In today's hyper-competitive healthcare operating environment, liquidity is a key motivator (or constraint) towards achieving innovation, updating technology, and capturing market share.

In evaluating strategic direction for real estate assets, many leading healthcare providers decide to leverage third-party capital to fund existing and future real estate needs – Hackensack University Medical Center, Crystal Run Healthcare, TriHealth and Catholic Healthcare Partners(1). These healthcare providers have used third party capital in a variety of situations, such as: monetizing existing buildings, funding to-be-constructed facilities, and refinancing existing indebtedness/ownership. Utilization of third-party capital is often evaluated in terms of strategic, financial, and operational considerations.

Strategic considerations: A healthcare provider's core objective is to deliver quality care to its patient base and enhance the health of its local population. To accomplish this objective the provider must deliver care through hiring or affiliating with quality physicians, recruiting and maintaining strong provider networks, and providing caretakers with the best operating environment. The physical buildings that health providers utilize to deliver care, whether it be a hospital, medical office, surgery center, clinic or rehabilitation site, is viewed as essential to developing both patient and physician loyalty, but ownership of the building is not.

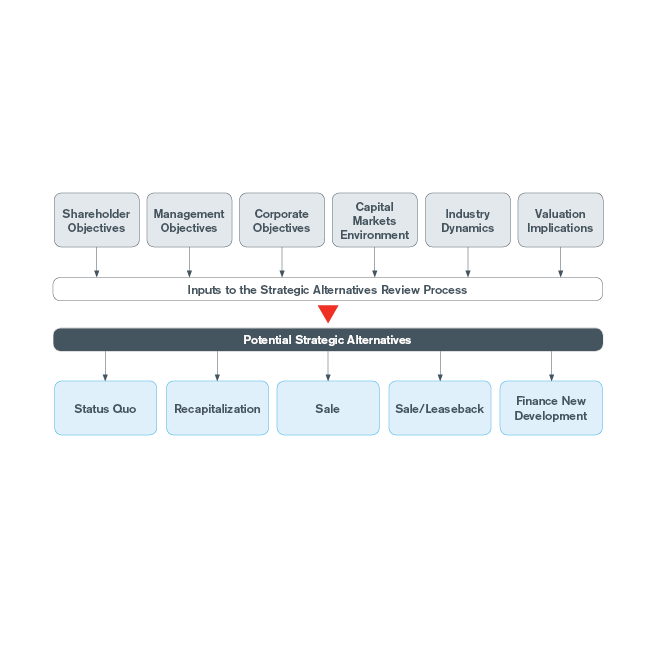

During the consideration process for strategic funding options in regard to ongoing/future projects, a health enterprise must carefully evaluate the benefits, costs, and risks associated with real estate ownership. For example, a health system may recognize that ambulatory care facilities are an important element in their strategic plan; however, allocating $50 million towards the ownership of such assets could potentially constrict resources and compete with higher priority investment in technology and equipment. Health systems experiencing the aforementioned situation have found that third party ownership of non-core real estate creates capital liquidity and allows for investment in other strategic initiatives, as well as eliminates the financial, legal, and operational liabilities that exist through real estate ownership. Utilizing third party capital to own or fund one's real estate does not preclude the former owner (now tenant) from controlling the building(s) future tenancy, usage, signage or other prior benefits associated with ownership. Control features can be developed to ensure the health system's control survives for generations of caretakers, often 99 years or longer.

Financial considerations: The potential financial benefits of monetization focus on four factors: capital allocation, average cost of capital, debt capacity and future required capital expenditures for real estate assets.

Capital allocation: Through ownership of non-core real estate assets a health system has allocated a precious resource to the real estate business away from its primary operations. By owning its urgent care centers and medical office space providers, miss financial opportunities to redeploy capital to margin-generating projects or advance growth imperatives.

Cost of capital: There is evidence investors value more highly and require a lower cost of capital for the real estate than a combination of healthcare operations plus real estate. As of March 31, 2015 healthcare real estate investment trusts averaged a 19.6x cash flow multiple while publicly-traded hospitals and surgical / rehabilitation companies averaged noticeably lower multiples of 8.9x and 10.5x cash flow. This is support that investors value the real estate significantly more, by a 2:1 multiple!

This also implies an average cost of capital of 5.3% for real estate versus meaningfully higher average costs of capital of 11.2% and 9.5% for publicly-traded hospitals and surgical / rehabilitation companies, respectively.

Although, as a healthcare provider, capital considerations may differ considerably, leveraging third party capital for a sale/leaseback or higher priority capital projects often makes compelling financial sense due to the disparity in returns. Case in point - the Ardent Health Services transaction in April 2015 split hospital real estate from operations in two concurrent transactions with Ventas REIT. The spinoff of real estate allowed Ardent Health to create additional value for its shareholders of almost $0.17 on every dollar allocated to real estate. Ventas priced the hospital real estate at 14x rent (7.1% capitalization rate), while the operations with the real estate were valued at a significantly lower multiple (albeit a record high for the hospital market) of 12x. In other words, the real estate's 14x multiple or 7.1% cap rate, the investor's cash-on-cash return, was deemed acceptable. When compared to required returns to a healthcare provider, such as for medical equipment, which often returns in excess of 20%, this real estate yield seems slim. Thus given the disparity in returns, leveraging third party capital for a sale/leaseback or higher priority capital projects is financially powerful.

Debt capacity: Real estate can carry a fair amount of debt, 75% or 90% of a property's value, this debt can have a meaningful impact to an organization's balance sheet, credit rating and corporate debt covenants. Through leveraging third party capital an organization can pay down its property debt with sales proceeds – creating capital liquidity to achieve materially lower interest rates, and/or more generous financial covenants. A new long-term lease can be structured for operating lease treatment so that the lease obligations do not burden the right side of the balance sheet, even if 15 or 20-years in term. Some healthcare providers have monetized their real estate in advance of obtaining an independent credit rating.

Future capital requirements: Bricks-and-mortar requires upkeep and maintenance. Moreover, when a tenant's lease expires, the landlord is expected to update a space to attract new tenants, costing nearly $30-$50 per square foot in some situations. Negotiating new rents can cause undue tension between the tenant, and the landlord, especially if a business relationship extends beyond the lease. Third-party ownership of real estate can dramatically reduce this deferred/future liability for tenant improvements, while maintaining the arms-length nature of the rental rate discussion, preserving goodwill between related parties. Also, by divesting of involvement in leasing, future Stark or anti-kickback violations are easily avoided.

Operational considerations: Real estate ownership requires not only an allocation of financial capital but also an allocation of human capital in terms of managing real estate operations. Healthcare professionals generally are already tasked with demands beyond capacity, so to expect effective and efficient real estate management of an aging physical plant or development of new outpatient facilities concurrent with other corporate initiatives, often leaves the real estate as one of the last priorities. An attractive building for patients and providers requires the property to be maintained at a level consistent with properties in the area or those owned by the competition. Being responsible for tenant demands requires much attention and effort to ensure tenant needs are met on a timely basis. Similar to capital, which can be allocated away from the core businesses, time and talent dedicated to real estate operations can be reallocated to more focused, critical missions.

While many health system owners assume that serving as a landlord can help facilitate efforts to build physician loyalty, the opposite is in fact often true. A third party landlord who is experienced in meeting tenant needs and rent negotiations provides professional high quality management of the properties, as well as an intermediary between physician and hospital relationships. With compliance being a growing concern and economic drain, the third party can help meet requirements by ensuring real estate transactions are completed at fair market value and not designed to provide prohibited financial incentives to physician tenants. In the west a large not-for-profit health system was fined $25 million in a Stark penalty case, this is not uncommon.

Types of third party ownership

There are numerous ownership options common in real estate transactions, including direct sale, sale/leaseback, joint venture and co-investment. In a direct sale, the real estate is monetized without future leaseback obligations to a third-party. This is most popular for health providers desiring to divest of non-core or obsolete space. Real estate investors are most interested in sale/leaseback transactions, whereby, the seller becomes a tenant to a new landlord agreeing to a long-term lease at market rates, as was the case with Hackensack, Crystal Run, and CHP. The motivation for each organization to sell its real estate was different but the result was the same – an infusion of capital reinvested into the core business.

Physician-investors are often invited into a third party financed real estate transaction, offering the health system another opportunity to build a stronger relationship between the doctor and hospital / physician practice. The seller is afforded immediate liquidity while maintaining ownership-like control through covenants in the space lease (or deed restrictions or ground lease). The space lease can be structured as an off-balance sheet or operating lease with consultation of a company's auditor, further enhancing the flexibility afforded to an organization's corporate capital structure.

Real estate investors have the ability to co-invest or formulate a joint venture agreement for long-term financing of a company's real estate. It can be done through an ownership or developer agreement for future facilities, which was a framework successfully created for TriHealth and implemented through a five year period – a more creative approach.

Dr. Richard Becker(2), former CEO of Brooklyn Hospital Center, and CEO of New Found Health LLC said "As Brooklyn Hospital Center continues to expand its outpatient presence through expansion of urgent care sites and other ambulatory facilities, we were considering a number of financial alternatives, such as a lease versus own model that utilizes third party capital for the ownership of the real estate and allows us to reallocate our capital into the core business of providing health care."

In the future, when a competitor mentions operating margins recognize that third-party real estate capital may be the leverage for growth.

Notes:

Hackensack, Crystal Run, TriHealth and CHP are all clients of the author.

Dr. Becker is now CEO of New Found Health LLC, a portfolio company of Blue Wolf Capital Partners LLC.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.