The trend of hospitals, particularly rural and critical access hospitals, entering into management agreements with related health systems, specialized hospital management companies or larger health systems has continued due to the increasing regulatory compliance burden, decreasing reimbursement and cost increases in the healthcare industry.

In situations between related parties, it is important that such arrangements be consistent with fair market value to avoid potential civil or criminal penalties that, depending on circumstances, may be applicable under Medicare regulations1, the Anti-Kickback Statute2 or provisions of the Internal Revenue Code.3 This is particularly true for Critical Access Hospitals ("CAH") considering their cost-based reimbursements from Medicare.

CAHs are reimbursed at cost. "[C]osts applicable to services, facilities, and supplies furnished to the provider by organizations related to the provider by common ownership or control are includable in the allowable cost of the provider at the cost to the related organization. However, such cost must not exceed the price of comparable services, facilities, or supplies that could be purchased elsewhere."4 Certain definitions are needed to clarify these guidelines:5

- "Related to the provider" means that the provider to a significant extent is associated or affiliated with or has control of or is controlled by the organization furnishing the services, facilities, or supplies.

- "Common ownership" exists if an individual or individuals possess significant ownership or equity in the provider and the institution or organization serving the provider.

- Control exists if an individual or an organization has the power, directly or indirectly, significantly to influence or direct the actions or policies of an organization or institution.

As enumerated in regulatory guidance, the cost approach and the market approach may be used to perform the fair market value determination for such services. There is little market evidence published regarding unrelated party hospital management fee agreements. The United States General Accounting Office conducted a 1980 study of hospitals' use of contract management services. More recent analysis, which acknowledges the limitations of the data, has focused on hospital management services agreements between affiliated entities disclosed in Medicare cost reports. While analysis of related party management fees may be informative, it does not address "the price of comparable services... that could be purchased elsewhere." This analysis is intended to address the issue directly by looking at the nature of transactions between unrelated parties. As a further note, our objective was to understand the fee purely for management services and we explicitly excluded executive compensation passed through the management entity in our determination of the management fee.

We analyzed public filings and not-for-profit hospital disclosures to identify management agreements between hospitals and unrelated management entities. We identified 100 management services agreements with effective dates between June 30, 2009 and February 28, 2015 of which 50 disclosed sufficient information to determine the consideration for such management services. We eliminated those agreements that met any of the following criteria:

- Executive and management compensation was not separately reported or explicitly excluded from the management fee (34 exclusions).

- The management company was a related party to the hospital (12 exclusions).

- The management fees were significant outliers (less than 0.1% of net patient revenue ("NPR") or greater than 10% of NPR) (2 exclusions).

- We excluded management fee transactions that were determined based on the previously referenced related-party management fee study, to avoid self-fulfillment of the related-party findings (1 exclusion).

- No contemporaneous net revenues were available (1 exclusion).

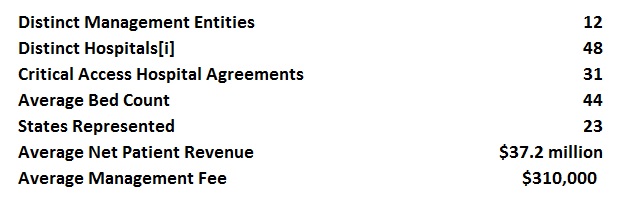

The characteristics of the data sample include:

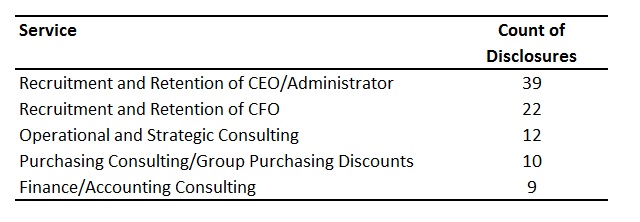

We analyzed the disclosures to identify the specific services provided under the agreements. There was little consistency amongst the disclosures, with some providing very generic descriptions such as (i) management services, (ii) management and supervision of day-to-day operations or (iii) administrative services, while others contained lengthy descriptions of the services. A sampling of the most common explicitly identified services is presented below. It is likely that the below counts are understated considering the brief, generalized nature of many disclosures.

Other services identified in the sample of agreements include physician recruitment, human resources services/consulting, managed care consulting, compliance consulting, quality assurance, recruitment and retention of chief nursing officers, training/education and information technology consulting.

The identified hospitals were diverse in terms of size, scale and geography, but were less diverse in terms of management companies. Quorum Health Resources, a market leader in hospital management services, was the manager in 62% of the identified management agreements.

Many of the subject hospitals were rural, critical-access hospitals. Generally, these types of hospitals have greater need for management services due to their smaller size and isolated geographies. These factors may complicate independent development of economies of scale and present recruitment and retention challenges due to their locations. Also, the management fees payable by these hospitals are more likely to meet the materiality threshold and require separate disclosure in the subject hospital's regulatory filings.6

Eight of the hospitals reported NPR greater than $50 million annually, four reported NPR greater than $100 million annually and only one hospital reported NPR greater than $200 million annually. Five hospitals in the sample reported NPR of less than $10 million annually.

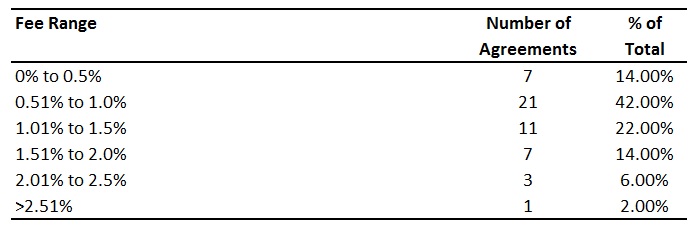

On a relative basis, the indicated management fees were between 0.2% and 6.3% of NPR. The arm's length market data indicated the following ranges:

Although it is common in the industry to reference management fees as a percentage of NPR or profitability, none of the identified agreements were explicitly structured in this manner. For those agreements where there was sufficient disclosure to determine the management fee structure, all were based on fixed dollar values with annual fee escalators often tied to the consumer price index.

Management entities may be averse to variable management fees for multiple reasons. The 1980 USGAO analysis recommended "that providers be prohibited from using percentage arrangements as a basis for calculating the amount of management fees." The rationale was that these types of arrangements could create an adverse incentive for management companies to increase revenues, not to keep costs down. Further, management companies are likely averse to these structures as hospitals in need of management services may be struggling financially. If the management fees were structured variably, the management fee may decline as a result of declining financial performance. Also, the nature of the management services provided, and the corresponding costs incurred by the management provider, may be more fixed than variable in nature. A fixed management fee would mitigate the risk related to the management entity's committed costs.

Conclusion

The unrelated party market data analyzed herein supports a hospital management fee between 0.5% and 2.0% of NPR, which differs considerably from existing published data. In this context, the findings of this analysis, in concert with other published data may provide a range of market evidence to assess the reasonableness of the cost approach indication of value. While the determined fee should be tested against NPR to assess reasonableness, the nature of the services should be considered to determine whether the costs to provide such services are variable and whether "comparable services... that could be purchased elsewhere" would be structured in a similar manner.

References

1 - 42 CFR Section 413.17(a)

2 - 42 USC Section 1320a-7b(b).

3 - IRC Section 501(c)(3), as interpreted by the Tax Court American Campaign Academy v. Commissioner, 92 TC 1053

(1989) and in District Courts Church by Mail v. Commissioner, 765 F. 2d 1387 (9th Cir. 1985).

4 - 42 CFR Section 413.17(a)

5 - 42 CFR Section 413.17(b)

6 - Not-for-profit entities must disclose the five highest compensated independent contractors that received more

than $100,000 of compensation. For smaller hospitals, the magnitude of the management fee is more likely to

meet this criteria. It should be noted that the audited financial statements may also contain disclosures regarding

the structure of the management agreement in the notes to the financial statements, if available.