, beginning with the end in mind. From the initial steps of the transaction, a successful program depends on decisive leadership, valuing teamwork and the establishment of thoughtful business processes.

For further information, visit grantthornton.com/healthcare.

Bryan D. Wiggins specializes in helping organizations evaluate, plan and execute large-scale, technology-enabled transformational initiatives. He concentrates on helping leading organizations improve business performance and organizational effectiveness through the application of best practices, organizational alignment and leading technologies. Wiggins is a well-rounded and versatile business and technology executive with broad experiences advising a wide variety of Fortune 500, midmarket and emerging companies across multiple industries. For the past several years, he has focused exclusively on consulting with healthcare and life sciences companies.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.