On April 15, 2015, Congress and President Obama approved one of the most bipartisan and significant bills in the history of U.S. healthcare reform, the so-called "doc fix" bill, which repeals the Medicare Part B Sustainable Growth Rate (SGR) reimbursement formula and replaces it with a new pay-for-performance program: the Merit-Based Incentive Payment System (MIPS).

Read on to hear some of the most frequently asked questions about MIPS we fielded at the Healthcare Information and Management Systems Society (HIMSS) 2015 Annual Conference and Exhibition last week, such as how MIPS relates to the Meaningful Use (MU), Physician Quality Reporting System (PQRS), and Value-Based Modifier (VBM) programs. MIPS consolidates and strengthens the financial impacts of these programs, while continuing their performance measurement and reporting mechanisms that have become familiar to providers over the last few years. In other words, there will still be a wealth of complex and changing Centers for Medicare and Medicaid Services (CMS) rules to understand, keep up with, and act upon.

1. What is MIPS?

MIPS annually measures Medicare Part B providers in four performance categories to derive a "MIPS score" (0 to 100), which can significantly change a provider's Medicare reimbursement in each payment year. The performance categories are: VBM-measured quality (up to 30 points), VBM-measured resource use (30 points), MU (25 points), and a new category named "clinical practice improvement" (15 points). The MIPS score's maximum impact on reimbursement increases from +/- 4% for the 2019 payment year to +/- 9% for the 2022 and subsequent payment years. These are very significant potential adjustments to provider organizations' Medicare reimbursements, as many organizations have operating margins in the single-digit percentages.

The measurement or performance period determining the MIPS score must end prior to and as close as possible to the applicable payment year. Based on past experience with Medicare programs such as MU and VBM, there is typically a two-year lag from performance year to payment year, making 2017 the anticipated first performance year—the MIPS score would then adjust reimbursements in the 2019 payment year. CMS will define the performance years and other details of the MIPS program in a final rule anticipated to be published in the Federal Register by the end of 2016. For the 2015 and 2016 performance years (and the respective 2017 and 2018 payment years), the VBM, PQRS, and MU programs will continue as separate and distinct measurement and payment adjustment programs. One interesting fact is that MU Stage 3, proposed to begin in the 2017 performance year, would only ever be measured under the MIPS program and would not result in standalone Medicare MU incentives or penalties.

2. Who is eligible for MIPS?

For the first two years of MIPS, the following Medicare Part B providers are deemed eligible professionals: physicians, physician assistants, nurse practitioners, clinical nurse specialists, and nurse anesthetists. For the third and succeeding years, the following providers also become MIPS-eligible: physical or occupational therapists, speech-language pathologists, audiologists, nurse midwives, clinical social workers, clinical psychologists, and dietitians or nutrition professionals. Provider groups including such professionals for each respective year are also deemed "eligible professionals" for purposes of measurement and payment adjustment by means to be defined in the CMS final rules. Some components of MIPS, such as PQRS, already support the concept of group measurement. However, other parts such as MU only measure individual providers; therefore, the CMS final rules may need to define how individual MU performance is rolled up to the group level when needed for MIPS purposes.

There are three notable exclusions of providers from MIPS eligibility. First, providers participating in an "alternative payment model" (see section 5 below) are not subject to MIPS. Second, CMS will define a low-volume threshold that includes a combination of minimum Medicare patients, service volume, and/or billings below which a provider is excluded from MIPS. Third, providers who enroll in Medicare for the first time during a performance year are exempt from MIPS until the subsequent performance year.

3. How will MIPS scores be publicly reported on the CMS Physician Compare consumer website?

Each MIPS-eligible professional's MIPS score and individual category scores will be available on the Physician Compare website, including the ranges of all such scores for EPs across the country. For the first time, consumers will be able to see their providers rated on a scale of 0 to 100 and how their providers compare to peers nationally. This level of transparency and specificity goes beyond existing programs such as VBM, which calculates quality and resource use scores but does not publicly publish the results.

4. How does MIPS consolidate and leverage the MU, PQRS, and VBM programs?

MIPS consolidates Medicare MU and PQRS penalties and VBM incentives and penalties, while continuing to measure provider performance as specified by those three programs. Note that Medicare and Medicaid MU incentives are not impacted by MIPS.

Section 101(b)(1) of the bill sunsets separate MU payment adjustments starting with the 2019 payment year (the 2017 MU performance year), but continues the "application for purposes of MIPS"—the determination of whether an eligible professional (EP) is a meaningful Electronic Health Record (EHR) user. The EP can then earn a maximum of 25 points for complying with MU in the performance year. Similarly, the MIPS quality category score (maximum 30 points) is determined by the PQRS mandatory quality reporting requirement and the VBM quality measures. Finally, the MIPS resource use category score (maximum 30 points) is determined by the VBM cost measures. The bottom line: MIPS simplifies the application of incentives and penalties while relying on the performance measurement rules of the three individual programs.

5. What is an alternative payment model (APM) & the benefit of participating in one?

In order to encourage EPs to make greater portions of their Medicare reimbursements subject to at-risk, performance-based contracts, the bill rewards those who participate in an alternative payment model (APM) with an additional financial incentive of 5% of their Medicare reimbursements received in the year preceding the MIPS payment year and payable as "a lump sum, on an annual basis, as soon as practicable." For the 2019 and 2020 payment years, at least 25% of the EP's Medicare reimbursement "during the most recent period for which data are available" (aka, to be determined in the CMS final rule) must have been provided through an "eligible APM entity," such as a Medicare Shared Savings Program Accountable Care Organization (ACO). In particular, the eligible APM entity must require that participants use certified EHR technology, pay based on quality measures comparable to those used in the MIPS quality category, and place material financial risk for monetary losses on providers. Examples of programs for which eligible APM entities may be created are:

• Programs created by the CMS Center for Medicare and Medicaid Innovation (CMMI), such as the Advance Payment (ACO) Model, but excluding healthcare innovation awards;

• The Medicare Shared Savings Program (MSSP) for ACOs;

• The Health Care Quality Demonstration Program; and

• "a demonstration required by Federal law."

A 5% incentive is fairly significant in the world of single-digit provider organization operating margins. CMS clearly is aggressively driving the adoption of pay-for-performance models, including those provided by private payers. For the 2021 and 2022 payment years, an EP may also qualify for the APM incentive if the APM share of Medicare reimbursement is at least 25% and at least 50% of the sum of all-payer reimbursements is through eligible APM entities or APM-equivalent programs from non-Medicare sources, such as private payers. The 50% threshold rises to 75% for the 2023 and subsequent payment years.

6. What does the new "clinical practice improvement" performance category entail?

CMS will use a request for information to solicit recommendations from stakeholders to identify activities in at least the following categories: expanded practice access (e.g., same-day appointments), population management (e.g., monitoring population health), care coordination (e.g., telehealth), beneficiary engagement (e.g., self-management training), patient safety and practice assessment (e.g., use of clinical checklists), and participation in APMs. Although this is a broad swath of potential improvement activities, the bill states that an EP in a practice certified as a patient-centered medical home (PCHM) or "comparable specialty practice" shall be given the maximum score of 15 for the practice improvement category. Or, if the EP participates in an APM, then the minimum score must be 7.5 and not 0 for this category.

7. How are MIPS payment adjustments determined?

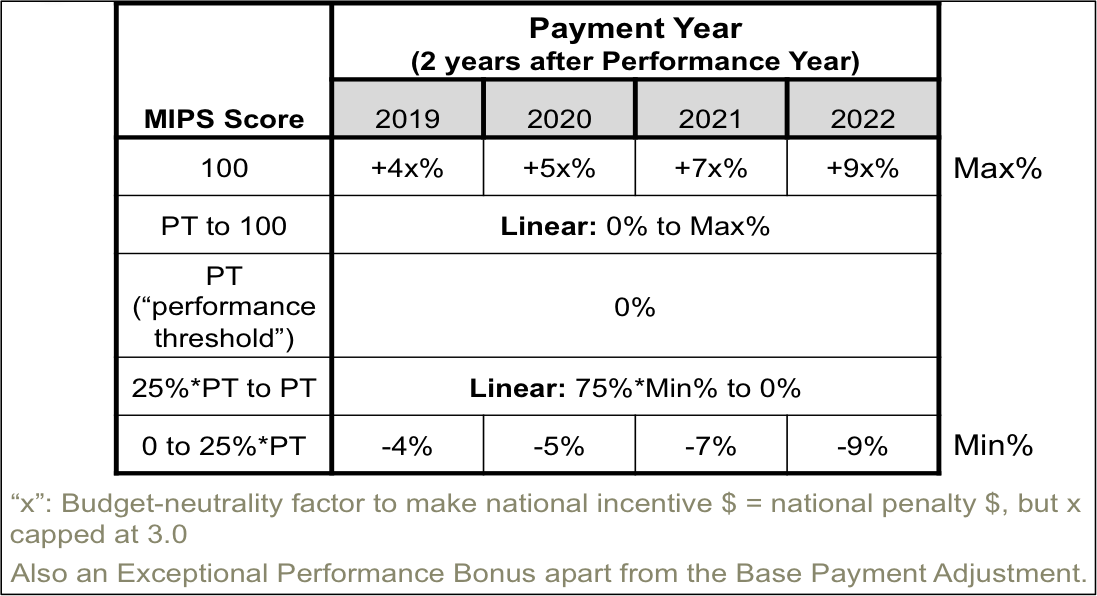

The following table shows how MIPS score translates into payment adjustments for each payment year.

MIPS Medicare Payment Adjustment Table

Note that the maximum payment adjustment is multiplied by a scaling factor, "x", such that the total of all the positive and negative payment adjustments across all MIPS providers results in either neutral or reducing impacts on Medicare budgetary spending. In other words, "the "winners take from the losers." As a result, the maximum payment adjustment for a given year could, in theory, be up to 27%, or 3.0 times that shown in the MIPS=100 row of the table.

The performance threshold (PT) is the demarcation MIPS score between positive or negative adjustments and is determined annually as the mean or median of the MIPS scores for all EPs in a prior period as selected by CMS (and is likely to be specified in an annual CMS final rule published prior to each performance year). For the initial two payment years (2019 and 2020), the PT will not be based on historical MIPS scores but rather on a combination of historical performance on measures and activities related to PQRS, MU, VBM, and possibly other factors as determined by CMS.

Note also that there is no "neutral tier" where a finite range of MIPS scores will yield no payment adjustment—that is, only a MIPS score of exactly the PT would result in no payment adjustment. Hence, unlike under the original VBM payment tiers, which include a wide neutral tier, practically all providers under MIPS will experience either a positive or neutral payment adjustment, which amplifies the psychological, motivational, and financial impacts of MIPS on providers.

There are two additional notable features of the MIPS score and payment policies. First, CMS will define an "exceptional performance" bonus in the form of an additional payment adjustment of up to 10% for EPs who exceed the 25th percentile of positive MIPS scores. The bonus pool will be $500M for each payment year from 2019 to 2024. Second, CMS is authorized to "take into account" year-over-year improvement of an EP in the quality and resource use categories in calculating the scores for those categories. In other words, a low-scoring EP may still get credit for improving those scores even if the new scores are still low. This is reminiscent of recent changes to the Medicare Shared Savings Program (MSSP) ACO program in which year-over-year improvement, independent of the amount of shared savings generated, is separately rewarded in order to encourage low performers to continue to improve.

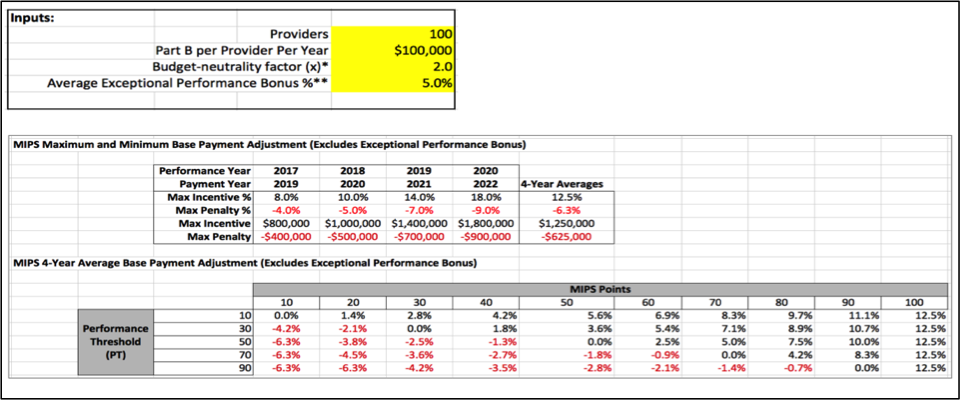

Here is an example to illustrate the potential financial impacts of MIPS in the 2022 payment year for a 100-provider practice with $100,000/provider/year in Medicare Part B reimbursements, where the budget-neutrality factor x = 2.0, and excluding the exceptional performance bonus:

• maximum positive adjustment =

2.0 x 9% x 100 providers x $100,000/provider/year = +$1.8M/year

• maximum negative adjustment = -$0.9M/year

If the practice were to achieve an exceptional performance bonus averaging 5% per provider, then the additional incentive would be:

• exceptional performance bonus =

5% x 100 providers x $100,000 = $0.5M/year

Here's a 4-year analysis of the maximum and minimum financial impacts and a sensitivity analysis of the average payment adjustment per year versus the CMS-set performance threshold (PT) and the MIPS points earned by a provider:

If you would like to see the financial impacts as above using your own inputs, you may download our MIPS Financial Calculator coming soon to our website.

8. What are provisions to assist small practices and providers in rural or underserved areas?

Two provisions in the bill are specifically designed to assist these providers in the MIPS program. First, an individual EP or a group practice with up to 10 EPs may form with other such individual EPs and/or group practices a "virtual group" defined by the combination of the tax IDs of the participating EPs and/or group practices. The virtual group's performance is then measured as the combined performance of all the EPs in the virtual group. For example, this mechanism may allow a struggling individual EP to benefit from the MIPS score of the entire virtual group of which that EP is a part. CMS will define any additional requirements for virtual groups in the final rule. Second, $20M per year will be allocated to provide technical assistance via entities such as quality improvement organizations or regional extension centers to practices that have 15 or fewer EPs, particularly in rural and underserved areas. Finally, with respect to defining what constitutes Clinical Practice Improvement activities to earn points in that MIPS category, "the Secretary shall give consideration to the circumstances of small practices (consisting of 15 or fewer professionals) and practices located in rural areas and in health professional shortage areas".

9. What should I do now to start preparing for the MIPS program?

Although MIPS does not begin until most likely the 2017 performance year, the fact that MIPS mandates and relies on the performance measurement mechanisms of MU, PQRS, and VBM means that the best thing an organization can do now is to continue to improve performance and administrative processes for those three existing programs. Also, look to consolidate organizational and administrative efforts among the programs to create efficiencies. For example, it is now possible to utilize the electronic clinical quality measures (eCQMs) calculated by certified EHR technology to meet the reporting requirements of all three programs. Design and align eCQM reporting and improvement tasks to meet more program requirements for the same effort. In addition, assign or hire a resource to understand the MIPS legislation and stay on top of the forthcoming CMS final rule, which will likely be updated on an annual basis. You can also check our blog and website regularly, as we'll continue to provide updates. Regarding reimbursement, public reporting, and performance measurement, MIPS resets the table in many respects for Medicare providers, but with some advance planning it is possible to best leverage your existing efforts and sunk investments to help maximize your MIPS scores over the long term.

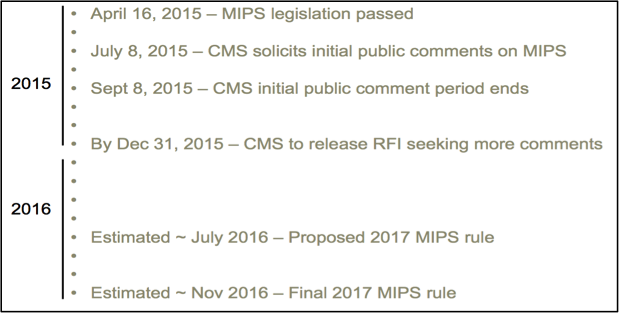

10. What does the MIPS rulemaking timeline look like?

Here's a current estimated timeline for MIPS to be further defined in CMS rulemaking, leading up to a launch of the program in the 2017 performance year:

Tom is a technology innovator and leader who brings his unique worldview and compassion to create health IT solutions for the business of caring for people. Tom was instrumental in the establishment of the Chicago Health IT Regional Extension Center (CHITREC) and has consulted for leading healthcare and health IT organizations such as the Northwestern University School of Medicine, Erie Family Health Center, and the Alliance of Chicago. Tom earned a B.S. with Distinction in Physics from Stanford, a Ph.D. in Physics from U.C. Berkeley where he was an NSF Fellow, and an M.B.A. with Distinction from the Kellogg School of Management at Northwestern University.