Rapid change has reshaped healthcare markets nationwide with more still to come as key provisions of the Patient Protection Affordable Care Act roll out over the next few years. Central to the transformation that is underway is accelerated hospital consolidation. A growing number of hospitals and health systems have joined together in search of new efficiencies, more comprehensive delivery systems, enhanced leverage with payors and access to broader patient populations and related data for managing population health. It's a widespread trend, and even markets that have seemed settled for some time are experiencing new alignment activity and seeing larger, stronger competitors emerge.

Our nation's roughly 134 academic medical centers are particularly vulnerable in this environment and much of what makes them unique and has contributed to their standing as essential providers in the marketplace is at risk. Their larger size, perceived higher quality and specialized clinical capabilities that have allowed them to enjoy preferred payor contracts in most markets and higher margins on complex clinical work are all being challenged as other providers collaborate, get bigger and evolve.

Competitors are quickly gaining the size and wherewithal to drive market dynamics and negotiate insurance contracts on equal footing with AMCs. They are becoming part of larger systems and integrated networks, are developing more advanced clinical capabilities and are keeping and caring for more patients themselves. While this has advantages from a continuity of care and accountability standpoint, it dampens historic referral streams to AMCs and makes it increasingly difficult for them to secure sufficient patient volumes for mission-critical activities.

The squeeze on healthcare costs further strains the ability of AMCs to compete and vie for patients within existing markets. With fewer dollars available, buyers today are less willing to pay a premium for services provided in academic settings where the cost-per-patient discharge is generally higher than average given their broader mission. The perceived quality of the product at AMCs and their unique brand equity in the marketplace no longer trump price considerations. Through various incentives, payors and other purchasers are steering patients to less costly solutions, and AMCs risk losing a substantial portion of their most profitable business.

AMCs that want to avoid future losses and the possibility of becoming 'commodity' providers contracted to deliver only a narrow range of complex services in their markets are smart to explore their own alignment opportunities at this time. Those that find ways to successfully partner with high-quality, low-cost partners in the community and become lead partners in building broad networks across large geographic markets will be better positioned to address the challenges of the day and compete in a value-driven healthcare world.

Finding the right mechanism to accomplish this can be tricky. Many state-based AMCs don't have the wherewithal to engage in traditional merger and acquisition activities as a means for joining with others due to state statutes or political considerations that limit how they can apply capital to reposition for the future. For them and others like them that that are looking for creative ways to grow and adapt to widespread change, an alternative alignment structure has emerged that is gaining momentum in markets across the country that expands the realm of options for all providers, perhaps especially so for AMCs with their strong brand equity.

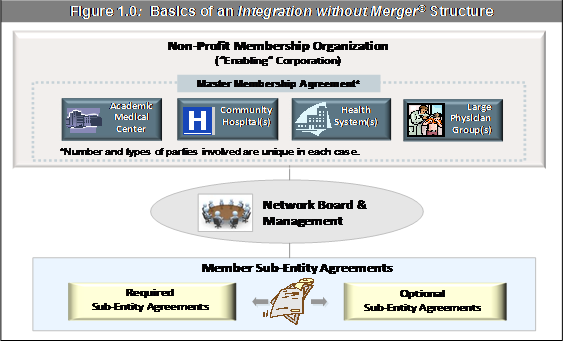

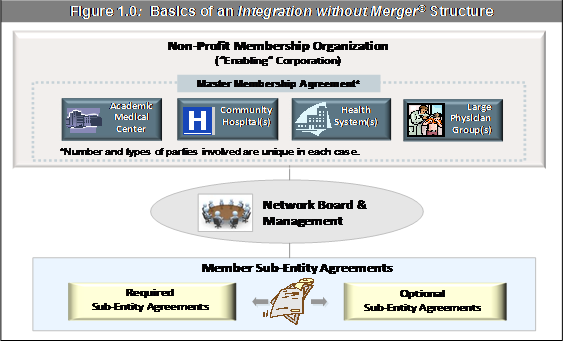

This alignment structure, which we've created and given the trade name "Integration without Merger©*," enables AMCs to work as a collective with hospitals and health systems in the community while sustaining their organizational autonomy. They can also align with large physician groups as additional members. There is no change in ownership or governance control and members sustain their local missions and orientation. It can involve just two or possibly several partners. Involving more members often means greater complexity, but there is an upside. Having more members can also return greater economies of scale and other size-related benefits that make it worth while. Whatever the number, participants are brought together through the creation of a non-profit membership organization, an "enabling" corporation, which enables collaboration among members in areas of mutual choosing.

The parties negotiate a master membership agreement which acknowledges the value each member brings and delineates member rights. Members are granted certain "common" rights applicable to everyone, as well as certain "specific" rights that vary based on the unique position of each organization. For instance, a university hospital may have the specific right to be the only academic partner in the group. A network board is established to manage within the parameters of the master membership agreement with appropriate representation from each partner.

The primary business activities between members occur through sub-entity agreements. Groups of two or more members enter into these agreements to pursue collaboration in specific areas of interest. The term "sub-entity agreements" may be informal business arrangements, contracts, joint ventures or the creation of new entities. There may be required sub-entity agreements that all members must take part in to qualify for membership. There may also be any number of optional sub-entity agreements that are developed between and among subsets of members to create greater value. Figure 1.0 offers a basic overview of a generic "Integration without Merger" structure and its various component parts.

The possibilities for collaboration through the sub-entity agreements are essentially limitless so it is up to members decide where to focus their efforts. Opportunities that represent "easy wins" are a good place to start. For example, laboratory consolidation across member hospitals may be one place to find quick savings and prepare for the shift toward population health. A huge component of costs within labs is manageable and can be reduced through consolidated structures that are properly focused on appropriate utilization, efficiency and value. Coordinating clinical services across organizations to create joint centers of excellence may also yield significant returns in the form of better patient care and outcomes, greater efficiency and lower costs.

The opportunities members pursue should ultimately advance their overall goals for alignment. Figure 2.0 outlines some potential goals and corresponding areas for collaboration that might make sense given what they wish to accomplish together. Participants can start small, get to know each other and build on early successes to knit together more pieces over time. The more members choose to do together, the more resilient the structure becomes. Member commitments and mandatory components for participation also help build resilience.

The formality of creating of an "Integration without Merger" structure enables providers to engage in dialogues that may not otherwise take place and uncover new opportunities to leverage each others unique strengths for mutual gain. For AMCs, this might mean applying specific expertise in designing system wide centers of care to help partners organize to accept risk. It might involve leveraging existing relationships with medical trainees to assist partners with physician recruitment or providing partners with access to expert faculty resources in support of emerging models of care (e.g., telemedicine). The opportunities are wide and ultimately depend on the circumstances and needs of those involved.

This structure allows AMCs to 'test the waters' with other organizations and establish a premise for building more tightly integrated relationships with select partners over time. While it is not intended to be a transitional structure leading to a full blown transaction, it could eventually lead to a merger between members if one eventually made sense. A key benefit is that it affords members the agility and flexibility to adapt to unforeseen changes in the market and adjust their strategy accordingly.

This alignment structure is also a very efficient approach to bringing multiple parties together. A provider network that might take years to piece together through traditional merger and acquisition activities could be accomplished in months and members can begin to enjoy the benefits of membership now rather than having to wait while the world passes them by. For AMCs and their partners this could mean significant financial and strategic gains in the near-term.

To determine whether "Integration without Merger" might be right for your AMC in today's changing healthcare landscape, consider the following:

*Integration without Merger© is a protected trademark of TRG Healthcare, LLC.

Our nation's roughly 134 academic medical centers are particularly vulnerable in this environment and much of what makes them unique and has contributed to their standing as essential providers in the marketplace is at risk. Their larger size, perceived higher quality and specialized clinical capabilities that have allowed them to enjoy preferred payor contracts in most markets and higher margins on complex clinical work are all being challenged as other providers collaborate, get bigger and evolve.

Competitors are quickly gaining the size and wherewithal to drive market dynamics and negotiate insurance contracts on equal footing with AMCs. They are becoming part of larger systems and integrated networks, are developing more advanced clinical capabilities and are keeping and caring for more patients themselves. While this has advantages from a continuity of care and accountability standpoint, it dampens historic referral streams to AMCs and makes it increasingly difficult for them to secure sufficient patient volumes for mission-critical activities.

The squeeze on healthcare costs further strains the ability of AMCs to compete and vie for patients within existing markets. With fewer dollars available, buyers today are less willing to pay a premium for services provided in academic settings where the cost-per-patient discharge is generally higher than average given their broader mission. The perceived quality of the product at AMCs and their unique brand equity in the marketplace no longer trump price considerations. Through various incentives, payors and other purchasers are steering patients to less costly solutions, and AMCs risk losing a substantial portion of their most profitable business.

AMCs that want to avoid future losses and the possibility of becoming 'commodity' providers contracted to deliver only a narrow range of complex services in their markets are smart to explore their own alignment opportunities at this time. Those that find ways to successfully partner with high-quality, low-cost partners in the community and become lead partners in building broad networks across large geographic markets will be better positioned to address the challenges of the day and compete in a value-driven healthcare world.

Finding the right mechanism to accomplish this can be tricky. Many state-based AMCs don't have the wherewithal to engage in traditional merger and acquisition activities as a means for joining with others due to state statutes or political considerations that limit how they can apply capital to reposition for the future. For them and others like them that that are looking for creative ways to grow and adapt to widespread change, an alternative alignment structure has emerged that is gaining momentum in markets across the country that expands the realm of options for all providers, perhaps especially so for AMCs with their strong brand equity.

This alignment structure, which we've created and given the trade name "Integration without Merger©*," enables AMCs to work as a collective with hospitals and health systems in the community while sustaining their organizational autonomy. They can also align with large physician groups as additional members. There is no change in ownership or governance control and members sustain their local missions and orientation. It can involve just two or possibly several partners. Involving more members often means greater complexity, but there is an upside. Having more members can also return greater economies of scale and other size-related benefits that make it worth while. Whatever the number, participants are brought together through the creation of a non-profit membership organization, an "enabling" corporation, which enables collaboration among members in areas of mutual choosing.

The parties negotiate a master membership agreement which acknowledges the value each member brings and delineates member rights. Members are granted certain "common" rights applicable to everyone, as well as certain "specific" rights that vary based on the unique position of each organization. For instance, a university hospital may have the specific right to be the only academic partner in the group. A network board is established to manage within the parameters of the master membership agreement with appropriate representation from each partner.

The primary business activities between members occur through sub-entity agreements. Groups of two or more members enter into these agreements to pursue collaboration in specific areas of interest. The term "sub-entity agreements" may be informal business arrangements, contracts, joint ventures or the creation of new entities. There may be required sub-entity agreements that all members must take part in to qualify for membership. There may also be any number of optional sub-entity agreements that are developed between and among subsets of members to create greater value. Figure 1.0 offers a basic overview of a generic "Integration without Merger" structure and its various component parts.

The possibilities for collaboration through the sub-entity agreements are essentially limitless so it is up to members decide where to focus their efforts. Opportunities that represent "easy wins" are a good place to start. For example, laboratory consolidation across member hospitals may be one place to find quick savings and prepare for the shift toward population health. A huge component of costs within labs is manageable and can be reduced through consolidated structures that are properly focused on appropriate utilization, efficiency and value. Coordinating clinical services across organizations to create joint centers of excellence may also yield significant returns in the form of better patient care and outcomes, greater efficiency and lower costs.

The opportunities members pursue should ultimately advance their overall goals for alignment. Figure 2.0 outlines some potential goals and corresponding areas for collaboration that might make sense given what they wish to accomplish together. Participants can start small, get to know each other and build on early successes to knit together more pieces over time. The more members choose to do together, the more resilient the structure becomes. Member commitments and mandatory components for participation also help build resilience.

The formality of creating of an "Integration without Merger" structure enables providers to engage in dialogues that may not otherwise take place and uncover new opportunities to leverage each others unique strengths for mutual gain. For AMCs, this might mean applying specific expertise in designing system wide centers of care to help partners organize to accept risk. It might involve leveraging existing relationships with medical trainees to assist partners with physician recruitment or providing partners with access to expert faculty resources in support of emerging models of care (e.g., telemedicine). The opportunities are wide and ultimately depend on the circumstances and needs of those involved.

This structure allows AMCs to 'test the waters' with other organizations and establish a premise for building more tightly integrated relationships with select partners over time. While it is not intended to be a transitional structure leading to a full blown transaction, it could eventually lead to a merger between members if one eventually made sense. A key benefit is that it affords members the agility and flexibility to adapt to unforeseen changes in the market and adjust their strategy accordingly.

This alignment structure is also a very efficient approach to bringing multiple parties together. A provider network that might take years to piece together through traditional merger and acquisition activities could be accomplished in months and members can begin to enjoy the benefits of membership now rather than having to wait while the world passes them by. For AMCs and their partners this could mean significant financial and strategic gains in the near-term.

To determine whether "Integration without Merger" might be right for your AMC in today's changing healthcare landscape, consider the following:

- What are the financial and strategic needs of your AMC and the nature and intensity of the competition in your marketplace?

- What types of organizations and specific capabilities would help to alleviate your AMCs key challenges and strengthen your strategic positioning?

- What are your goals and vision for alignment? What would you like the alignment structure to look like (e.g., types of parties, geographic reach, etc)?

- Are the right types of partner organizations available in your target market?

- Does the structure make sense given their circumstances and strategic objectives for the future?

*Integration without Merger© is a protected trademark of TRG Healthcare, LLC.