Two imperatives are driving a broad and intense attack on healthcare costs.

One is a public sector imperative, fueled by the dominant role of healthcare spending in the nation's budget deficit. The other is a private sector imperative, fueled by employers and the consumer struggling under the burden of rising healthcare costs. These imperatives have given rise to multiple forces targeting healthcare cost reduction, including downward pressure on payment rates, new payment models that reward value rather than volume, and insurance plan designs that create incentives for consumers to shop for healthcare based on price and quality.

Traditionally, hospitals and health systems—the most expensive providers of care—have focused cost-reduction efforts largely on their internal cost structure. However, these pervasive forces are creating an impetus for hospitals and health systems to embrace much broader efforts to reduce the total cost of care in their regions.

A broad view of cost

As researchers have sought to understand what drives healthcare spending, they have discovered that not all parts of the country contribute equally to high costs. For example, per capita health expenditures in Connecticut and Maine are far higher than those in Georgia and Arizona. Even more telling, research has shown striking variations in healthcare costs within small areas, variations that are not readily explained by demographic differences and are more likely associated with differences in how healthcare is deployed, used, and practiced.

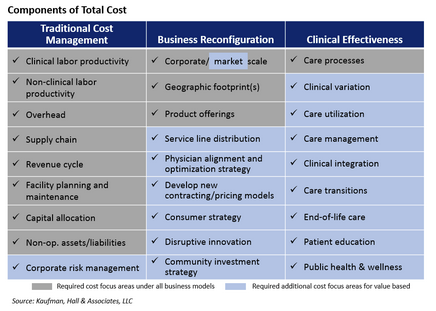

For hospitals and health systems, cost management has traditionally focused largely on a small subset of the factors driving total healthcare spending—controlling labor, overhead, supply, and capital costs within the organization. This traditional cost management approach has made economic sense as providers sought to improve their margins under fee-for-service payment. Despite years of effort, however, hospitals have found that cost reductions in these areas are hard to achieve and even harder to maintain. The narrow scope of such efforts also means they have limited impact on the total healthcare costs of a community.

The broader range of cost-reduction opportunities falls into two additional categories: business reconfiguration and clinical effectiveness.

Business reconfiguration encompasses areas such as organizational scale, service line distribution, physician integration, retail strategy, and price. Activities in these areas tend to be periodic rather than continuous. Although some of these activities are required under fee-for-service payment, most are more closely associated with a value-based business model.

Business reconfiguration encompasses areas such as organizational scale, service line distribution, physician integration, retail strategy, and price. Activities in these areas tend to be periodic rather than continuous. Although some of these activities are required under fee-for-service payment, most are more closely associated with a value-based business model.

Consider service line distribution as just one example. As health systems grow, many find that they offer similar clinical services at multiple facilities, sometimes within close proximity. By thoughtfully limiting the locations where a service is provided, the total cost of providing that service can be significantly reduced, and efficiency and quality should improve. In a value-based environment, this type of change makes a health system more attractive to purchasers looking for efficient, high-quality organizations.

Another nontraditional type of cost reduction focuses on continuous improvement of clinical effectiveness. Examples include improving the efficiency and effectiveness of care processes, reducing clinical variation, managing the care of high-risk patients to avoid unnecessary hospitalization or emergency care, and ensuring that care takes place in the most appropriate, least costly setting. This type of effort also includes investments that a health system makes to enhance public health and wellness—for example, providing patient education and addressing environmental conditions that may contribute to health risks for the chronically ill.

Most efforts at clinical effectiveness make little fiscal sense under volume-based payment. Reductions in utilization of high-cost services decrease revenues, and health systems receive no payment for investments in care management designed to help patients avoid the need for more intensive treatment. A county health official in Minnesota put it this way: "We'd pay to amputate a diabetic's foot, but not for a warm pair of winter boots." Under value-based payment, however, these kinds of clinical effectiveness efforts hold the promise of lowering a community's cost burden and enhancing health, but can also be a competitive advantage.

Why provider organizations have not tackled total cost

Hospitals are understandably wary about undertaking activities that threaten the current revenue model, whether their revenue stream is weak or strong. Even as value-based payment gains traction, the speed of adoption and future manifestations in each market remain unclear, raising questions for providers about which value-oriented strategies to develop and when to roll them out.

In addition, while traditional cost management has proved difficult, the broader range of activities that address total cost require an even more daunting level of change. For example, establishing a retail strategy requires striking a complex balance among inpatient facilities, different types of outpatient facilities, and virtual capabilities to meet consumers' evolving demands. Further, a retail strategy requires consumer segmentation with an understanding of consumers' attitudes and behaviors combined with an approach to pricing that allows providers to compete with freestanding facilities while maintaining viable margins. Service line reconfiguration also involves significant strategic complexities and carries the potential for significant political sensitivities as organizations seek to determine which facilities will and will not offer particular clinical services.

Finally, implementing these broad total-cost-reduction strategies requires support from outside an individual organization. Employers and public agencies need to play a role to help create the incentives, structures, and processes to monitor consumers' health status, identify at-risk segments, manage and coordinate care, and intervene to prevent the need for more acute and expensive care. Payers that are willing to be true partners in total cost reduction can also play a key role in this effort.

Why providers should tackle total cost

Despite the daunting nature of the total cost challenge, the reasons to take action are more compelling than the countervailing forces.

Alignment with mission. This approach to total cost reduction is grounded in improving quality, improving health, meeting public needs, and providing a positive healthcare experience. In short, it is closely aligned with the mission of not-for-profit healthcare provider organizations to improve the health of their communities.

Healthcare's business model change. Total cost reduction and the value-based business model are two sides of the same coin. Under traditional fee-for-service payment, the sphere of influence for hospitals and health systems is limited to the areas under their direct purview—they are rewarded for increasing patient volumes and for reducing costs associated with providing patient care. Under the value-based model, the health system's sphere of influence broadens considerably to include the entire continuum of care, as well as activities designed to keep people healthy. Value-based payment rewards providers for helping a defined population to avoid the need for care, or to receive care in the least expensive, most appropriate setting.

Successful precedents. Organizations have demonstrated success in broadening their approach to cost reduction to encompass total cost. A coalition of providers in Camden, N.J., for example, delivers intensive, primary-care-focused care management to patients identified as high utilizers of hospital emergency and inpatient services. After six months, patients in this program had a 46 percent reduction in average hospital admissions. Geisinger Health System's patient-centered medical home initiative, which focuses on prevention, chronic disease management, and comprehensive care management, showed cumulative cost savings of 7.1 percent in its first four years. In a Hennepin County, Minnesota, pilot program, people at high risk for hospitalization receive supportive social services, and the county hospital is paid a fixed amount per patient. The county has reduced medical costs 11 percent annually since the program began in 2012.1

Increasing scrutiny. As CMS and others continue to release information about healthcare spending, and as regional and local variations are revealed, scrutiny will increase. Hospitals and health systems will need data to explain their cost position and will need to articulate a strategy to positively influence community and regional healthcare spending.

Regional economic benefit. Traditionally, charity care has been a key way that not-for-profit healthcare organizations demonstrated their community benefit. As the uninsured population decreases, providers may increasingly measure their community benefit by devoting larger amounts to broader community health improvement activities that would reduce the total cost of care for a community and in turn produce real regional economic benefits.

Getting started

In a total-cost environment, hospitals' traditional cost management efforts will continue to be critically important. In addition, organizations need a detailed, multi-year roadmap for addressing business reconfiguration and clinical effectiveness.

The roadmap should lay out the timing for initiatives in these areas, along with needed investments and anticipated benefits to the organization's cost structure and to the total cost of care.

Investments will be required in areas such as organizational structure, data analytics, integrated planning, and project management that constitute the platform for all cost-reduction efforts. Organizations will need to work with the available data to compare total costs in their communities with other markets, and to establish goals for traditional and total cost reduction, factoring in demographics and other market-specific characteristics. Finally, the roadmap needs to incorporate scenarios for the market's shift from fee-for-service to value-based payment and their financial impact on different forms of cost reduction.

As pressures from public and private imperatives to control healthcare costs increase, health systems will have little choice but to address total cost if they want to remain relevant. Organizations must decide whether to wait until external forces compel them to act, or to act from a position of strength while they still have time to develop a thoughtful, tailored plan that will ultimately lead to their success. This approach to reducing total cost requires a major organizational commitment and is not without risk. Yet, as an investment in the organization's future success and in the community's health and economic wellbeing, it is the right thing to do.

Resources

1- Tavernise, S. (2015).

With more than 25 years of experience, James W. Blake is a leader in strategic financial solutions for hospitals and healthcare systems. Mr. Blake's experience includes strategic capital planning, creation and implementation of innovative credit structures, mergers and acquisitions, real estate transactions, reorganization and restructuring of troubled credits, and specialty hospital joint ventures. Prior to joining Kaufman Hall in June 2009, Mr. Blake was Managing Director of Citigroup's Health Care Group since 1995. Prior to this (from 1982 to 1995), he was a Director with CS First Boston, and a Manager with Arthur Andersen. Mr. Blake has an A.B. in Mathematics from Harvard University.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.