Healthcare providers are issuing a growing number of refunds driven by rising patient financial obligation for care, expansion of preservice cost estimates with upfront collections, and complex payer reimbursement policies. Refund management is often inefficient, costly, and detracts from the patient financial experience.

Fortunately, meaningful opportunities exist to improve the situation. This report briefly explores the primary issues and highlights the CommerceHealthcare® solution to address them.

Key issues.

Multiple sources produce the cost and productivity issues in healthcare refund programs:

- Volume-related. Patient refunds totaled an estimated $3.1 billion in 2022.1 Many involve small dollar amounts that require as much administrative effort as larger ones. Overall volume is challenging to manage and frequently creates mounting backlogs.

- Process-related. Many steps in the process remain manual, consuming staff time and adding cost. Integration of information systems and workflows is often lacking. Further complexity arises from variations required in processing both patient and insurance company refunds as well as the detailed document attachments that frequently accompany payments.

- Payment-related. Checks continue to be pervasive. One study indicated that 82% of patient refunds are in the form of checks.2 Escheatment exposure is another element in the equation. Many small checks are never cashed, and staff time is expended executing state regulation and reporting requirements.

These problems have larger implications. They impede progress toward two major objectives shared by health systems, hospitals, and practices. One is the imperative to cut costs. An analysis concludes that “inflation and pricing pressures are leading to significant cost increases in goods and services” and producing “relatively flat margins … likely to continue in the near term.”3 Hospitals have been “forced to take aggressive cost-cutting measures.”4

The second goal impacted is improvement of the patient financial experience to address growing consumer-centric, technology-forward competition as well as patient demands. A Harris Poll found that 61% of consumers “would like their healthcare experience to be more like the customer experience of an online convenience service app.”5

The core need in refund management.

All providers require solutions that let them deliver refunds and other payment adjustments to recipients quickly, conveniently, and cost-effectively. The right solution will consistently optimize the experience for all participants.

The CommerceHealthcare® solution.

PreferPay® from CommerceHealthcare® assumes complete life cycle management of a provider’s refunds to patients and insurers. Patient interaction is facilitated by a well-designed application that does not require setting up a password-based account and is accessible on computers or smartphones. Individuals exercise choice in how they receive payments: direct to debit card, direct deposit, electronic check or paper check. Digital payments are increasingly favored, growing at almost 23% annually in healthcare.6

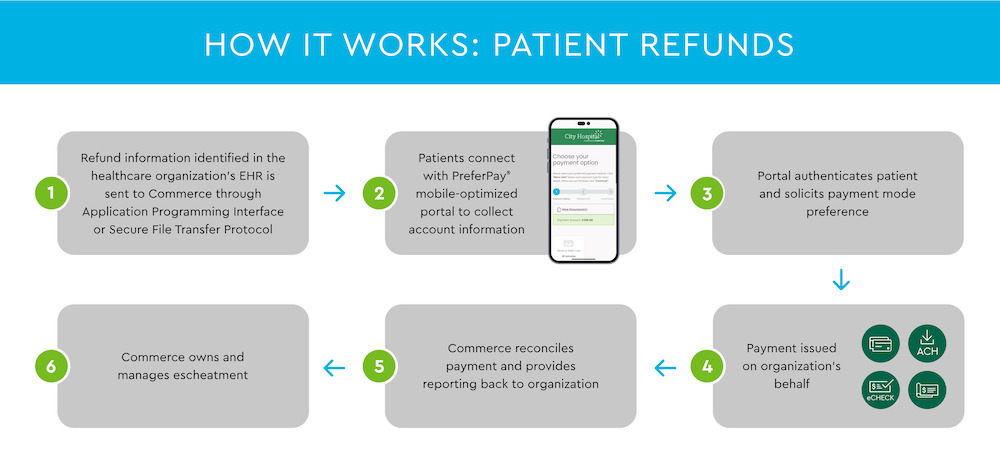

The workflow is encrypted, automated and streamlined for convenience and efficiency (see Figure 1). When a provider’s system triggers a refund request to PreferPay®, Commerce Bank electronically communicates with the patient to gather account data. The system issues payment in the patient’s chosen mode and returns reconciliation information to the provider.

A few of the many features show how PreferPay® meets today’s IT and user requirements:

- Integration with EHRs and financial systems via Application Programming Interface (API) or file transfer options. Specific prebuilt data extracts ensure synchronization with Epic, Meditech and numerous other systems.

- Patient account setup not required.

- Strong security and confidentiality. CommerceHealthcare® hosts its portal and stores customer data behind the bank’s firewall and relies on multifactor authentication. All workflows conform to HIPAA requirements.

- Branding flexibility. PreferPay® can be adapted to the provider’s branding “look and feel.”

- Payment reconciliation and reporting.

An array of benefits.

PreferPay® benefits patients and organizations alike. Patients can elect the payment method best suited to their needs and offering the fastest receipt of funds. Transactions are conducted easily on a smartphone or computer. The bottom line is a better experience: choice, convenience, consistency.

For health systems, hospitals, and practices, PreferPay® generates cost and time savings through greatly reduced staff involvement in all aspects of the refund process. Fewer paper checks are issued. Customer satisfaction is enhanced, boosting competitive strength. Providers can be confident that their refund management program is backed by the security and resources of a leading bank.

Conclusion and next step.

PreferPay® is a timely solution amid today’s financial and operational challenges. It offers demonstrated success, is easy to implement, and generates a rapid return. To learn more, visit Patient Refunds | CommerceHealthcare®.

Disclosures:

- Aite-Novarica, U.S. Patient Refunds: A Market Sizing, November 27, 2019.

- V.Bailey, “Consumers Faced Surprise Medical Bills, Payment Struggles in 2021,” RevCycle Intelligence, March 28, 2022.

- Kaufman Hall, National Hospital Flash Report: March 2023, April 2023.

- A. Sudimack and D. Polsky, “Inflation is Squeezing Hospital Margins – What Happens Next?” Health Affairs Forefront, October 25, 2022.

- Tegria, “New Data Finds 69% of Americans Would Consider Switching Healthcare Providers for More ‘Appealing’ Services,” February 15, 2022.

- Market Research Future, Global Digital Payment in Healthcare Market Research Report, September 2022.