With last month's addition of 17 new organizations to the Next Generation ACO program, 26% of all Medicare ACOs now participate in a downside-risk model (including the Medicare Shared Savings Program's (MSSP) Track 1+, Track 2, and Track 3), up from 17% in 2017.

While 2018 is shaping up to be a big year for ACOs making the transition to risk, 2019 could be even bigger. In fact, next year 82 ACOs that have been in the MSSP Track 1 since 2013 must either take on downside risk or leave the program. Organizations that haven't decided whether to continue participating face a rapidly approaching application deadline this summer. CMMI will not accept Next Generation ACO applications for 2019, so these organizations should focus on which downside risk MSSP track (if any) makes the most sense for them.

If the most recent MSSP performance results are any indication, many of the remaining Track 1 ACOs could be ready to take the leap. In 2016, 43% of organizations that joined MSSP in 2012-2013 received a shared savings payment compared with only 18% that joined in 2016, suggesting that experience makes a difference. However, with only 31% of total ACOs achieving significant enough savings to earn a bonus payment in 2016, success is still far from guaranteed. Executives face a complex decision between multiple downside risk models with both financial and political capital on the line.

Following these key imperatives will help demystify the decision and set your organization up for success in Medicare risk:

1. Don't be blinded by the 5% bonus

For Track 1 ACOs faced with the decision to shift to downside risk, it's just as important to know what not to base the decision on as it is to know what to base it on. While providers should certainly consider the 5% APM bonus that can be earned in risk-bearing MSSP Tracks 1+, 2, and 3 under MACRA, the bonus alone does not warrant a shift from an upside to a downside models. In fact, it is unlikely that the APM bonus would offset losses accrued by ACOs that prematurely take on downside risk since the bonus is applied to providers' Part B professional fees exclusively (about 27% of average Medicare per capita medical spending), while ACO performance is evaluated based on the total cost of care delivered.

Further, the two-year lag between the performance year and the payment year under MACRA could result in cash flow troubles. For example, an ACO that loses money in 2019 will owe CMS a penalty payment in 2020, but its providers wouldn't receive the APM bonus payment for their 2019 performance until early 2021. And with the annual APM bonus scheduled to expire after 2024, it's crucial not to "bet the farm" solely based on a near-term revenue boost.

2. Consider benchmark economics first and foremost

The key is to evaluate the likelihood of earning savings versus owing losses based on the projected size of your benchmark. Past performance results clearly indicate that a higher benchmark disproportionately contributes to the likelihood of success in MSSP.

For participants that joined the program in 2012 or 2013, 2019 is the first year that regional spending adjustments will be applied to your benchmarks. Track 1 ACOs that deferred the transition to a downside-risk track in 2016 due to unfavorable economics should pay close attention this time around. The updated methodology may be more beneficial, especially for organizations in historically high-growth regions.

The good news is that you are at a significant data advantage compared with new program entrants. Since CMS uses historic performance to rebase the benchmark for the next agreement period, ACO financial leaders should capitalize on the reports they've received from CMS in the program to date to project the size of the benchmark for 2019.

3. Match model selection with risk tolerance

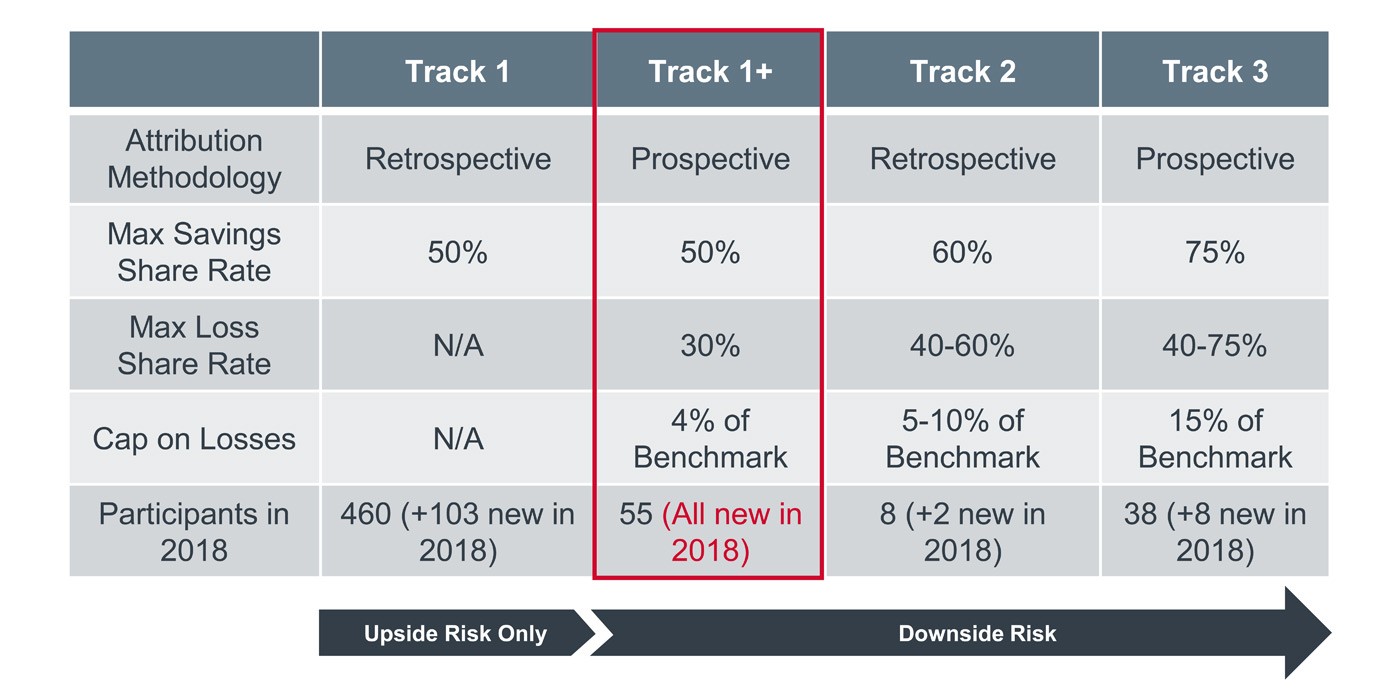

For some, the benchmark analysis will reveal a clear path to success. But for ACOs projecting lower than expected targets, the decision hinges on how much risk the organization is willing to bear. ACOs with unfavorable benchmark projections should consider whether a lower-risk option like MSSP Track 1+ is feasible. Track 1+ was the clear preferred choice for ACOs new to risk in 2018, attracting 55 new participants compared with only eight new entrants to the higher-stakes Track 3. See below for a more detailed description of how risk and reward differ in each of MSSP's three downside risk models.

MSSP tracks have varying levels of risk, participation

For the organizations confronting this complex decision in 2019, the alternative to taking on risk means forgoing participation altogether, including the opportunity to qualify for MACRA's APM track or MIPS-APM reporting advantages. If an ACO leaves the program, their individual participants will have to do quality reporting on their own for the first time in six years, which would be incredibly disruptive for some systems, particularly those with hundreds of participating organizations. This alone could be the motivation you need to get risk-adverse stakeholders on board.

4. Capitalize on remaining time in upside only to improve risk readiness

Regardless of which downside model an ACO selects, all organizations should consider these no regrets ways to prepare for downside risk in the time they have left in Track 1:

• Improve coding and documentation to ensure accurate risk adjustment. Address risk adjustment gaps now so that patients' costs are attributed to the right benchmark category (e.g. ESRD, dual-eligible) and future performance targets accurately reflect the case mix and severity of the population you serve (e.g. does your patient have diabetes without complications or do they have diabetes with acute or chronic complications?).

• Minimize churn to stabilize cost targets. Use annual wellness visits and care management resources to ensure that the patients included in the benchmark calculation are the same patients seen during the performance period. This is particularly critical to focus on this year since Tracks 1+ and Track 3 utilize a prospective attribution methodology. It's also important to ramp up efforts to reduce network leakage by solidifying patient loyalty to ACO providers which yields returns through fee-for-service revenue and shared savings.

• Reevaluate who is in your network. Most ACOs realize that there are certain providers they are comfortable having in network for an upside only contract, but may want to exclude when there are millions of dollars in potential losses on the line. Use the first months of this year to ensure that every participant in your ACO shares a commitment to the ACO's success (and will help bear the cost in the event of failure).

• Adopt successful strategies used by other ACOs. Post-acute care spend reduction efforts were critical to the success of ACOs in 2016 and should remain a key focus (organizations that earned shared savings payments reduced SNF spending by 18% and home health by 10%). Emergency department diversion, readmission reduction initiatives, education regarding unnecessary imaging and monitoring of Part B drug expenditures should all remain areas of renewed focus in 2018.

Hunter Sinclair is a Vice President and Rebecca Nolan a Senior Analyst, Consulting at Advisory Board.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.