Payers, health systems and management services organizations aiming for high-value care need physicians to accomplish their goals. But these organizations face a major hurdle: Doctors nationwide are hitting the breaking point.

An astonishing 91% of physicians experience burnout at some point in their careers, with paperwork, government and payer regulations, long work hours and poor work-life balance among the top drivers. A growing physician shortage will only exacerbate the problem.

Financial uncertainty amid new payment models and growing administrative complexity is prompting more physicians to leave independent practice for the security of employment. A PwC survey conducted in June found that at least 10% of physicians are considering switching from private practice to hospital employment, affirming a long-standing trend accelerated by COVID-19.

Additionally, physicians face pressure to fundamentally change the way they practice medicine as more care goes virtual, new care models proliferate, and providers are increasingly asked to share downside financial risks.

In short, doctors need help. Payers, health systems and management services organizations (MSOs) can offer their assistance in a way that not only addresses physicians’ need for financial stability, work-life balance and independence, but also promotes the delivery of value-based care.

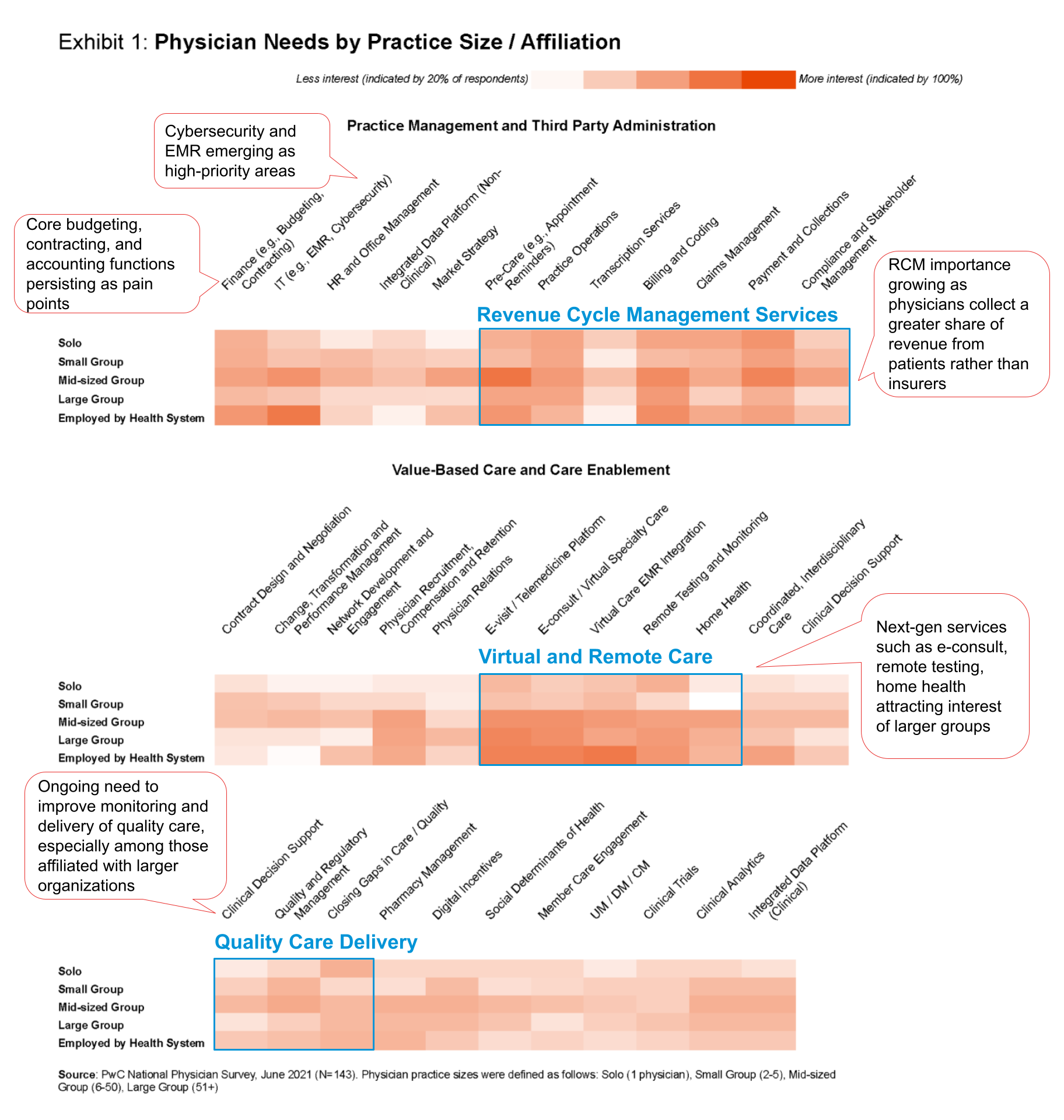

The first step is recognizing what physicians need to build a vibrant practice model fit for the changing ecosystem. These needs vary depending on practice size. For example, smaller practices often want support on important scale-sensitive functions like human resources and finance management, while larger groups might require more sophisticated IT infrastructure. Still, PwC’s physician survey revealed a set of core needs that cuts across practice size:

- Greater automation of core administrative tasks like scheduling and credentialing that consume too much physician time.

- Improved billing and collections through enhanced transparency on prices and payment as well as digital enablement to improve practices’ finances as costs shift from payers to consumers.

- Increased sophistication of virtual care offerings, including electronic medical records (EMR) integration and specialty consults (requested by over half of PwC survey respondents).

- Advanced analytics and integrated data platform support to make clinical decision support available at the point of care, which is critical to increasing evidence-based care delivery.

- Clinical communication platforms for coordinating across interdisciplinary care teams (requested by over 40% of respondents overall).

Physicians’ needs also may vary by specialty type or career stage. Certain professional subgroups, such as recent graduates, women, and primary care doctors, are more comfortable with employment. This variation means the ideal models will be flexible enough to serve the range of profiles that characterize modern physician practices.

PwC estimates that the physician enablement services market could be worth $20 to $40 billion, with even greater savings possible by eliminating wasteful spending and improving outcomes. The field is ripe for innovative payers, health systems and MSOs to help physicians navigate an increasingly complicated market while creating value for their organizations and patients. Here’s how:

- Payers can offer physician enablement services to effectively compete with national plans and diversify revenue streams. By empowering physicians with tools that support integration with community-based services, clinical coordination and care administration solutions like decision-support tools, payers can improve the member experience, align financial incentives, support independent physicians and strengthen their relationships with their physician networks, all while asserting greater influence across the health value chain.

- Health systems can offer an “interdependent” model that helps independent physicians gain the capacity to deliver value-based care and enables the organization to build more robust networks. Such models can meet physicians’ different risk appetites while retaining their practice independence. A health system might offer access to a value-based care enablement platform to improve the productivity of its employed physicians or to entice independent physicians to join its network. This approach would allow hospitals to extract more value from care delivery at a lower cost than capital-intensive practice acquisitions.

- MSOs, large physician groups and other third-party stakeholders can preserve practice autonomy even more directly. In addition to improving practice efficiency and enabling value-based care, they can support practice marketing and growth. Next-gen MSO offerings can help entrepreneurial physicians preserve and thrive under their existing name, brand and staff by helping manage back-end web presence or securing better rates for campaigns to attract new patients. In addition, physicians gain access to a network that provides additional patient volume through referrals and digital tools like automated scheduling that can improve the member experience. Combined with value-based care incentives and operational efficiencies, MSOs can convert financial autonomy to financial vitality.

The physician-enablement space is starting to attract serious attention. Payers, health systems and MSOs that are first movers can expect to gain distinct advantages of scale and learning. By taking the right approach, they can turn macro changes in healthcare that are driving doctors to the brink into a win-win for their organizations and clinicians. Together, physicians and enablers can create a pluralistic, multi tier model where most doctors are happy and high-performing while aligning incentives to realize new efficiencies, collaborations and mutually beneficial growth opportunities.

For more insights or questions, contact us: US_healthindustries@pwc.com.

© 2021 PwC. All rights reserved. PwC refers to the US member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.